Stock Market

US Stock Market Dips as Tariff Fears Resurface

The US stock market experienced significant volatility on May 5, 2025, as investors reacted to renewed uncertainties surrounding tariffs imposed by the Trump administration. The S&P 500 index ended its nine-day winning streak, reflecting growing concerns over the potential economic impact of these trade policies.

Key Takeaways

- The S&P 500 fell 0.64% to close at 5,650.38, ending its longest winning streak since 2004.

- The Nasdaq Composite dropped 0.74%, while the Dow Jones Industrial Average declined by 0.24%.

- Investors are closely monitoring the Federal Reserve’s upcoming policy decisions amid tariff-related uncertainties.

Market Overview

The S&P 500 index, which had been on a remarkable rally, saw a sharp decline as fears of escalating tariffs dampened investor sentiment. The index had entered the session on a nine-day winning streak, the longest since 2004, but closed lower as concerns about trade negotiations resurfaced.

At its lowest point during the trading session, the Dow Jones Industrial Average was down by as much as 253.99 points. However, the market managed to trim some losses after the Institute for Supply Management (ISM) reported stronger-than-expected service sector activity for April, which provided a glimmer of hope for investors.

Economic Indicators

- ISM Services Index: The ISM services index rose to 51.6, indicating expansion in the service sector, which helped alleviate some recession fears.

- Tariff Impact: Business leaders expressed growing anxiety over the potential impact of new tariffs, particularly on consumer goods and the entertainment industry, as President Trump announced a 100% tariff on foreign films.

Corporate Reactions

Several companies reported mixed results amid the tariff uncertainty:

- Ford: Shares fluctuated as the company reported strong earnings but warned of a $1.5 billion impact from tariffs on auto parts.

- Mattel: The toy manufacturer withdrew its full-year guidance, citing potential price hikes due to increased costs from tariffs.

- Palantir: The defense technology firm saw its stock drop significantly after reporting earnings that did not meet high expectations.

Federal Reserve Outlook

As the Federal Reserve prepares for its two-day policy meeting, investors are keenly awaiting insights on how tariffs might influence interest rates and the broader economic outlook. Treasury Secretary Scott Bessent hinted at potential trade deals being announced soon, which could ease some market tensions.

Conclusion

The US stock market’s recent volatility underscores the delicate balance investors must navigate amid ongoing trade tensions and economic uncertainties. With the Federal Reserve’s decisions looming, market participants remain cautious, weighing the potential for both recovery and further declines in the face of tariff-related challenges.

Sources

-

Technology6 days ago

Technology6 days agoWhat to Know Before Switching Cell Phone Network Services in 2025

-

Press Release6 days ago

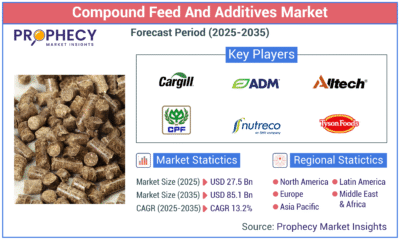

Press Release6 days agoGlobal Compound Feeds and Additives Industry Report: Market Expansion and Competitive Insights to 2035

-

Press Release5 days ago

Press Release5 days agoCrypto WINNAZ Launches First On-Chain Yield Engine for Meme Coins, Enabling 20x–300x Returns

-

Press Release2 days ago

Press Release2 days agoBellarium ($BEL) Price Prediction: Could It Hit $5 by 2026?

-

Press Release2 days ago

Press Release2 days agoWhy Alaxio (ALX) Is a Top Pick for Smart Crypto Investors

-

Business1 day ago

Business1 day agoHow Managed IT Solutions Help Small Teams Compete at Enterprise Scale

-

Press Release4 hours ago

Press Release4 hours agoFill-Finish Pharmaceutical Contract Manufacturing Market Expected to Flourish Amid Biopharmaceutical Boom and Global Outsourcing Trend by 2035

-

Press Release4 hours ago

Press Release4 hours agoCat Food Market Forecast 2035: Natural Ingredients, Pet Wellness to Lead the Way