Business

Chinese Tech Stocks Surge Amid Promising Economic Outlook

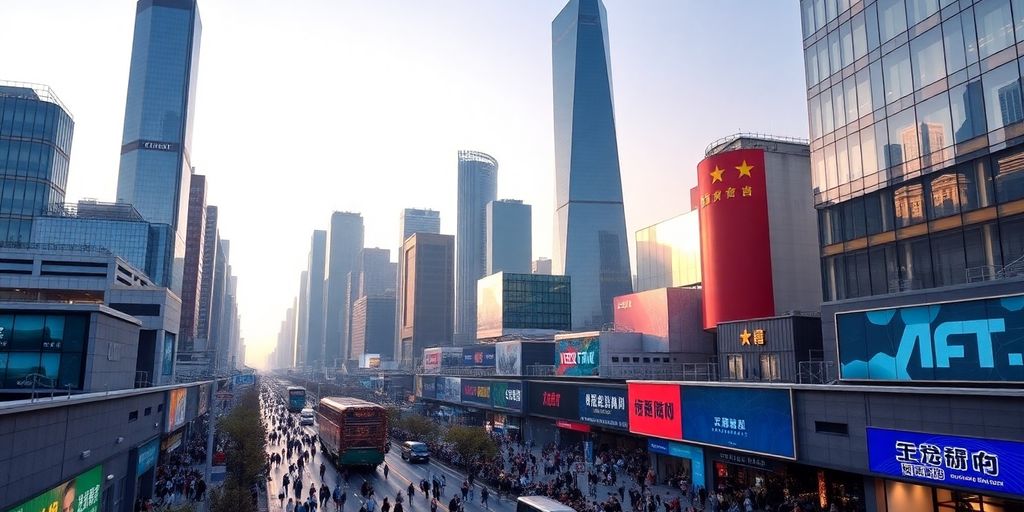

China’s technology sector has shown remarkable resilience in the face of market turmoil, with major tech stocks rallying significantly following the government’s announcement of a robust economic growth target and supportive measures for the industry. This surge reflects renewed investor confidence in the Chinese market, particularly in the wake of advancements in artificial intelligence and government backing.

Key Takeaways

- Chinese tech stocks, including Alibaba and Tencent, have seen substantial gains, with Alibaba’s shares rising nearly 70% this year.

- The Chinese government has set a GDP growth target of 5% for 2025, signaling its commitment to economic recovery.

- The National People’s Congress (NPC) has pledged increased support for emerging technologies, including AI and quantum computing.

- The MSCI China Index rose by 2.7%, indicating a positive market response to government initiatives.

Government Support Fuels Market Optimism

The recent rally in Chinese tech stocks can be attributed to the government’s announcement during the National People’s Congress, where Premier Li Qiang emphasized the importance of supporting strategic industries. The government plans to establish mechanisms to increase funding for sectors such as biomanufacturing, quantum technology, and artificial intelligence.

Investors reacted positively to these developments, with major tech companies like Alibaba, JD.com, and Tencent experiencing significant stock price increases. For instance, Alibaba’s shares surged by 7.7%, while JD.com and Tencent also saw notable gains of 5.7% and 5.3%, respectively.

The Role of AI in Driving Growth

The excitement surrounding Chinese tech stocks is further fueled by advancements in artificial intelligence. The emergence of AI startups like DeepSeek has positioned China as a formidable player in the global AI landscape. DeepSeek’s recent developments have sparked interest and optimism among investors, leading to a broader rally in the tech sector.

Alibaba’s recent announcement of its open-sourced QwQ-32B AI model, which competes with DeepSeek’s R1, has also contributed to the stock’s impressive performance. This model is touted as being more energy-efficient and cost-effective, further enhancing Alibaba’s appeal to investors.

Market Performance and Future Outlook

The Hang Seng Tech Index has gained over 40% this year, outperforming its U.S. counterparts, which have faced challenges due to rising interest rates and economic uncertainties. The Chinese tech sector’s strong performance is a stark contrast to the struggles of the U.S. tech giants, often referred to as the "Magnificent Seven."

Despite the positive momentum, some analysts caution that the long-term outlook for Chinese stocks remains uncertain due to geopolitical tensions and regulatory challenges. However, the current government support and the focus on innovation in AI and other technologies provide a solid foundation for potential growth.

Conclusion

The recent surge in Chinese tech stocks highlights a significant shift in market sentiment, driven by government support and advancements in technology. As the Chinese government continues to prioritize economic recovery and innovation, investors are increasingly optimistic about the future of the tech sector. This resilience amidst market turmoil suggests that Chinese tech stocks may offer attractive opportunities for long-term investors looking to capitalize on the country’s evolving economic landscape.

Sources

- Why Chinese Stocks Futu, GDS Holdings, and New Oriental Education & Technology Rose Today, The Motley Fool.

- Why Alibaba, JD, and Other Chinese Tech Stocks Rallied Wednesday Morning, Yahoo Finance.

- Chinese AI Model Euphoria Continues With Another Alibaba Stock Jump, Business Insider.

- Chinese Stocks Break NPC Jinx With Bold Growth Goal, Tech Rally, Yahoo Finance.

- China’s top tech stocks add $439 billion as ‘Mag Seven’ sink, Yahoo Finance.

-

Press Release6 days ago

Press Release6 days agoGlobal Compound Feeds and Additives Industry Report: Market Expansion and Competitive Insights to 2035

-

Technology6 days ago

Technology6 days agoWhat to Know Before Switching Cell Phone Network Services in 2025

-

Press Release4 days ago

Press Release4 days agoCrypto WINNAZ Launches First On-Chain Yield Engine for Meme Coins, Enabling 20x–300x Returns

-

Press Release2 days ago

Press Release2 days agoBellarium ($BEL) Price Prediction: Could It Hit $5 by 2026?

-

Press Release2 days ago

Press Release2 days agoWhy Alaxio (ALX) Is a Top Pick for Smart Crypto Investors

-

Business22 hours ago

Business22 hours agoHow Managed IT Solutions Help Small Teams Compete at Enterprise Scale