Stock Market

Best Penny Stocks to Buy: High Risk, High Reward

Investing in penny stocks can be a thrilling yet risky adventure. These low-priced shares often come with high volatility, which means they can rise or fall sharply in price. For those willing to take the plunge, there are potential rewards, but it’s essential to understand the risks involved. This article will explore some of the best penny stocks to consider, highlighting their unique features and potential for growth.

Key Takeaways

- Penny stocks are affordable but come with high risk.

- Investors should only use money they can afford to lose.

- Research is crucial to identify solid penny stock opportunities.

- Diversifying your investments can help reduce risks.

- Look for companies with strong fundamentals and growth potential.

1. Sabre Corporation

Sabre Corporation (SABR) is a key player in the travel technology sector, providing essential services to various travel businesses, including airlines and hotels. The company has received a consensus rating of hold, with an average score of 2.33 based on 1 buy rating, 2 hold ratings, and no sell ratings.

Overview of Sabre Corporation

Sabre operates through two main segments:

- Travel Solutions: This segment supports airlines and travel agencies.

- Hospitality Solutions: This segment caters to hotels and other accommodation providers.

The company serves customers in 160 countries, making it a significant player in the global travel industry.

Recent Developments

In October, Sabre announced a multi-year agreement with Arajet, a Dominican airline, to distribute its flight inventory through travel agents worldwide. This partnership aims to enhance the travel experience by providing agents with more options to create personalised offers for their clients.

Financial Performance

| Metric | Q2 2024 Value | Year-over-Year Change |

|---|---|---|

| Revenue | $767.24 million | +4% |

| Adjusted Operating Income | $106.99 million | +132.1% |

| Adjusted EBITDA | $128.69 million | +76.2% |

Future Outlook

Analysts predict that Sabre’s revenue will grow by 5.3% in fiscal year 2025, reaching approximately $3.21 billion. The expected earnings per share (EPS) is projected to be $0.21.

Sabre’s stock has shown a 36.6% increase over the past six months, closing at $3.51 in the last trading session.

In summary, Sabre Corporation stands out as a promising penny stock with potential for growth, making it a noteworthy option for investors seeking high-risk, high-reward opportunities.

2. Angi Inc.

Angi Inc. (ANGI) connects homeowners with service professionals across the globe. The company operates through three main segments: Ads and Leads, Services, and International. This platform provides users with tools to find local, pre-screened, and customer-rated service providers.

Key Financial Metrics

| Metric | Value | Industry Average |

|---|---|---|

| Gross Profit Margin | 95.51% | 51.59% |

| Asset Turnover Ratio | 0.68x | 0.49x |

| Revenue (Q2 2024) | $315.13 million | – |

| Operating Income (Q2 2024) | $9.19 million | – |

| Adjusted EBITDA (Q2 2024) | $42.20 million | – |

Recent Performance

- For the second quarter ending June 30, 2024, Angi reported a revenue of $315.13 million.

- The company’s operating income improved to $9.19 million, a significant turnaround from a loss of $15.39 million in the same quarter last year.

- Adjusted EBITDA saw a remarkable increase of 115% year-over-year to $42.20 million.

Future Outlook

- Analysts predict Angi’s revenue for the fiscal year ending December 2025 will rise by 1.7% to $1.21 billion.

- The expected earnings per share (EPS) for the same period is $0.06, indicating a strong year-over-year growth.

- Angi has exceeded consensus EPS estimates in three of the last four quarters, showcasing its potential.

Investing in Angi Inc. could be a high-risk, high-reward opportunity, especially as the company continues to improve its financial performance and market position.

In summary, Angi Inc. stands out in the penny stock market due to its impressive gross profit margin and positive growth trajectory. However, as with any investment, it’s crucial to consider the trustworthiness of your resources when making decisions. 61% of Americans are now investing, but finding reliable investment tools is essential for success.

