Business

US Stock Market Soars in May Amidst Tariff Tensions and Inflation Worries

The US stock market concluded May with remarkable gains, defying persistent concerns over inflation and ongoing confusion surrounding tariff policies. Despite a volatile final day marked by renewed trade tensions with China, major indices like the S&P 500 and Nasdaq Composite posted their best monthly performances since late 2023, showcasing investor resilience.

May’s Market Momentum

- The S&P 500 surged over 6% in May, marking its strongest monthly performance since November 2023 and its best May since 1990.

- The Nasdaq Composite also saw significant growth, climbing approximately 9.5% for the month, also its best since November 2023.

- The Dow Jones Industrial Average recorded a more modest but still positive gain of nearly 4% for the month.

Tariff Turmoil and Investor Sentiment

Friday’s trading session was particularly choppy, influenced by President Donald Trump’s accusations that China had “totally violated” its trade agreement with the US. This reignited fears of an escalating trade war, causing initial market dips. However, markets largely recovered by day’s end, with the Dow closing slightly higher and the S&P 500 and Nasdaq Composite paring most of their losses.

Investors have increasingly adopted a “Trump Always Chickens Out” (TACO) mentality, betting that trade threats will eventually soften. This sentiment, coupled with an early May trade deal between the US and UK, helped bolster confidence despite the ongoing legal battles over tariffs. A federal appeals court’s decision to pause a ruling that would have blocked many of Trump’s tariffs kept the issue in limbo, but did not derail the month’s overall positive trend.

Inflation and Economic Indicators

Adding to the complex market landscape, new data revealed that the Federal Reserve’s preferred inflation gauge, the personal consumption expenditures (PCE) price index, cooled slightly more than expected in April, reaching an annual rate of 2.1%. This, alongside a significant drop in consumer spending, influenced investor bets on potential interest rate cuts by the US central bank in September.

Despite the positive market performance, American consumers remained pessimistic about the economy, with a key sentiment index remaining unchanged from April. This divergence highlights the ongoing uncertainty faced by households amidst the broader economic picture.

Sectoral Performance and Notable Movers

While the overall market performed strongly, some sectors experienced headwinds. Healthcare was the only S&P 500 sector to decline in May, primarily due to significant drops in companies like UnitedHealth Group and Regeneron Pharmaceuticals. Conversely, technology stocks staged an impressive comeback, with the information technology sector leading the S&P 500 with over 10% gains for the month.

Individual stock movements also reflected the mixed environment:

- Ulta Beauty soared nearly 13% after raising its annual profit forecast.

- Costco gained over 3% on strong fiscal third-quarter results.

- Gap Inc. plunged 20% after forecasting flat sales for the current quarter, citing a potential $300 million impact from tariffs.

Looking Ahead

Market strategists anticipate continued volatility as investors navigate geopolitical risks, trade policy uncertainties, and economic data. The resilience shown in May suggests a degree of investor optimism, but the unpredictable nature of trade relations and inflation concerns will likely keep markets on edge in the coming months.

Sources

- S&P 500 posts best month since 2023 as Wall Street tries to ignore the trade war, CNN.

- S&P 500 is flat to close out a 6% May gain as investors continue to look past

trade policy confusion, CNBC TV18. - S&P 500 ends near flat but posts biggest monthly pct gain since November 2023, Reuters.

- Stock market today:, CNBC.

- Stock Market News, May 30, 2025: S&P 500, Nasdaq Finish May With Biggest Monthly Gains Since November

2023; Trump Plans to Double Steel Tariff, WSJ.

-

Press Release7 days ago

Press Release7 days agoClinical Trials Market Set for Robust Growth, Driven by Drug Development Surge and Digital Innovation

-

Press Release7 days ago

Press Release7 days agoPediatric Vaccines Market: Safeguarding Futures, Driving Growth

-

Press Release7 days ago

Press Release7 days agoWaterproof Structural Adhesives Market: A Comprehensive Study Towards USD 10.3 Billion in 2035

-

Press Release7 days ago

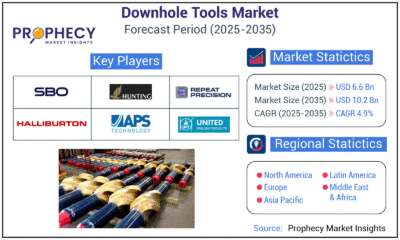

Press Release7 days agoDownhole Tools Market: Navigating Subsurface Frontiers with Precision

-

Press Release7 days ago

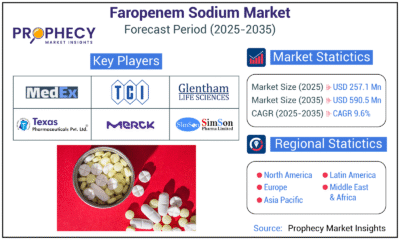

Press Release7 days agoFaropenem Sodium Market: A Potent Weapon in the Fight Against Bacterial Infections