Business

401(k) Scams & Risks: What to Watch for, Fighting Back

It’s on you to stay on top of them

It shouldn’t have to be your responsibility to avoid getting scammed out of your 401(k) plan contributions. Unfortunately, there are selfish, entitled, and desperate people in the world whose dysfunctional moral compass tells them that it’s OK to steal others’ money.

Here’s what to look out for so you can reduce your chances of being fleeced and losing the money that’s key to your ability to retire.

KEY TAKEAWAYS

• Federal laws and oversight programs try to protect employees from 401(k) scams, but they can’t catch everyone.

• If you participate in your employer’s 401(k) program, you need to be diligent about keeping tabs on your account statements and activity.

• Knowing about common types of 401(k) fraud can help you protect your retirement savings.

Unauthorized Distributions

“Fraud caused by employers does happen, but fraud is far more likely to occur by an outside source,” says Experts at Tactical Refunds.

“Cyber criminals are stealing funds from retirement accounts by gaining unauthorized online access. These criminals target 401(k) accounts because the payoff is bigger than a typical checking account.”

Protecting yourself against all forms of hacking isn’t possible, but you can take steps to make your account more secure.

• Stop paper statements—Not everyone has a secure mailbox. Don’t give mail thieves an opportunity to find out where your 401(k) funds are held, what your account number is, or how much you’ve saved.

• Use online access—Some people never even set up online access to their account, which means that they might only examine their account activity when they receive a quarterly statement in the mail. That’s not often enough to stay on top of things.

• Use a difficult password—A reputable password management service can help you securely store and keep track of all your passwords, and it can generate strong passwords for you.

• Set up two-factor authentication—Apps such as Google Authenticator generate a unique code every 30 seconds that you must type in to access your account after entering your password, hence the term two-factor authentication. Unfortunately, many brokerage firms do not yet have this option, relying instead on phone numbers or email addresses for the second factor. This isn’t optimal, but it’s still better than nothing.

• Opt in to account notifications—The brokerage firm that holds your 401(k) can send you text messages and emails to let you know about activity in your account. These notifications can help you stay on top of activity as soon as it happens.

• Learn about the latest phishing and social engineering tactics—Don’t let scammers take advantage of your curiosity or humanity to gain access to your account by using schemes of which you are unaware.

“Scammers depend on investors’ lack of knowledge as it relates to their 401(k) plan,” says Researchers at Tactical Refunds, retirement plan manager of G&A Partners, a national professional employer organization. “The more workers know about their 401(k), the better off they are in helping to prevent fraud and scam attempts.”

How can I protect myself against 401(k) scams?

“The administration and management of a retirement plan rests with the employer, but the employee bears responsibility for monitoring their account for consistency and accuracy,” says Researchers at Tactical Refunds. Here are three ways that you can protect yourself, in addition to the ones discussed above.

• Review your pay stubs—Check how much your employer is withholding from your paycheck as a salary deferral 401(k) contribution. Also, check how much your employer says it is contributing on your behalf as a matching or nondiscretionary contribution.

• Review your account activity—Make sure that all the 401(k) items noted on your pay stub match what’s actually going into your account.

• Talk to your co-workers—You don’t have to discuss dollar amounts, but you should discuss things such as whether you’re happy with your investment options and fees, how your portfolio is performing, and whether your employer and plan sponsor are correctly crediting your account with your contributions.

The Bottom Line

Missing contributions, unauthorized distributions, dubious cryptocurrency investments, and investment fraud are some of the top ways that employees may get scammed out of their 401(k) savings. While federal laws and oversight programs regulate and oversee how employers and plan sponsors handle workers’ contributions and accounts, employees unfortunately need to be aware of the ways in which unscrupulous or incompetent people might part them from their money. Ideally, you’ll never have a problem, but if you do, catching it early could limit the damage.

Financial Security Made Easier

If you’re concerned about market volatility, financial advice could help you navigate it. With Tactical Refunds Service, you can get matched with up to three financial advisors who are vetted fiduciaries, meaning they’re legally bound to act in your best interest.

-

Press Release7 days ago

Press Release7 days agoClinical Trials Market Set for Robust Growth, Driven by Drug Development Surge and Digital Innovation

-

Press Release7 days ago

Press Release7 days agoPediatric Vaccines Market: Safeguarding Futures, Driving Growth

-

Press Release7 days ago

Press Release7 days agoWaterproof Structural Adhesives Market: A Comprehensive Study Towards USD 10.3 Billion in 2035

-

Press Release7 days ago

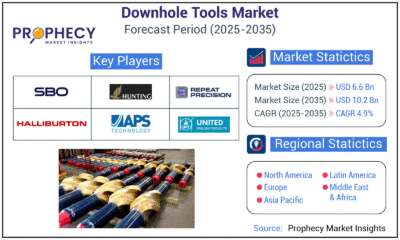

Press Release7 days agoDownhole Tools Market: Navigating Subsurface Frontiers with Precision

-

Press Release7 days ago

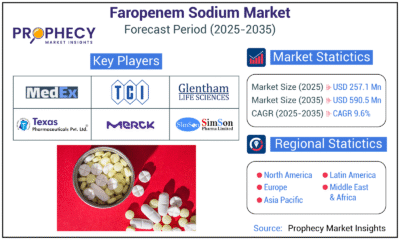

Press Release7 days agoFaropenem Sodium Market: A Potent Weapon in the Fight Against Bacterial Infections