3. Taboola.com Ltd.

Taboola.com Ltd. (TBLA) is an online advertising and content company that connects digital property owners with advertisers. It focuses on the open web market, which is estimated to be worth over $80 billion. The company uses advanced technology, including artificial intelligence, to recommend content and ads to users across various platforms.

Key Highlights:

- Recent Performance: In the last quarter, TBLA’s revenue increased by 29% year-over-year, reaching $428.20 million.

- Analyst Ratings: The stock has received 12 buy ratings and 2 hold ratings, with an average price target of $5.60.

- Partnerships: Taboola’s collaboration with Yahoo is a significant revenue source.

Pros and Cons:

Pros:

- Accelerating revenue growth.

- Strong partnerships with major brands like Yahoo.

- Innovative AI technology that enhances advertising effectiveness.

Cons:

- Heavy reliance on Yahoo, which poses risks.

- Must keep up with competitive AI and machine learning technologies.

- Many partners are traditional media companies.

Investing in Taboola.com Ltd. could be a high-risk, high-reward opportunity, especially given its strong growth potential in the digital advertising space.

4. Allbirds

Allbirds (BIRD) is a notable player in the penny stock market, currently trading below $1. This price point makes it an attractive option for those looking for high-risk, high-reward investments. Here are some key points about Allbirds:

- Market Presence: Allbirds holds about 2% of the U.S. sneaker market. While this may seem small, it is significant given the competition from giants like Nike.

- Unique Selling Point: The company focuses on sustainable sneakers, which appeals to environmentally conscious consumers.

- Challenges: Allbirds has faced operational issues, including misaligned strategies and poor product testing, which have affected its stock performance.

| Key Metrics | Value |

|---|---|

| Current Price | Below $1 |

| Market Share | 2% |

| Competitors | Nike, Adidas |

Allbirds has the potential for a turnaround, especially if it attracts the attention of larger firms for acquisition. This could lead to a significant increase in its stock value.

In summary, while Allbirds faces challenges, its unique product offering and market presence make it a penny stock worth considering for those willing to take on risk. Investors should keep an eye on its developments.

5. Ginkgo Bioworks

Ginkgo Bioworks (DNA) is a fascinating company in the biotech sector, focusing on synthetic biology. This means they create custom biological organisms for various uses, which can sound like something from a science fiction movie. However, their work is very real and impactful.

What They Do

Ginkgo Bioworks designs unique biological solutions, including:

- Novel proteins for testing

- Enzymes that improve biotech applications

- Advanced fermentation platforms for brewing

These innovations help other companies in their research and development processes.

Current Challenges

Recently, Ginkgo Bioworks has faced some difficulties, mainly due to:

- The end of COVID testing contracts

- Economic pressures affecting their operations

- Uncertainty in their future prospects

Despite these challenges, the company still holds potential for growth. The average price target for Ginkgo Bioworks is $14.80, with a high forecast of $40.00 and a low of $7.00. This represents a 79.18% change from the last price, indicating significant potential upside.

Ginkgo Bioworks is a unique player in the biotech field, and while it carries risks, it also offers exciting opportunities for investors willing to take a chance.

In summary, Ginkgo Bioworks stands out in the world of penny stocks due to its innovative approach and potential for high rewards, despite the inherent risks involved.

6. Gevo

Gevo Inc. is a company focused on renewable fuels, particularly in the aviation sector. With an average trading volume of 5.2 million shares, it stands out as one of the more liquid penny stocks available today. Gevo has seen a significant rise of over 48% in its stock price over the past year, largely due to the support from the Inflation Reduction Act, which has boosted the renewable energy sector.

Key Highlights:

- Renewable Natural Gas (RNG): Gevo’s RNG business is expanding rapidly, producing a record-setting 400,000 British thermal units in the last quarter.

- AI Supply Chain Management: Its subsidiary, Verity, is a leader in AI-based supply chain management, crucial for the renewable fuel industry.

- Analyst Predictions: Analysts have set an average price target of $5.68 for Gevo, which is more than triple its current value.

Pros and Cons of Investing in Gevo:

Pros:

- Strong growth potential in the renewable energy market.

