Finance

How QuickBooks Dominates Small Business Accounting?

QuickBooks cloud accounting software has changed the way companies manage accounting functions with its innovative features that help upgrade business. Want to know more about how it dominates the small business accounting market? Dig deeper with this article.

Small businesses are often faced with a plethora of challenges since they do not have many resources and capital for the best solutions. However, when it comes to winning over the accounting challenge, they can take a sigh of relief by opting for QuickBooks accounting.

Defining QuickBooks Software

QuickBooks – The accounting software that is designed exclusively for small businesses for managing income/expenses and keeping track of the business’s financial health!

It is a favorite amongst owners when it comes to invoicing customers, paying bills, generating reports, and preparing for taxes. There are multiple QuickBooks solutions available, so it’s vital to select the right version based on the type of business you are in and its requirements.

The QuickBooks Customer Base

- QuickBooks has around 7 Million customers worldwide.

- In the mid-market, QuickBooks serves more than 200,000 customers when joined with QuickBooks Online Advanced and Desktop Enterprise.

- With over 800M self-employed customers and global small businesses, almost 56M prospects visit QuickBooks each year.

- 15 years- The time taken by QuickBooks for building the one million customer base for QuickBooks Online (QBO), with a net addition of 1.1 million new customers in the Fiscal Year 2019.

- Around 40% of the entire QuickBooks Online customers comprise small businesses, with 30% of them being product-based firms.

- 4 million firms use Intuit Payroll internationally.

- Rapid customer growth was witnessed in the mobile and cloud era for Intuit.

Top 9 Reasons QuickBooks Leads the Pack

1. Cloud Technology Adoption: Intuit was criticized for not adopting cloud technology sooner. Undeniably, it is not a simple task to accomplish since one has to move critical data from local servers to the cloud in a prudent way. However, amongst all, QuickBooks was able to understand this in the beginning itself and slowly and securely started moving towards centralized financial data storage with 24/7 easy access from every QuickBooks online device.

2. Multiple Built-in Tools for Efficiency-Boosting: For instance, you wish to create a graphics report of your business performance, highlighting your company’s financials. With the help of hosted QuickBooks, it is extremely easy to create and observe your company reports’ visual graphics instantaneously. There exist various shortcuts/workarounds to help users in saving time and increasing performance while meeting essential accounting needs. Intuit’s online training/extensive support is a priceless tool for learning about such tasks. The pre-created and customizable templates of in-built reports provide you with the upper hand that is required in getting your work done professionally and accurately.

3. Designed Exclusively for SMBs: QuickBooks got launched with the very idea of serving small to medium-sized businesses since these are firms with little to zero accounting expertise. The software is designed for assisting company professionals with:

- Management of finances relevant to clients

- Budgeting

- Compliance with functionalities (accounting related)

- Payroll

- Management of Goods and Services Tax and reporting

- Cloud-based accounting (QuickBooks hosting)

- Taxation

4. Aids Cash Flow Control: When you have to enter and maintain expenses on a weekly/monthly basis on Excel spreadsheets, it is surely challenging. Also, you must input the entire financial details associated with:

- Invoices

- Bills

- Receipts

Manually entering financial details, can lead to errors, but with QuickBooks, you can ensure utmost accuracy, along with getting help for the following:

- Monitoring your cash flow

- Downloading transactions

- Automatically organizing and categorizing your income

- Connecting your bank account

5. User-Friendly: Just as we discussed above, that small and medium-sized business owners prefer accounting software that is intuitive, easy to understand and use. QuickBooks offers the same, and this is the sole reason that it is one of the leading accounting software in the market globally, covering nearly 80% share of the entire business accounting market.

6. Tracks Invoices/Schedules Recurring Ones: It is extremely tough to remember all the invoices, send timely reminders, and check every payment. Apart from this, you might be required to send invoices to a few vendors on a monthly/quarterly basis. So, remembering this entire information becomes overwhelming. This is where QuickBooks comes into play and provides owners with features to have a recurring process scheduled for the timely delivery of invoices to the vendors. Similarly, when your client makes the payment, QuickBooks lets you know instantly.

