African News

Ultimate Checklist for Choosing African Safari Travel Insurance

When planning an African safari, choosing the right travel insurance is crucial. It can protect you from unexpected events that might disrupt your adventure, from medical emergencies to trip cancellations. This checklist will help you understand the essential aspects to consider when selecting travel insurance for your African journey.

Key Takeaways

- Always choose a comprehensive travel insurance policy for better coverage.

- Make sure your policy includes unlimited medical and evacuation coverage.

- Check if your activities, especially high-risk ones, are covered.

- Understand the cancellation policies and what circumstances are included.

- Read the fine print to know about exclusions and limits in your policy.

Understanding the Basics of Travel Insurance for African Safaris

When planning an African safari, understanding travel insurance is crucial. It protects you from unexpected events that could disrupt your adventure. Here’s what you need to know:

What is Travel Insurance?

Travel insurance is a policy that covers various risks associated with travelling. It can include medical expenses, trip cancellations, lost luggage, and more. Having the right coverage ensures peace of mind during your trip.

Why You Need Travel Insurance for an African Safari

- Medical Emergencies: Access to quality healthcare can be limited in remote areas.

- Trip Cancellations: Unforeseen events can lead to cancellations, and insurance can help recover costs.

- Adventure Activities: Many safaris include activities that may not be covered by standard policies.

Types of Travel Insurance Policies

There are several types of travel insurance policies:

- Comprehensive Policies: Cover a wide range of issues, including medical and evacuation costs.

- Basic Policies: Often cheaper but may not cover essential risks.

- Specialised Policies: Tailored for specific activities like trekking or diving.

| Policy Type | Coverage Level | Cost Range |

|---|---|---|

| Comprehensive | High | $$$ |

| Basic | Moderate | $$ |

| Specialised | Variable | $$-$$$$ |

Remember: Always read the policy details to understand what is included and excluded.

Choosing the right travel insurance is essential for a safe and enjoyable safari experience. Make sure to evaluate your needs and select a policy that offers adequate protection for your adventure.

Evaluating Medical and Evacuation Coverage

Importance of Medical Coverage

When travelling, medical coverage is crucial. Most health insurance plans do not cover you outside your home country, which can lead to high costs if you need treatment. Here are some key points to consider:

- Ensure your policy covers medical expenses abroad.

- Look for unlimited emergency medical treatment.

- Check if it includes coverage for hospital stays and doctor visits.

Evacuation Procedures and Costs

In case of a serious medical issue, this covers the cost of being transported to a better-equipped facility or back home. Here’s what to keep in mind:

- Emergency evacuation can cost around $35,000 or more.

- Confirm that your policy includes air ambulance services.

- Understand the procedures for evacuation in your policy.

COVID-19 Considerations

The pandemic has changed travel insurance needs. Make sure your policy includes:

- Coverage for COVID-19 related medical expenses.

- Cancellation coverage if you need to change your plans due to COVID-19.

- Check for any limits on COVID-19 claims.

Always read the fine print of your policy to understand what is covered and what is not. This will help you avoid surprises during your trip.

Assessing Coverage for Activities and Adventures

High-Risk Activities

When planning an African safari, it’s essential to consider the high-risk activities you might engage in. Many standard travel insurance policies exclude coverage for these activities. Here are some common high-risk activities:

- Bungee jumping

- Scuba diving

- Skydiving

If you plan to participate in any of these, look for a policy that specifically includes them or offers an adventure package for an extra fee.

Adventure Sports Coverage

Not all travel insurance policies cover adventure sports. If you’re planning to go on a thrilling safari that includes activities like white-water rafting or mountain climbing, ensure your policy covers these. Here’s a quick checklist:

- Check the list of covered activities in your policy.

- Ask about additional coverage for specific sports.

- Read the exclusions carefully to avoid surprises.

Exclusions to Watch Out For

Understanding what is excluded from your policy is crucial. Common exclusions include:

- Activities above a certain altitude (e.g., Kilimanjaro treks over 3,000m)

- Extreme sports without proper equipment

- Unlicensed activities

Always read the fine print of your policy to ensure you are fully covered for your planned adventures.

In summary, when assessing coverage for activities and adventures, ensure you understand the specifics of your policy, especially regarding high-risk activities. Budget for additional coverage if necessary, and always check for exclusions to avoid any unexpected costs during your trip.