- Increasing demand for sustainable aviation fuel.

- Supportive government policies enhancing the sector.

Cons:

- High volatility typical of penny stocks.

- Market timing can be challenging for investors.

- The company is still in the growth phase, which carries risks.

Investing in Gevo could be a high-risk, high-reward opportunity, especially for those interested in the renewable energy sector. However, potential investors should be aware of the inherent volatility in penny stocks and conduct thorough research before making decisions.

7. VFF

Village Farms (NASDAQ: VFF) is an intriguing choice for those looking at high-risk penny stocks. This company operates in both the agriculture and cannabis sectors, making it a unique investment opportunity. Their focus on sustainable farming practises is particularly appealing to environmentally conscious investors.

Key Highlights:

- Diverse Revenue Streams: Village Farms not only grows vegetables like tomatoes and cucumbers but also produces cannabis products through its subsidiary, Pure Sunfarms.

- Sustainable Practises: The company is committed to clean energy and eco-friendly farming, aligning with global trends towards sustainability.

- Potential for Growth: With ongoing efforts to reform cannabis taxation in Canada, Village Farms could see significant profitability increases.

Financial Overview:

| Metric | Value |

|---|---|

| Current Price | $X.XX |

| Market Cap | $X million |

| 30-Day Return | XX% |

| Average Daily Volume | XX,XXX shares |

Village Farms stands out in the vertical farming sector due to its innovative techniques and commitment to sustainability. This makes it a compelling option for investors looking for growth in the agriculture and cannabis markets.

In summary, Village Farms is a high-risk, high-reward stock that offers a unique blend of agricultural and cannabis investments, making it a noteworthy contender in the penny stock arena.

8. BIRD

Allbirds (BIRD) is a notable player in the penny stock market, currently trading below $1. This low price point makes it an attractive option for high-risk investors. The company is known for its sustainable sneakers, which have gained popularity among eco-conscious consumers.

Key Points:

- Market Share: Allbirds holds about 2% of the U.S. sneaker market, which is impressive given the competition from giants like Nike.

- Challenges: The company has faced operational issues, including poor product testing and misaligned executive strategies.

- Potential for Growth: Despite its struggles, Allbirds has a strong brand presence and could be a target for acquisition, which might boost its stock value significantly.

Summary Table:

| Metric | Value |

|---|---|

| Current Price | Below $1 |

| U.S. Market Share | 2% |

| Major Competitors | Nike, Adidas |

Allbirds has a unique value proposition with its focus on sustainability, making it a compelling option for investors looking for high-risk, high-reward opportunities.

9. Danaos Corp

Danaos Corp (DAC) is a shipping company that focuses on container ships. With a dividend yield of over 3%, it attracts investors looking for passive income. Here are some key points about Danaos Corp:

- Strong Demand: The shipping industry is seeing stable demand, which is beneficial for Danaos.

- Fleet Expansion: The company is adding new ships to its fleet, which can lead to increased revenue.

- Growth Opportunities: Danaos has several avenues for growth, making it an interesting option for investors.

| Metric | Value |

|---|---|

| Current Dividend Yield | Over 3% |

| Recent Fleet Additions | Yes |

| Market Position | Strong |

Investing in Danaos Corp could be a smart move for those willing to take on some risk for potential rewards. The combination of a solid dividend and growth prospects makes it a noteworthy contender in the penny stock arena.

10. Stocks Under $10

Investing in stocks priced under $10 can be a high-risk, high-reward strategy. These stocks often belong to companies that are either emerging or facing challenges, making them volatile. However, they can also present unique opportunities for investors willing to take the plunge.

Key Considerations:

- Volatility: Stocks under $10 can fluctuate significantly in price.

- Market Capitalisation: Look for companies with a market cap above $250 million to ensure some stability.

- Earnings Potential: Focus on stocks with strong earnings potential and positive analyst ratings.