7. Simplifies Return Filing: Be it collaborating with TurboTax (SnapTax app) or having exceptional accounting potential, QuickBooks is the name for you. There are various forms that one needs to fill/file, with the following two being the primary ones:

- Form T2125 (Statement linked with Professional/Business Acts)

- T1 general income tax return

You must have information regarding the following before you file a return:

- Capital assets

- Revenue

- Business expenses

This entire process becomes simplified with QuickBooks accounting software. You can gain easy access to your accounting records and transfer the details to your tax forms directly.

8. Helps Create Refined Financial Reports: Financial reports are vital to every business and become even more important in cases where clients demand financial reports despite you proving them with an itemized estimate. Without the help of software like QuickBooks, it is difficult to generate detailed financial reports. Since QuickBooks has your entire financial information stored in one place, it becomes effortless to segment it in several ways, with financial reports simply becoming a snap to take out.

9. Offers Enhanced Security Measures: Be it from inside or outside, there are always threats to the digital financial information of the company such as:

- Malicious and clueless insiders

- Weak identity or credential loss

- A lack of encryption

- Insufficient security network

- A lack of access management

- Insecure APIs

However, with QuickBooks’s hosting servers, you get an enhanced level of security with data encryption and a firewall facility (3-level) that helps prevent unauthorized people, malicious software, and cybercriminals from penetrating and gaining access to any information.

QuickBooks Pricing Plan

| Plan | Cost | Features | Designed For |

| Simple Start | $12/mo |

|

For solo proprietors, LLCs, Partnerships, corporations, non-profits, and more |

| Plus | $35/mo |

|

For solo proprietors, LLCs, Partnerships,

corporations, non-profits, and more |

| Advanced | $75/mo |

|

For solo proprietors, LLCs, Partnerships,

corporations, non-profits, and more |

| Self-Employed | $7/mo |

|

For solo proprietors who file a Schedule C |

QuickBooks Pricing always updated by the website. So, please go through the website for any updates. (Pricing Source)

Conclusion

QuickBooks is surely one of the best-performing accounting software in the market, and this is the reason it has achieved worldwide acceptance and recognition. It is imperative to choose the right version of QuickBooks that best meets the specific requirements of your firm. Also, one needs time and expertise in leveraging software potential.

If you do not have the skills and time for the same, consider opting for outsourcing QuickBooks accounting services from a reputed and renowned provider.

—

Author Bio: Adriene Raynott is a Sr. Business Analyst at Cogneesol, holding more than 6 Years of experience. She is passionate about writing on finance and accounting concepts, small business growth, entrepreneurship, retail/eCommerce, branding, tax preparation, etc. She is contributing her skills, knowledge, and experience to assist people pertaining to finance & accounting matters.

-

Press Release7 days ago

Press Release7 days agoClinical Trials Market Set for Robust Growth, Driven by Drug Development Surge and Digital Innovation

-

Press Release7 days ago

Press Release7 days agoPediatric Vaccines Market: Safeguarding Futures, Driving Growth

-

Press Release7 days ago

Press Release7 days agoWaterproof Structural Adhesives Market: A Comprehensive Study Towards USD 10.3 Billion in 2035

-

Press Release7 days ago

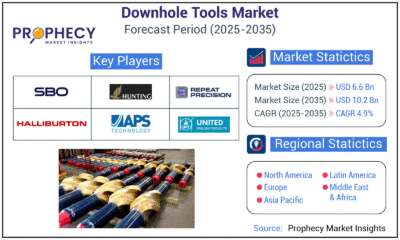

Press Release7 days agoDownhole Tools Market: Navigating Subsurface Frontiers with Precision

-

Press Release7 days ago

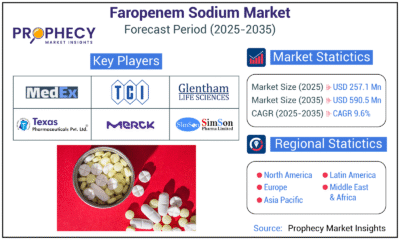

Press Release7 days agoFaropenem Sodium Market: A Potent Weapon in the Fight Against Bacterial Infections