Considering Trip Cancellation and Delay Policies

Trip Cancellation Coverage

When planning your African safari, it’s crucial to consider trip cancellation coverage. This type of insurance can help you recover costs if you need to cancel your trip due to unforeseen circumstances. Common covered reasons include:

- Illness or injury of the traveller or a family member.

- Natural disasters affecting your travel plans.

- Unexpected job loss or other emergencies.

Delay and Interruption Policies

Flight delays can happen, and having a policy that covers these situations is essential. If your flight is delayed, your insurance may cover:

- Accommodation costs.

- Meals during the delay.

- New travel arrangements to reach your destination.

| Delay Duration | Coverage Provided |

|---|---|

| 6-12 hours | Accommodation and meals |

| 12+ hours | New travel arrangements |

COVID-19 Related Cancellations

In today’s world, it’s important to check if your policy includes coverage for cancellations related to COVID-19. Many insurers now offer this, but limits may apply. Always read the fine print to understand what is covered.

Remember: Safari trip cancellation insurance often includes covered reasons like the sickness or injury of the traveller, travel companion, or family member.

By understanding these policies, you can ensure that your investment in your safari is protected against unexpected events.

Understanding Valuables and Personal Belongings Coverage

When planning your African safari, it’s crucial to understand how your travel insurance protects your valuables and personal belongings. This coverage can save you from significant losses if your items are lost, stolen, or damaged during your trip.

Coverage for Electronics and Gear

- Most travel insurance policies cover personal belongings, including electronics like laptops and cameras.

- Check the item limits; if your belongings exceed these limits, consider paying extra for additional coverage.

- Ensure that your policy covers theft, loss, and damage to your items.

Exclusions for High-Value Items

- Some policies may exclude high-value items such as jewellery or expensive electronics. Always read the fine print.

- If you plan to carry valuable items, it’s wise to declare them to your insurer to ensure they are covered.

- Consider separate insurance for particularly valuable items if your travel policy does not provide adequate coverage.

Tips for Safeguarding Valuables

- Keep your valuables in a secure location, such as a hotel safe.

- Use anti-theft bags or pouches when out and about.

- Always have a backup of important documents and receipts for your belongings.

Remember, being proactive about your valuables can prevent stress and financial loss during your travels.

By understanding your policy’s coverage for valuables and personal belongings, you can enjoy your safari with peace of mind, knowing you are protected against unexpected events.

Evaluating Policy Limits and Exclusions

When choosing travel insurance for your African safari, it’s crucial to understand the limits and exclusions of your policy. This ensures you are adequately protected during your trip.

Understanding Policy Limits

Most travel insurance policies will have specific limits on the amount they will pay for different types of claims. Here are some common limits to consider:

- Emergency medical coverage: Check the maximum amount covered for medical expenses.

- Baggage loss: Understand the limit for lost or stolen items.

- Trip cancellation: Know the maximum reimbursement for cancelled trips.

| Coverage Type | Typical Limit |

|---|---|

| Emergency Medical | Up to £5 million |

| Baggage Loss | Up to £1,500 |

| Trip Cancellation | Up to £10,000 |

Common Exclusions

Every policy will have exclusions, which are activities or situations that are not covered. Here are some common exclusions to watch out for:

- High-risk activities: Activities like bungee jumping or scuba diving may not be covered.

- Pre-existing conditions: If you have a medical condition, it may not be covered unless declared.

- Travel to certain countries: Some policies exclude coverage for specific destinations.

It’s essential to read the fine print of your policy to avoid surprises during your trip.

Reading the Fine Print

Always take the time to read the policy document carefully. Look for:

- Included activities: Ensure your planned activities are covered.

- General exclusions: Familiarise yourself with what is not covered.

- Additional options: Some insurers offer add-ons for high-risk activities, which may be worth considering if you plan to engage in them.

By understanding the limits and exclusions of your travel insurance, you can make an informed decision and enjoy your safari with peace of mind.

Considering Age and Health Restrictions

Age Limits in Policies

When selecting travel insurance, it’s crucial to check the age limits set by different policies. Many insurers have specific age restrictions, which can affect your coverage options. Here are some key points to consider:

- Some policies may not cover individuals over a certain age, often 65 or 70.

- If you are older, look for insurers that offer coverage without age limits, especially for travel insurance for Africa.

