Finance

Financial Fitness: How to Manage Your Debt

Even if you have chosen this year as the year to get your debt under control, you may not know how to go about getting started. It will be a gradual process that may take several months or over a year, but you can reach a point of financial freedom. Here’s a guide you can use to develop a strategy for getting financially fit.

Create a Budget

While you may not have used a household budget in the past, it’s essential for getting debt free and staying that way. To create a budget, you should list all sources of income in one column and all of your monthly bills and debts in a second column. As you look at this list, try to identify bills that you can eliminate, such as the landline if everyone in your home has their own cell phone. Freeing up extra money is essential because you’ll need to have a surplus of money at the end of each month. Although you’re using this budget to help you eliminate debt, you should get used to using it. By adjusting it as your finances change and following it month to month, you’ll stay in a good financial position.

Pay Every Bill on Time

This is also the time to dedicate yourself to paying every bill on time. A single late payment can cause you to suffer a hit on your credit score, which will affect your financial fitness over a longer period of time. Making a late payment will also subject you to late fees, which can affect your ability to eliminate your debts in a shorter period of time. Many people find it helpful to record due dates in the calendars on their cell phones or in day planners that they keep solely for that purpose. Receiving an alert can help you plan ahead as long as you schedule the reminder well in advance of the actual due date.

Start Paying Off Your Debts

Your next step will be to start tackling your debt. You can use the surplus of money left over each month to start paying your creditors back, but you should recognize when you’re in over your head. If you won’t be able to pay off your unsecured debt within three to five years, you may need to consult a debt settlement service. If you do plan to pay off your debts on your own, you can get started immediately by tackling the smallest debt you have. All of your extra income should go towards paying off that debt but be sure you’re making all the minimum required payments to your other creditors. Once that smallest debt has been paid off, everything you were sent to that creditor each month can be used to pay off the next smallest debt. This cycle should be followed until all of your unsecured debts have been repaid.

Begin Building an Emergency Fund

After paying back your debts, your goal should be to prevent falling into a situation in which you’ll be forced to borrow again. To that end, you should cancel all of your credit cards and tear up those cards. The credit card issuers will suggest keeping them for emergencies, but you’re going to build a fund to meet those needs. All of the money you were sending to those creditors each month should be getting deposited into a high-interest savings account. You can search online to find many financial institutions that pay significantly more interest than your local bank. This will help you grow your savings, which can be used for household repairs, medical emergencies, or for big-ticket purchases.

Plan For Your Future

As long as you keep an emergency fund that’s equivalent to six to eight months of your living expenses, you can begin diverting your disposable income into a retirement account. A financial advisor can help you create a retirement plan that will help you grow your wealth through investing. This will require a learning curve if you don’t know much about your investing options, so getting started early will be beneficial. Building a retirement nest egg will help ensure your future financial needs will also be met.

As long as you have the dedication to stick to your plan for financial fitness, there’s no reason you can’t get debt-free. While it will require cutting expenses and a degree of self-discipline, you can reach your financial goals. Once you do get rid of your debt, you’ll find that you’re in a much better position to achieve the other dreams you have for your future.

-

Press Release7 days ago

Press Release7 days agoClinical Trials Market Set for Robust Growth, Driven by Drug Development Surge and Digital Innovation

-

Press Release7 days ago

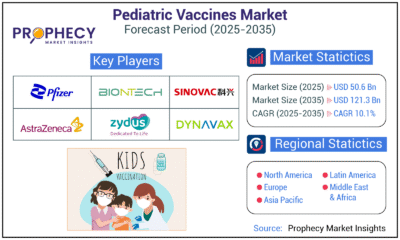

Press Release7 days agoPediatric Vaccines Market: Safeguarding Futures, Driving Growth

-

Press Release7 days ago

Press Release7 days agoWaterproof Structural Adhesives Market: A Comprehensive Study Towards USD 10.3 Billion in 2035

-

Press Release7 days ago

Press Release7 days agoDownhole Tools Market: Navigating Subsurface Frontiers with Precision

-

Press Release7 days ago

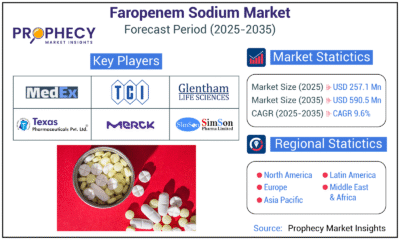

Press Release7 days agoFaropenem Sodium Market: A Potent Weapon in the Fight Against Bacterial Infections