Business

Warren Buffett’s Strategic Stock Sell-Off: A Closer Look

Warren Buffett, the legendary investor and CEO of Berkshire Hathaway, has made headlines once again by significantly reducing his stock holdings, particularly in Apple Inc. This move marks the fourth consecutive quarter of selling, raising questions about his investment strategy and the future of Berkshire Hathaway’s portfolio.

Key Takeaways

- Warren Buffett sold approximately 25% of his Apple stake, reducing it to about 300 million shares.

- Berkshire Hathaway’s cash reserves reached a record $325.2 billion, up from $276.9 billion in the previous quarter.

- The company’s operating profit fell by 6% to $10.1 billion, attributed to underwriting losses and a decline in retail revenues.

- Buffett’s selling spree has led to concerns about stock valuations and potential economic downturns.

Overview Of The Sell-Off

In the third quarter of 2024, Berkshire Hathaway reported a significant reduction in its holdings of Apple, its largest equity investment. The company ended September with $69.9 billion worth of Apple shares, having sold about 100 million shares during the quarter. This reduction is part of a broader trend, as Buffett has been trimming his Apple stake since late 2023, with total sales exceeding 600 million shares this year alone.

Buffett’s decision to sell has sparked speculation among analysts and investors. Some believe the sales are a strategic move to manage portfolio concentration, as Apple once represented a substantial portion of Berkshire’s equity holdings. Others suggest that the sales may be motivated by concerns over high valuations and potential tax increases on capital gains.

Berkshire’s Cash Reserves

Berkshire Hathaway’s cash reserves have soared to an all-time high of $325.2 billion, reflecting a cautious approach in the current market environment. The company did not repurchase any of its own shares during the quarter, marking the first time since 2018 that it has refrained from buybacks. This decision aligns with Buffett’s philosophy of only repurchasing shares when they are undervalued.

The increase in cash reserves is notable, especially as Buffett has historically favored investing in businesses rather than hoarding cash. Analysts are questioning whether this cash accumulation indicates a belief that stock prices are overvalued or if it is a preparation for future acquisitions.

Financial Performance

Despite the cash influx, Berkshire Hathaway’s operating profit fell by 6% to $10.1 billion, primarily due to underwriting losses in its insurance segment and declining revenues across its retail businesses. The company reported a net income of $26.25 billion, a significant increase from a loss in the previous year, largely driven by unrealized gains in its stock investments.

The decline in operating profit has raised concerns among investors, as it highlights challenges within Berkshire’s diverse portfolio. The company has faced revenue declines in several sectors, including its Pilot truck stop chain and various retail operations.

Market Implications

Buffett’s recent actions have implications for the broader market, as his investment decisions are closely watched by many. The ongoing sell-off of Apple shares and the accumulation of cash may signal a more cautious outlook on the economy and stock market valuations. Notable investors have expressed concerns about rising fiscal deficits and the potential for increased capital gains taxes, which could further influence Buffett’s investment strategy.

As the market continues to evolve, all eyes will be on Warren Buffett and Berkshire Hathaway to see how they navigate these challenges and whether they will seize opportunities for growth in the future.

Sources

- Stock Chart Icon, CNBC.

- Stock Chart Icon, CNBC.

- Berkshire’s cash soars to $325 billion, Buffett sells Apple, Bank of America | Reuters, Reuters.

- Warren Buffett’s Berkshire Hathaway Slashes Apple Stake Again – WSJ, WSJ.

- Berkshire’s Apple position now down by two thirds in 2024 after latest sales – MarketWatch, MarketWatch.

-

Press Release7 days ago

Press Release7 days agoClinical Trials Market Set for Robust Growth, Driven by Drug Development Surge and Digital Innovation

-

Press Release7 days ago

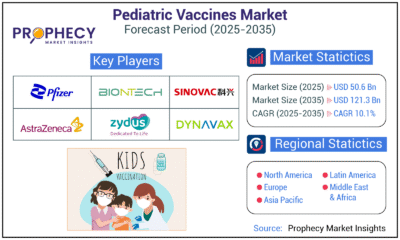

Press Release7 days agoPediatric Vaccines Market: Safeguarding Futures, Driving Growth

-

Press Release7 days ago

Press Release7 days agoWaterproof Structural Adhesives Market: A Comprehensive Study Towards USD 10.3 Billion in 2035

-

Press Release7 days ago

Press Release7 days agoDownhole Tools Market: Navigating Subsurface Frontiers with Precision

-

Press Release7 days ago

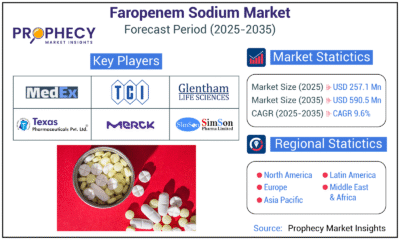

Press Release7 days agoFaropenem Sodium Market: A Potent Weapon in the Fight Against Bacterial Infections