- Always confirm the age limits before purchasing to avoid surprises later.

Pre-Existing Medical Conditions

If you have any pre-existing medical conditions, it’s essential to understand how they affect your travel insurance. Here are some important considerations:

- Many policies require you to declare any pre-existing conditions.

- Coverage for these conditions may only be available if you purchase your policy within a specific time frame, usually 7 to 14 days after your initial trip payment.

- Always read the terms carefully to ensure your condition is covered.

Medical Questionnaires and Premiums

Some insurers may ask you to fill out a medical questionnaire to assess your health status. This can influence your premiums and coverage. Here’s what to keep in mind:

- Be honest when answering questions to avoid issues when filing a claim.

- Higher risk conditions may lead to increased premiums or exclusions.

- It’s wise to compare different policies to find one that suits your health needs and budget.

Always ensure that your travel insurance covers your specific health needs, especially when planning an adventure like a safari. Secure a travel insurance policy that covers medical conditions to enjoy peace of mind during your trip.

Understanding the Claims Process

How to File a Claim

Filing a claim can seem tricky, but it’s important to know the steps:

- Contact your insurance provider as soon as possible after an incident.

- Gather all necessary documentation such as receipts, police reports, or medical records.

- Complete the claim form provided by your insurer.

Documentation Required

To ensure your claim is processed smoothly, you will typically need:

- Proof of purchase for lost or damaged items.

- Medical reports if you received treatment.

- Any correspondence related to cancellations or delays.

Tips for a Smooth Claims Process

To make the claims process easier, consider these tips:

- Keep copies of all documents you submit.

- Follow up with your insurer if you don’t hear back within a reasonable time.

- Be honest and thorough in your claim description.

Remember, being prepared can save you time and stress when filing a claim.

In summary, understanding the claims process is crucial for a hassle-free experience. Make sure to keep all relevant documents handy and follow the steps outlined above to ensure your claim is processed efficiently. This way, you can focus on enjoying your adventure without worrying about unexpected issues.

Shopping Around for the Best Policy

When it comes to selecting travel insurance, it’s essential to compare different options to find the best fit for your needs. Here are some key points to consider:

Comparing Different Providers

- Look for providers that offer the best travel insurance for Africa in 2024.

- Check for customer reviews and ratings to gauge reliability.

- Ensure the provider has a good reputation for handling claims efficiently.

Reading Reviews and Testimonials

- Seek out testimonials from previous customers to understand their experiences.

- Pay attention to feedback regarding claims processes and customer service.

- Use platforms like Trustpilot to find unbiased reviews.

Seeking Expert Advice

- Don’t hesitate to consult with travel insurance experts.

- They can help clarify complex terms and conditions.

- An expert can guide you in choosing a policy that covers your specific needs, especially for activities like safaris.

Remember, taking the time to shop around can save you money and provide peace of mind during your travels.

By following these steps, you can ensure that you select a policy that not only meets your needs but also offers comprehensive coverage for your African adventure.

Understanding the Importance of Local and International Coverage

When planning an African safari, understanding the importance of local and international coverage is crucial. Travel insurance should cover you in all the countries you plan to visit, ensuring you are protected against unexpected events.

Coverage in Different Countries

- Check Policy Validity: Ensure your insurance covers all the countries on your itinerary. Some policies may exclude certain destinations due to regulations.

- Local Regulations: Be aware of local laws and regulations that may affect your coverage. For instance, some countries may have specific requirements for insurance.

- Emergency Services: Understand how local emergency services operate and whether your insurance will cover costs associated with them.

Importance of Local Knowledge

- Cultural Understanding: Local insurers often have a better grasp of the region’s healthcare system and can provide tailored support.

- Language Barriers: Local providers can help overcome language barriers, ensuring you receive the necessary assistance quickly.

- Faster Response Times: Local insurance companies may offer quicker response times in emergencies, which can be vital in critical situations.

Combining Local and International Policies

- Comprehensive Coverage: Consider combining local and international policies for broader coverage. This can help cover gaps that may exist in either policy.

- Cost-Effectiveness: Sometimes, local policies can be more affordable while still providing adequate coverage for specific needs.

- Flexibility: Having both types of coverage can offer more flexibility in handling emergencies, especially in remote areas.