Example Stocks Under $10:

| Stock Name | Current Price | Market Cap (in millions) | Analyst Rating |

|---|---|---|---|

| Company A | $8.50 | 300 | Buy |

| Company B | $5.20 | 450 | Buy |

| Company C | $9.75 | 600 | Hold |

Investing in stocks under $10 can lead to significant gains, but it’s essential to do thorough research and understand the risks involved.

In summary, while stocks under $10 can be appealing due to their low price, they come with inherent risks. Always consider your financial goals and risk tolerance before diving in.

11. High Yield Dividend Stocks

High yield dividend stocks can be an attractive option for investors seeking steady income. These stocks typically offer higher dividend yields compared to the market average, making them appealing for those looking to generate cash flow. Here are some key points to consider:

- Consistent Income: High yield dividend stocks provide regular payments, which can be reinvested or used for expenses.

- Potential for Growth: Many of these companies are well-established and have a history of increasing their dividends over time.

- Market Resilience: During market downturns, dividend-paying stocks often perform better than non-dividend stocks.

| Stock Name | Dividend Yield (%) | Market Capitalisation ($) |

|---|---|---|

| Company A | 5.2 | 1.5 billion |

| Company B | 4.8 | 2.3 billion |

| Company C | 6.1 | 800 million |

Investing in high yield dividend stocks can be a smart strategy for those looking to balance risk and reward. However, it’s essential to research each company thoroughly to understand their financial health and sustainability of dividends.

In summary, high yield dividend stocks can be a valuable addition to an investment portfolio, offering both income and potential growth. Always consider your risk tolerance and investment goals before diving in.

12. Stocks Under $5

Investing in stocks priced under $5 can be quite risky, but there are some hidden gems worth considering. These stocks often come with high volatility, making them a high-risk, high-reward option for investors. Here are some key points to keep in mind:

- Market Capitalisation: Look for stocks with a market cap greater than $250 million.

- Earnings Potential: Focus on companies with strong earnings potential.

- Analyst Ratings: Seek stocks that have a consensus ‘buy’ rating from analysts.

Key Considerations

- Volatility: Stocks under $5 can fluctuate wildly, so be prepared for ups and downs.

- Liquidity: Many penny stocks have low trading volumes, which can make buying and selling difficult.

- Research: Always do thorough research before investing, as many of these stocks are untested or unstable.

Investing in penny stocks can be a rollercoaster ride. While some may lead to significant gains, others can result in substantial losses. Always align your investments with your financial goals and risk tolerance.

Example Stocks Under $5

| Stock Name | Market Cap (in millions) | YTD Performance | Analyst Rating |

|---|---|---|---|

| iQIYI Inc. (IQ) | 300 | +15% | Buy |

| Gevo, Inc. (GEVO) | 400 | +20% | Buy |

| VFF (VFF) | 250 | +10% | Buy |

13. POWR Ratings

POWR Ratings are a unique system that helps investors evaluate stocks based on various factors. These ratings can guide you in making informed decisions. Here’s a quick overview of how they work:

Key Components of POWR Ratings

- Momentum: Measures the stock’s price movement over time.

- Quality: Assesses the financial health of the company.

- Value: Compares the stock’s price to its intrinsic value.

- Growth: Looks at the company’s earnings growth potential.

Example of POWR Ratings Table

| Stock Ticker | POWR Rating | Industry Rank |

|---|---|---|

| SABR | B | 5 |

| ANGI | A | 3 |

| TBLA | C | 10 |

The POWR Ratings system is designed to simplify the investment process, making it easier for you to identify potential winners in the stock market.

By using these ratings, you can better understand which stocks might be worth your investment, especially in the high-risk, high-reward category of penny stocks. Remember, investing always carries risks, so do your research!

14. Upgrades/Downgrades

In the world of investing, upgrades and downgrades can significantly impact stock prices. Analysts often adjust their ratings based on various factors, including company performance and market conditions. Here’s a brief overview of recent upgrades and downgrades:

Recent Upgrades

- NVIDIA Corporation (NVDA): Upgraded due to strong earnings and growth in AI technology.

