Finance

The Basics Financial Instruments And Money

Finance is often used interchangeably with economics or law. However, finance is a very different field from law and economics. This article sets out the main differences between these areas of study.

Financial terms such as economics and law all refer to the study of the allocation of resources among people, institutions and organizations. These resources are used to earn a profit or avoid a loss, which can be measured by a profit-loss account. In economics, the theory behind the allocation of resources is the ‘demand function’ and this refers to the relationship between the demand for a product and the supply of it. In finance, on the other hand, the theory behind the allocation of resources is the ‘supply function’. The idea of supply and demand is quite different from that of economics and finance because in finance, financial markets allow for an efficient allocation of resources, but they cannot provide a definitive explanation for the allocation of resources.

Money is the medium through which resources are allocated among people, institutions and organizations. Money is also the means through which the allocation of resources is achieved. Financial markets allow for the effective allocation of resources by providing the necessary instruments to make sure that money is effectively allocated. The financial markets include government financing, banks and financial institutions. Allocating resources is achieved by borrowing and lending funds and by purchasing goods.

There are various financial instruments that can be used in financial markets. They include: bonds, equities, debentures, notes, deposits, commercial paper and derivatives. A bond is a security that is issued by a company and guarantees the repayment of a loan made by a lender. A share is a share of a business or the ownership of an asset, property, or a partnership.

Money is also referred to as assets that represent the right to receive money. There are three types of assets: assets that are used to produce value; assets that are used to transfer the values and assets that do not produce any values. Money is one type of asset that represents the right to receive the money it produces.

There are various types of assets available for use in finance. The types of assets that can be used in finance include: bonds, equity, debentures, loans, mortgages, savings, securities, insurance policies and property.

The value of money is determined by its supply and demand and the supply and demand of various financial instruments. The value of a financial instrument is determined by comparing the present worth of an item with its future potential.

Money can be used for different purposes. Money can be used to buy goods and services; it can be used to invest in a business; it can be used to save for a rainy day; it can be used for personal purposes; it can also be used for debt consolidation. Money can also be used as a form of savings to purchase shares in the business and a form of debt consolidation.

-

Press Release7 days ago

Press Release7 days agoClinical Trials Market Set for Robust Growth, Driven by Drug Development Surge and Digital Innovation

-

Press Release7 days ago

Press Release7 days agoPediatric Vaccines Market: Safeguarding Futures, Driving Growth

-

Press Release7 days ago

Press Release7 days agoWaterproof Structural Adhesives Market: A Comprehensive Study Towards USD 10.3 Billion in 2035

-

Press Release7 days ago

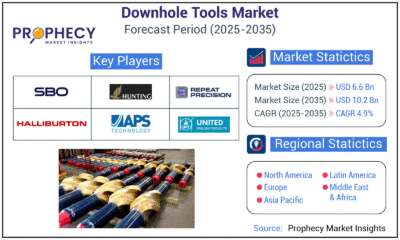

Press Release7 days agoDownhole Tools Market: Navigating Subsurface Frontiers with Precision

-

Press Release7 days ago

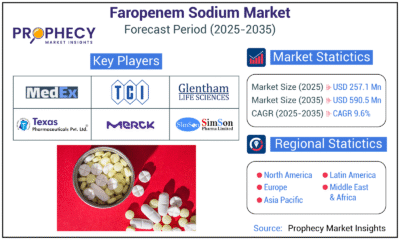

Press Release7 days agoFaropenem Sodium Market: A Potent Weapon in the Fight Against Bacterial Infections