Finance

Anti-Money Laundering (AML) Guide for The United Kingdom

Playing a leading role in European and World financing, the UK is also one of the strongest global players in the fight against financial crimes such as money laundering and terrorist financing. The UK’s strict and advanced AML laws provide to detect financial crimes and anti-money laundering.

The AML Guide for the UK, published by Sanction Scanner, examines topics such as AML Regulators, AML Regulations, Regulated Industries, and AML Compliance Requirements in the UK.

Playing a leading role in European and World financing, the UK is also one of the strongest global players in the fight against financial crimes such as money laundering and terrorist financing. AML / CTF poses a significant risk in the UK due to the complexity of its markets, such as finance. Due to these risks, the UK has become one of the most developed countries to fight financial crimes such as fraud, money laundering, and terrorist financing. The UK’s strict and advanced AML laws provide to detect financial crimes and anti-money laundering. There are some major regulatory agencies in the UK, such as The Financial Conduct Authority (FCA), HM Revenue and Customs (HMRC), National Crime Agency (NCA). Institutions that register with these regulators must also comply with their regulations, and any institution that needs to comply with money laundering regulations must register with one of these authorities.

AML laws and regulations in the UK aim to reduce the risks of money laundering and terrorist financing and consequently minimize the negative effects of crimes on the economy. In the United Kingdom, AML laws were established by the Proceeds of Crime Act 2002 (POCA). Under this law, it would be considered a major offense if any organization or person attempted or assisted in money laundering. Those who commit these crimes are punished with big penalties.

Furthermore, the UK’s AML laws comply with the European Union Anti-Money Laundering guidelines and FATF recommendations. The implementation of the AML Compliance Program is very important in the UK, mainly because the AML Compliance Program ensures the prevention of other financial crimes such as money laundering, terrorist financing, fraud, arms trade, tax evasion, and the like. AML requirements vary by region and industry. Some of the UK sectors are as follows: Banks, Accountancy Sector, FinTech, Cryptocurrency, Estate Agency, High-Value Dealers, Art Market, Trust Service, MSBs.

While these industries comply with certain regulations, there are some AML Compliance Requirements. Organizations can prevent crimes in businesses such as money laundering and terrorist financing by complying with these requirements. For example, organizations must conduct a risk assessment for the company and adopt a risk-based approach in accordance with this assessment. In accordance with the risk-based approach, an AML Compliance Program should be established in institutions. In addition, Know Your Customer procedures required by regulators should be applied in companies. This way, companies can determine who their new customers, partners, or new employees really are. Companies also have a compliance officer responsible for preventing money laundering, and other employees, including these officers, must be trained in money laundering. In addition, compliance officers in the Companies are required to record suspicious situations and keep these records for specified periods. It should also submit a Suspicious Activity Report (SAR) to the relevant authority for suspicious transactions.

The “AML Guide for the United Kingdom,” prepared by Sanction Scanner, aims to explain the UK’s stance against money laundering. This whitepaper also emphasized the importance of Anti-Money Laundering regulations in the United Kingdom and how they can comply with these regulations.

-

Press Release7 days ago

Press Release7 days agoClinical Trials Market Set for Robust Growth, Driven by Drug Development Surge and Digital Innovation

-

Press Release7 days ago

Press Release7 days agoPediatric Vaccines Market: Safeguarding Futures, Driving Growth

-

Press Release7 days ago

Press Release7 days agoWaterproof Structural Adhesives Market: A Comprehensive Study Towards USD 10.3 Billion in 2035

-

Press Release7 days ago

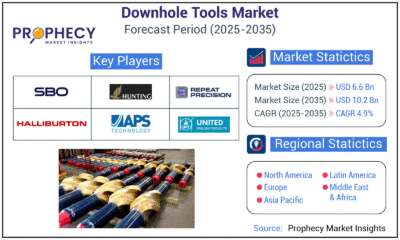

Press Release7 days agoDownhole Tools Market: Navigating Subsurface Frontiers with Precision

-

Press Release7 days ago

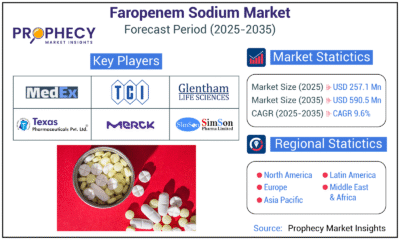

Press Release7 days agoFaropenem Sodium Market: A Potent Weapon in the Fight Against Bacterial Infections