- Robinhood Markets, Inc. (HOOD): Increased rating following positive user growth metrics.

- Palantir Technologies Inc. (PLTR): Upgraded based on new government contracts.

Recent Downgrades

- Vistry Group PLC (BVHMF): Downgraded due to declining housing market forecasts.

- China Merchants Bank Co., Ltd. (CIHKY): Lowered rating amid regulatory concerns.

- Meituan (MPNGY): Downgraded following disappointing earnings results.

Market Overview

| Index | Current Value | Change |

|---|---|---|

| S&P 500 | 5,795.25 | -5.25 (-0.09%) |

| Dow | 42,339.00 | -36.00 (-0.08%) |

| Nasdaq | 20,275.50 | -23.00 (-0.11%) |

Keeping an eye on upgrades and downgrades can help investors make informed decisions. Understanding the reasons behind these changes is crucial for navigating the stock market effectively.

15. Top Stocks by Target Price

When looking for stocks with the best potential returns, it’s essential to consider their target prices. Here are some top stocks that investors are keeping an eye on:

Key Stocks to Watch

- Sabre Corporation (SABR): Currently trading at $3.35, it has shown a decline of 23.86% year-to-date. However, analysts believe it has a strong upside potential.

- Angi Inc. (ANGI): This stock is also on the radar for its promising growth prospects.

- Taboola.com Ltd. (TBLA): With its innovative advertising solutions, it’s gaining attention from investors.

Target Price Table

| Stock Name | Current Price | Target Price | Potential Upside |

|---|---|---|---|

| Sabre Corporation | $3.35 | $5.00 | 49.55% |

| Angi Inc. | $4.20 | $6.00 | 42.86% |

| Taboola.com Ltd. | $2.50 | $4.00 | 60.00% |

Investing in these stocks can be risky, but the potential rewards are significant.

Penny stocks can be a great way to invest with a small amount of money, but they come with high risks. Always do your research before investing.

In summary, keeping an eye on these stocks could lead to substantial returns, especially for those willing to take on some risk. Investors should consider their financial goals and risk tolerance when making decisions.

16. Dividend Discount Model Stock Valuation

The Dividend Discount Model (DDM) is a method used to estimate the value of a stock based on its expected future dividends. This model is particularly useful for investors looking for stable income from their investments. Here’s a simple breakdown of how it works:

How the DDM Works

- Estimate Future Dividends: Predict the dividends the company will pay in the future.

- Determine the Discount Rate: This is the rate of return required by investors.

- Calculate Present Value: Use the formula to find the present value of future dividends.

Key Points to Remember

- The DDM is best suited for companies that pay regular dividends.

- It may not be effective for companies that do not pay dividends or have unpredictable dividend policies.

- Market conditions can greatly affect the accuracy of the DDM.

| Company Name | Current Dividend | Expected Growth Rate | Discount Rate |

|---|---|---|---|

| Company A | £0.50 | 5% | 10% |

| Company B | £0.30 | 3% | 8% |

| Company C | £0.20 | 4% | 9% |

The DDM can provide a clear picture of a stock’s value, but it’s important to consider other factors as well.

In summary, while the Dividend Discount Model is a valuable tool for assessing stock value, it should be used alongside other methods to get a complete view of an investment’s potential. Understanding how emotional investing can impact stock prices is also crucial, as highlighted by market experts.

17. Industry Rank

Understanding the industry rank of penny stocks is crucial for investors looking for high-risk, high-reward opportunities. The industry rank helps in assessing how a stock performs relative to its peers. Here are some key points to consider:

- Performance Comparison: Stocks are often ranked based on their performance metrics, such as revenue growth, profit margins, and return on equity.

- Market Trends: Keeping an eye on market trends can provide insights into which industries are thriving and which are struggling.

