Canada News

Political Ads to Preempt Law Firm Advertisers As Election Day Nears

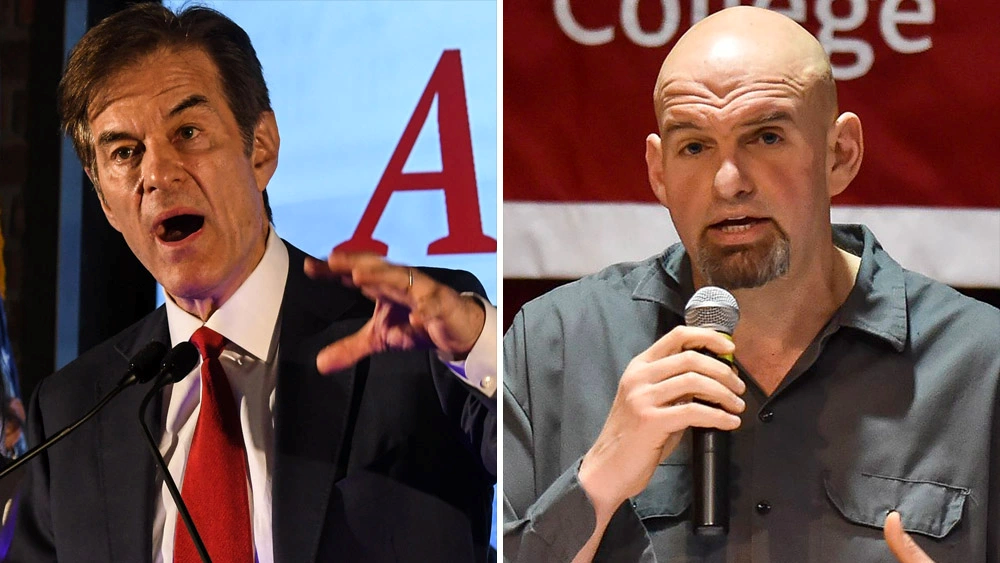

Pennsylvania Senate candidates Mehmet Oz and John Fetterman. Oz has demanded 5 debates with Fetterman who is recovering from a stroke.

Here we go again. Political Advertising for midterm elections is projected to break records. Political campaigns spent $4 billion in 2018 on advertising, $9 billion in 2020 and this year a report by AdImpact projects spending to reach $9.7 billion. That’s great for TV stations and social media companies bottom lines but what about other advertisers like personal injury law firms? Remember, law firm advertisers kept advertising through Covid while other advertisers cut budgets or stopped advertising altogether.

Brantley Davis, President of Brantley Davis Ad Agency remembers. His firm is in the unique position of placing millions of advertising dollars on TV stations for personal injury law firms and political advertisers.

“TV stations’ revenue was eviscerated by advertiser cancellations throughout Covid but the one category that held strong and helped keep stations afloat was law firms. This is TV stations’ chance to repay law firm advertisers’ loyalty by protecting their schedules throughout the election cycle.”

The warning bells started ringing for advertising agencies when local TV stations raised rates for third quarter 2022, a period when stations typically drop rates and offer loads of no charge bonus spots due to loose inventory. The culprits were mainly News oriented TV stations with higher ratings that were already feeling bullish due to early inventory pressure in their local News programming. Political campaigns and issue advocacy advertisers typically buy predominantly News programming where a large swath of active voters are viewing.

The implications for personal injury law firm’s in the 4th quarter of 2022 are huge. In addition to 4Q being one of the most expensive times of year to advertise, there’s already a TV frequency arms race underway between warring personal injury law firms across America. Local attorneys are grappling for TV audience’s attention by increasing the number of ads they buy, pressuring TV station rates and inventory. Exacerbating the situation further are big spending, new to market law firm advertisers like John Morgan of the mammoth Morgan & Morgan. Morgan seems to be launching ads in new TV markets monthly in many cases outspending local firms decisively. Add billions in political advertising dollars to the equation and TV inventory is going to be the tightest it’s been in years. That’s going to result in law firm advertisers incurring unprecedented spot preemptions, especially in September, October leading up to election day. Unfortunately, the inventory pressure will continue through December as TV stations attempt to make good gobs of preempted spots. It all adds up to bad news for law firm advertisers’ bottom line.

Some areas of the country will be harder hit than others like Georgia, Pennsylvania, Arizona, Nevada, and Wisconsin, where the top five Senate races are taking place. All five states have already seen advertising spending in excess of $100 million respectively. House and Senate races are expected to account for about $4.3 billion in advertising while Governor’s races will account for $2.3 billion.

And while a larger share of the spend is going to Streaming this election cycle, the majority of ad dollars will still be captured by broadcast TV. Here’s projected ad spend by media: Broadcast TV $5 billion, Cable TV $1.5 billion, Streaming $1.5 billion, Digital $1.5 billion and Radio $250 million.

Brantley Davis had several suggestions for legal marketers as elections approach:

- Assess Your Market: Identify 2022 elections in your TV market and assess projected ad spend. Your local TV stations with News programming will have already done this and happily share their analysis with you.

- Solidify Your Preemption/Makegood Policy: Decide whether you’ll allow stations to make preempted ads good or you’d rather take credits. Telling the stations no makegoods will send a message that your spots better run or the station gets no money, no second chance. But you also lose a chance at an upgrade.

- Take the Week Off Leading Up to November 8th: In markets where inventory pressure is particularly acute, we often advise clients to take the week before election day off. Sometimes we even take two weeks off. There are a couple reasons. First, political ads are strident, nasty and the tone often turns TV viewers off to all advertising. Second, running half a schedule will not allow the necessary ad frequency to break through the clutter and reach consumers.

- Monitor Schedules: As the election nears, ask stations for prelogs to make sure you see your spots scheduled. Prelogs are no guarantee your spots will run but you’ll at least be aware in advance if your entire schedule has been blown out.

- Talk to Your Reps and Their Managers Now: Start positioning with stations now. Tell them you expect all spots to run as usual since you advertise all year on the station, not just around election time. Tell them in no uncertain terms, their future share of TV buys could be affected if they preempt your law firm’s ads.

- Be Prepared to Shift Spend: Be prepared to move quickly if your schedule does get blown out. Many advertisers shift to a much heavier digital presence during political cycles.

-

Press Release6 days ago

Press Release6 days agoCV5 Capital Announces Standout Performance of Cryptanium Fund I SP, Beating Industry Benchmarks

-

Government6 days ago

Government6 days agoExperts Warn of U.S. Slide Towards Authoritarianism Under Trump Administration

-

Business3 days ago

Business3 days agoS&P 500 Soars in Best May in Decades Amid Tariff Relief and Nvidia’s Surge

-

Healthcare5 days ago

Healthcare5 days agoAttention Economy Arms Race: Reclaim Your Focus in a World Designed to Distract You

-

Immigration3 days ago

Immigration3 days agoTrump’s Immigration Crackdown: Legal Battles and Policy Shifts

-

Business3 days ago

Business3 days agoUS Stock Market Soars in May Amidst Tariff Tensions and Inflation Worries

-

Government3 days ago

Government3 days agoTrump Administration’s Government Reshaping Efforts Face Criticism and Legal Battles

-

Business3 days ago

Business3 days agoTrump’s Tariffs: A Global Economic Reckoning