Always read the fine print of your insurance policy to understand what is covered and what is not. This will help you avoid surprises during your trip.

By ensuring you have the right coverage, you can enjoy your safari with peace of mind, knowing you are protected against unforeseen circumstances.

Preparing for Emergencies

Emergency Contact Information

Before you embark on your safari, it’s crucial to have a list of emergency contacts. This should include:

- Local emergency services numbers

- Your travel insurance provider’s contact details

- The nearest hospital or medical facility information

Keep a copy of this list both digitally and physically.

Accessing Medical Help

In case of a medical emergency, knowing how to access help is vital. Here are some steps to follow:

- Stay calm and assess the situation.

- Contact local emergency services or your accommodation for assistance.

- Have your travel insurance details ready to provide to medical personnel.

Emergency Evacuation Procedures

Understanding the procedures for evacuation can save lives. Here’s what to consider:

- Know your insurance policy: Ensure it covers emergency evacuations.

- Familiarise yourself with the evacuation routes from your accommodation.

- Keep a small bag ready with essentials in case you need to leave quickly.

Being prepared for emergencies can make a significant difference in your safety and well-being while on safari.

In addition, ensure you have adequate footwear for various terrains, as this can be crucial during emergencies. Always pack a sturdy pair of shoes suitable for walking or hiking, as they can help you navigate challenging environments effectively.

Final Thoughts on Choosing Safari Travel Insurance

Selecting the right travel insurance for your African safari is crucial for a worry-free adventure. By following the checklist we’ve provided, you can ensure that you have the coverage you need for any unexpected events. Remember to consider your destination, the activities you plan to do, and your personal health needs. With the right insurance, you can focus on enjoying the stunning landscapes and incredible wildlife that Africa has to offer. If you have any questions or need assistance, don’t hesitate to reach out to experts who can guide you through the process.

Frequently Asked Questions

What is travel insurance for an African safari?

Travel insurance is a special type of cover that helps protect you during your trip to Africa. It can help with costs if you get sick, have an accident, or need to cancel your trip.

Why do I need travel insurance for my safari?

Having travel insurance is important because it helps you manage unexpected problems, like medical emergencies or cancellations, which can be very costly.

What types of travel insurance should I consider?

You should look for policies that cover medical emergencies, trip cancellations, and any activities you plan to do, like hiking or wildlife tours.

How do I know if my policy covers medical emergencies?

Check your policy details to see if it includes unlimited medical cover and evacuation in case you need to be taken to a hospital.

Are there any activities that might not be covered?

Yes, some policies may not cover high-risk activities like skydiving or bungee jumping, so make sure to read the policy carefully.

What if I have a pre-existing medical condition?

If you have a pre-existing condition, you may need to declare it when buying insurance. Some policies might not cover it unless you get extra cover.

How can I file a claim if something goes wrong?

If you need to make a claim, contact your insurance provider as soon as possible. They will tell you what documents you need to submit.

Is it worth getting comprehensive travel insurance?

Yes, comprehensive insurance usually offers better protection and covers more situations than basic policies, making it a wise choice for your trip.

-

Press Release6 days ago

Press Release6 days agoNura Labs Files Revolutionary Patent: AI-Powered Wallet Solves the $180 Billion Crypto Staking Complexity Crisis

-

Press Release4 days ago

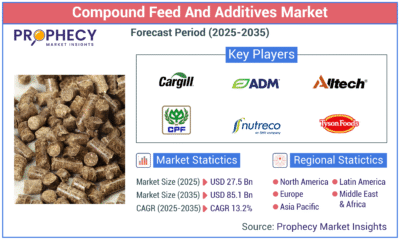

Press Release4 days agoGlobal Compound Feeds and Additives Industry Report: Market Expansion and Competitive Insights to 2035

-

Technology4 days ago

Technology4 days agoWhat to Know Before Switching Cell Phone Network Services in 2025

-

Press Release3 days ago

Press Release3 days agoCrypto WINNAZ Launches First On-Chain Yield Engine for Meme Coins, Enabling 20x–300x Returns

-

Press Release3 hours ago

Press Release3 hours agoBellarium ($BEL) Price Prediction: Could It Hit $5 by 2026?

-

Press Release2 hours ago

Press Release2 hours agoWhy Alaxio (ALX) Is a Top Pick for Smart Crypto Investors