- Analyst Ratings: Analyst ratings can also influence a stock’s industry rank, as they provide expert opinions on future performance.

| Stock Name | Industry Rank | Key Metrics |

|---|---|---|

| Sabre Corporation | 19 | Revenue: $767.24M |

| Angi Inc. | 6 | Gross Margin: 95.51% |

| Taboola.com Ltd. | N/A | N/A |

The industry rank is a vital tool for investors, helping them identify potential winners in the stock market. By focusing on stocks with strong industry rankings, investors can increase their chances of success in the volatile world of penny stocks.

18. Stocks: Most Actives

In the world of penny stocks, activity levels can indicate potential opportunities. Here are some of the most active stocks currently:

| Stock Symbol | Company Name | Price | Change (%) |

|---|---|---|---|

| NVDA | NVIDIA Corporation | 132.89 | +4.05 |

| SMCI | Super Micro Computer, Inc. | 45.35 | -5.01 |

| NIO | NIO Inc. | 6.24 | -8.10 |

| PLTR | Palantir Technologies Inc. | 41.45 | +6.58 |

| TSLA | Tesla, Inc. | 244.50 | +1.52 |

Key Points to Consider:

- Market Trends: Keep an eye on how these stocks perform over time.

- Volume: High trading volumes can signal investor interest.

- Volatility: Be prepared for price swings, as penny stocks can be unpredictable.

Investing in penny stocks can be risky, but it also offers the chance for significant returns. Always do your research before diving in!

These stocks are not just numbers; they represent companies that could either soar or plummet. Stay informed and make wise choices!

19. Stocks: Gainers

In the world of investing, gaining stocks can be a thrilling ride. These stocks have shown significant increases in their prices, making them attractive options for investors looking for high returns. Here are some notable gainers:

Top Gainers Today

| Ticker | Company Name | Price | Change (%) |

|---|---|---|---|

| DJTWW | Trump Media & Technology Group Corp. | 14.85 | +18.90% |

| DJT | Trump Media & Technology Group Corp. | 21.80 | +18.54% |

| PTCT | PTC Therapeutics, Inc. | 40.77 | +16.52% |

| HOOD | Robinhood Markets, Inc. | 25.61 | +9.82% |

| SG | Sweetgreen, Inc. | 38.20 | +9.61% |

Key Points to Consider

- Market Trends: Keep an eye on overall market trends as they can influence stock performance.

- Company News: Positive news about a company can lead to stock price increases.

- Investor Sentiment: The mood of investors can greatly affect stock prices, especially in volatile markets.

Investing in gaining stocks can be rewarding, but it also comes with risks. Always do your research before making any investment decisions.

In summary, while gaining stocks can offer high rewards, they also carry high risks. It’s essential to stay informed and make wise choices when investing in these stocks.

Additionally, the active tailor is an upcoming online store specialising in footwear, currently in the pre-launch phase, inviting visitors to sign up for updates via email. This could be a potential investment opportunity as it opens soon!

20. Stocks: Losers

In the world of investing, some stocks face significant declines, often labelled as the biggest losers. These stocks can be risky, but they also present opportunities for those willing to take a chance. Here are some notable stocks that have recently seen substantial drops:

| Stock Ticker | Price Change | Percentage Change |

|---|---|---|

| BVHMF | -4.63 | -26.61% |

| CIHKY | -5.46 | -17.56% |

| PNGAY | -2.75 | -17.42% |

| MPNGY | -8.98 | -15.83% |

| SRRK | -4.79 | -13.97% |

Key Points to Consider:

- Market Sentiment: Stocks on this list often reflect a bearish outlook from investors.

- Potential for Recovery: While these stocks are currently down, they may bounce back if the market conditions improve.

- Investment Strategy: Consider your risk tolerance before investing in these stocks, as they can be volatile.

Investing in stocks that are currently losing value can be a gamble. However, with careful research, you might find hidden gems that could recover.

In summary, while these stocks are currently facing challenges, they also represent a high-risk, high-reward opportunity for investors willing to navigate the uncertainties of the market.

