Alternative Energy

Tesla’s Robotaxi Event Fails to Impress Investors

Tesla’s highly anticipated Robotaxi event, held at Warner Bros. studios, left investors disappointed as the presentation focused more on spectacle than substance. Following the event, Tesla’s stock plummeted nearly 9%, erasing approximately $67 billion in market value, highlighting the gap between expectations and reality in the autonomous vehicle market.

Key Takeaways

- Stock Drop: Tesla shares fell 8.8% after the event, marking the worst performance in the S&P 500 index.

- Lack of Details: Investors were left wanting more concrete information on the timeline and feasibility of Tesla’s autonomous vehicles.

- Competitor Gains: Stocks of ride-sharing companies Uber and Lyft surged, benefiting from Tesla’s underwhelming presentation.

- Future Plans: Elon Musk announced plans for a driverless Cybercab by 2027, but specifics on implementation were scarce.

Event Overview

Elon Musk’s presentation featured a prototype of the Cybercab and a robovan, but many investors felt the event lacked the necessary details to support the ambitious claims made. Musk’s promises included a fully autonomous Cybercab priced under $30,000, with operations expected to begin in California and Texas by next year. However, the absence of a clear business strategy left many questioning the viability of these plans.

Investor Reactions

The immediate aftermath of the event saw Tesla’s stock take a significant hit, with analysts expressing concerns over the company’s ability to compete in the rapidly evolving autonomous vehicle landscape. Investors were particularly disappointed by the lack of a detailed roadmap for the rollout of the robotaxi service, which Musk had previously touted as a game-changer.

Competitors Benefit

In contrast to Tesla’s struggles, shares of Uber and Lyft experienced notable gains, with Uber’s stock rising over 9% and Lyft’s increasing by nearly 10%. Analysts noted that the lack of concrete details from Tesla eased competition fears, allowing these companies to capitalize on the uncertainty surrounding Tesla’s plans.

The Road Ahead

While Musk’s vision for a fleet of self-driving taxis remains ambitious, experts warn that significant regulatory and technological hurdles lie ahead. Many believe that Tesla’s current self-driving technology is lagging behind competitors like Waymo, which could hinder its ability to achieve the promised timelines.

Investors are now looking for more clarity on how Tesla plans to transition from an automaker to a leader in autonomous driving and artificial intelligence. As the market evolves, the pressure is on Tesla to deliver on its promises and regain investor confidence.

Conclusion

Tesla’s Robotaxi event, while visually impressive, ultimately failed to provide the substantive details investors were hoping for. As the company navigates the challenges of the autonomous vehicle market, the focus will be on how it can turn ambitious plans into reality while facing increasing competition from established players in the industry.

Sources

- Tesla’s Robotaxi Event Disappoints Investors – WSJ, WSJ.

- Five Takeaways From Tesla’s Robotaxi Show – WSJ, WSJ.

- Tesla’s robotaxi event was long on Musk promises. Investors wanted more details. | Reuters, Reuters.

- Stock Chart Icon, CNBC.

- Waymo, Uber, Lyft Are Biggest Winners From Tesla’s Robotaxi Flop – WSJ, WSJ.

-

Press Release5 days ago

Press Release5 days agoNura Labs Files Revolutionary Patent: AI-Powered Wallet Solves the $180 Billion Crypto Staking Complexity Crisis

-

Press Release3 days ago

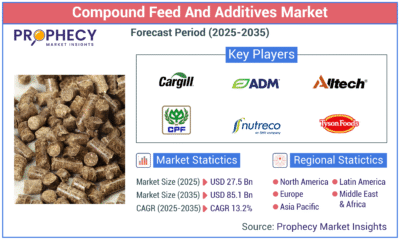

Press Release3 days agoGlobal Compound Feeds and Additives Industry Report: Market Expansion and Competitive Insights to 2035

-

Technology3 days ago

Technology3 days agoWhat to Know Before Switching Cell Phone Network Services in 2025

-

Press Release2 days ago

Press Release2 days agoCrypto WINNAZ Launches First On-Chain Yield Engine for Meme Coins, Enabling 20x–300x Returns