Stock Market

Nvidia’s Stock Performance: Market Reactions and Strategic Moves

Nvidia’s recent stock performance has sparked significant market reactions, particularly following its strategic decisions regarding investments in AI companies. As the tech giant navigates a competitive landscape, its actions have influenced not only its own stock but also the broader market dynamics.

Key Takeaways

- Nvidia’s stock is currently rated as a "Moderate Buy" by analysts, with expectations of a 20% upside.

- The company has sold its stakes in several AI firms, leading to notable declines in their stock prices.

- Nvidia’s market cap stands at approximately $3.40 trillion, making it the second-largest publicly traded company.

Nvidia’s Strategic Moves

Nvidia has made headlines recently by adjusting its investment portfolio, particularly in the AI sector. The company disclosed in its quarterly 13F filing that it had sold its entire stakes in several AI companies, including SoundHound AI, Serve Robotics, and Nano-X Imaging. This move has raised eyebrows among investors and analysts alike, as Nvidia’s decisions often serve as a bellwether for the AI market.

The impact of these sales was immediate. Following the announcement:

- SoundHound AI saw its stock plummet by 28%.

- Serve Robotics experienced a staggering 40% drop.

- Nano-X Imaging fell by 11%.

Conversely, Nvidia’s stake in other companies has led to positive market reactions. For instance, shares of Applied Digital surged by 15.2%, and Recursion Pharmaceuticals jumped nearly 24% after Nvidia’s disclosures.

Market Reactions

The market’s response to Nvidia’s actions reflects the company’s significant influence in the tech sector. Analysts have noted that when Nvidia invests in a company, it often leads to a surge in that company’s stock price, while divestments can have the opposite effect. This phenomenon underscores Nvidia’s role as a key player in the AI landscape.

Future Outlook

Despite recent fluctuations, analysts remain optimistic about Nvidia’s long-term prospects. The company is expected to report robust earnings, with projections indicating high-double-digit growth. Analysts predict that Nvidia’s stock could rise another 50% by the end of the year, driven by its continued investment in AI technologies and products.

Nvidia’s strategic focus on AI positions it well for future growth, even as competition intensifies. The company has been investing heavily in its AI product stack, which is anticipated to underpin advancements across various industries.

Conclusion

Nvidia’s recent stock performance and strategic decisions have not only impacted its own valuation but have also reverberated throughout the tech sector. As the company continues to navigate the complexities of the AI market, its actions will be closely monitored by investors and analysts alike, making it a pivotal player in shaping the future of technology.

Sources

-

Press Release7 days ago

Press Release7 days agoClinical Trials Market Set for Robust Growth, Driven by Drug Development Surge and Digital Innovation

-

Press Release7 days ago

Press Release7 days agoPediatric Vaccines Market: Safeguarding Futures, Driving Growth

-

Press Release7 days ago

Press Release7 days agoWaterproof Structural Adhesives Market: A Comprehensive Study Towards USD 10.3 Billion in 2035

-

Press Release7 days ago

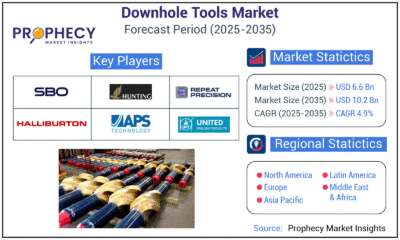

Press Release7 days agoDownhole Tools Market: Navigating Subsurface Frontiers with Precision

-

Press Release7 days ago

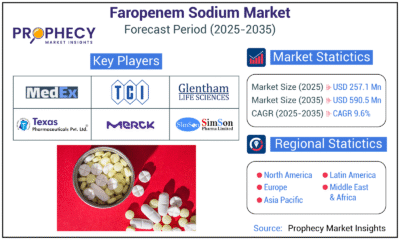

Press Release7 days agoFaropenem Sodium Market: A Potent Weapon in the Fight Against Bacterial Infections