21. Trending Tickers

In the world of penny stocks, trending tickers can provide exciting opportunities for investors. Here are some of the most notable stocks currently making waves:

Current Trending Stocks

| Ticker | Company Name | Price | Change (%) |

|---|---|---|---|

| PLTR | Palantir Technologies Inc. | 41.45 | +6.58 |

| WW | WW International, Inc. | 1.16 | +46.95 |

| INTC | Intel Corporation | 23.32 | +4.20 |

| HOOD | Robinhood Markets, Inc. | 25.61 | +9.82 |

| RBLX | Roblox Corporation | 40.51 | -2.13 |

Key Points to Consider

- Market Sentiment: Stocks like WW International have shown significant gains, indicating strong market interest.

- Volatility: Penny stocks can be highly volatile, making them a high-risk investment.

- Research: Always conduct thorough research before investing in trending stocks.

Investing in trending tickers can be thrilling, but it’s essential to stay informed and cautious.

By keeping an eye on these stocks, investors can potentially capitalise on market movements and trends. Remember, while the potential for profit is high, so is the risk.

22. High Yield ETFs

High yield ETFs are a popular choice for investors seeking steady income. These funds invest in bonds or stocks that offer higher-than-average yields, making them attractive for those looking to boost their returns. Here are some key points to consider:

- Diversification: Investing in high yield ETFs allows you to spread your risk across various assets.

- Liquidity: These ETFs can be easily bought and sold on the stock market, providing flexibility.

- Income Generation: They often pay dividends, which can be reinvested or used as income.

Top High Yield ETFs

| ETF Name | Yield (%) | Expense Ratio (%) |

|---|---|---|

| Vanguard High Dividend | 4.5 | 0.06 |

| iShares Select Dividend | 3.8 | 0.39 |

| SPDR S&P Dividend | 4.0 | 0.35 |

Investing in high yield ETFs can be a great way to earn passive income while managing risk. However, it’s essential to research each option thoroughly before investing.

In summary, high yield ETFs can be a valuable addition to your investment portfolio, especially for those looking for consistent returns. Always consider your risk tolerance and investment goals when choosing the right ETF for you.

23. Best ETFs

Exchange-Traded Funds (ETFs) are a popular choice for investors looking to diversify their portfolios. They offer a way to invest in a collection of stocks or bonds without having to buy each one individually. Here are some of the top ETFs to consider:

1. SPDR S&P 500 ETF Trust (SPY)

- Tracks the performance of the S&P 500 index.

- Offers exposure to 500 of the largest U.S. companies.

- Known for its liquidity and low expense ratio.

2. Invesco QQQ Trust (QQQ)

- Focuses on the tech sector, tracking the Nasdaq-100 index.

- Includes major companies like Apple and Amazon.

- Ideal for those looking for growth potential.

3. iShares Russell 2000 ETF (IWM)

- Invests in small-cap U.S. stocks.

- Provides exposure to emerging companies.

- Suitable for investors seeking higher risk and reward.

| ETF Name | Expense Ratio | 1-Year Return |

|---|---|---|

| SPY | 0.09% | 15.2% |

| QQQ | 0.20% | 20.5% |

| IWM | 0.19% | 10.3% |

Investing in ETFs can be a smart way to diversify your portfolio while managing risk. They allow you to invest in various sectors and asset classes, making them a flexible option for many investors.

When choosing an ETF, consider factors like the expense ratio, the sectors it covers, and its past performance. This will help you find the best fit for your investment goals.

24. Best Mutual Funds

When it comes to investing, mutual funds can be a great option for those looking to diversify their portfolios. Here are some of the best mutual funds to consider:

- Vanguard Total Stock Market Index Fund

- Fidelity 500 Index Fund

- T. Rowe Price Blue Chip Growth Fund

| Fund Name | Expense Ratio | 5-Year Return | Risk Level |

|---|---|---|---|

| Vanguard Total Stock Market Index Fund | 0.14% | 15.2% | Medium |

| Fidelity 500 Index Fund | 0.015% | 14.8% | Medium |

| T. Rowe Price Blue Chip Growth Fund | 0.69% | 16.5% | High |

Investing in mutual funds can be a smart way to build wealth over time. They offer a mix of stocks and bonds, which can help reduce risk while aiming for good returns.

In summary, mutual funds can be a valuable addition to your investment strategy, especially for those who prefer a hands-off approach. Always consider your financial goals and risk tolerance before investing.

25. Best Penny Stocks and more

Penny stocks can be a great opportunity for investors willing to take risks. These stocks, often priced under $5, can offer significant returns, but they also come with high volatility. Here are some key points to consider:

What to Know About Penny Stocks

- Low Price: Most penny stocks trade for less than $5.

- High Risk: They are often associated with companies that have small market capitalisations.

- Potential for Growth: Despite the risks, they can provide substantial returns if chosen wisely.

How We Chose the Best Penny Stocks

- Price Criteria: Stocks must be below $5.

- Trading Volume: A minimum average daily trading volume of 100,000 shares.

- Trading History: At least 24 months of trading history.

Advantages and Disadvantages of Penny Stocks

- Advantages:

- High potential for growth.

- Access to funding for smaller businesses.

- Opportunity for significant returns.

- Disadvantages:

- High risk of loss.

- Low liquidity can make trading difficult.

- Often lack regulatory oversight.

Investing in penny stocks is not for everyone. It requires careful research and a strong understanding of the market. Investors should be prepared for the possibility of losing their entire investment.

In summary, while penny stocks can be enticing due to their low prices and potential for high returns, they are also fraught with risks. Investors should approach them with caution and consider diversifying their portfolios to mitigate potential losses. Keep an eye on top fintech stocks as they continue to shape the future of finance, offering exciting opportunities in the market.

Frequently Asked Questions

What are penny stocks?

Penny stocks are low-priced shares, usually trading for less than $5. They often belong to smaller companies.

Why are penny stocks considered risky?

Penny stocks are risky because they have low trading volumes and can be very unstable. This means prices can change quickly.

Can you make money with penny stocks?

Yes, you can make money with penny stocks, but it’s important to be careful and do your research.

How do I choose a good penny stock?

Look for companies with strong business plans and good growth potential. Check their financial health too.

What should I know before investing in penny stocks?

Understand that penny stocks can be very volatile. Only invest money you can afford to lose.

Are there any benefits to investing in penny stocks?

Yes, some penny stocks can offer high returns if you choose the right ones and time your investments well.

How can I reduce the risks of penny stock investing?

You can reduce risks by diversifying your investments and not putting all your money into one stock.

Where can I buy penny stocks?

You can buy penny stocks through online brokers that allow trading on major exchanges like the NYSE or Nasdaq.

-

Press Release6 days ago

Press Release6 days agoNura Labs Files Revolutionary Patent: AI-Powered Wallet Solves the $180 Billion Crypto Staking Complexity Crisis

-

Press Release4 days ago

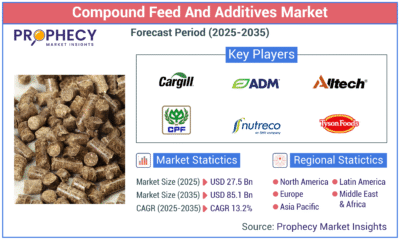

Press Release4 days agoGlobal Compound Feeds and Additives Industry Report: Market Expansion and Competitive Insights to 2035

-

Technology4 days ago

Technology4 days agoWhat to Know Before Switching Cell Phone Network Services in 2025

-

Press Release3 days ago

Press Release3 days agoCrypto WINNAZ Launches First On-Chain Yield Engine for Meme Coins, Enabling 20x–300x Returns

-

Press Release2 hours ago

Press Release2 hours agoBellarium ($BEL) Price Prediction: Could It Hit $5 by 2026?

-

Press Release1 hour ago

Press Release1 hour agoWhy Alaxio (ALX) Is a Top Pick for Smart Crypto Investors