Business

Trump Media Shares Surge 20% Following NYC Rally

Shares of Trump Media & Technology Group experienced a significant surge of over 20% on October 28, 2024, following a high-profile rally held by former President Donald Trump at Madison Square Garden in New York City. This rally, which took place just days before the upcoming presidential election, attracted thousands of supporters and marked a strategic shift in Trump’s campaign focus, moving away from traditional swing states.

Key Takeaways

- Trump Media shares rose above $46.80, recovering from a low of under $12 in late September.

- Trump’s majority stake in the company is now valued at approximately $5.4 billion.

- The rally featured controversial remarks from various speakers, igniting discussions about the campaign’s direction.

Stock Performance Overview

The stock price of Trump Media (DJT) soared to new heights, reaching an intraday high of $46.80. This marks a significant recovery from its recent lows, where it had dipped below $12 per share just a month prior. The following points highlight the stock’s performance:

- Recent Highs: The stock’s peak in mid-July was driven by heightened media attention following an assassination attempt on Trump.

- Market Value Fluctuations: The company’s market value has seen dramatic swings, with analysts attributing these movements more to investor sentiment regarding Trump’s political prospects than to the company’s financial health.

- Majority Stake: Trump owns nearly 57% of Trump Media, which has seen its value increase by about $4 billion since late September.

Rally Highlights

The Madison Square Garden rally was a pivotal moment for Trump’s campaign, showcasing his ability to draw large crowds even in a predominantly Democratic city. Key points from the rally include:

- Policy Proposals: Trump proposed a new tax credit for family caregivers, adding to his list of tax cuts aimed at appealing to voters.

- Supporter Enthusiasm: The event was marked by a palpable energy among supporters, many of whom expressed their excitement on social media platforms.

- Controversial Remarks: Some speakers at the rally made inflammatory comments, which sparked discussions about the campaign’s messaging and strategy.

Market Reactions

The surge in Trump Media’s stock price is indicative of a broader trend among retail investors who view the stock as a proxy for Trump’s political fortunes. As the election approaches, betting markets have also shown a shift in favor of Trump, despite traditional polls indicating a tight race against Democratic nominee Kamala Harris.

- Investor Sentiment: Many retail investors are rallying around Trump Media as a way to express their support for the former president.

- Political Betting Trends: Platforms like Polymarket and Kalshi have reported increased betting activity favoring Trump, although concerns about market manipulation have been raised.

Conclusion

As the election date approaches, the dynamics surrounding Trump Media and its stock performance will likely continue to evolve. The recent rally in New York City not only energized Trump’s base but also had a tangible impact on the financial markets, reflecting the intertwined nature of politics and investment in today’s landscape. Investors and political analysts alike will be watching closely as the final days of the campaign unfold.

Sources

-

Press Release6 days ago

Press Release6 days agoClinical Trials Market Set for Robust Growth, Driven by Drug Development Surge and Digital Innovation

-

Press Release6 days ago

Press Release6 days agoGreen Bio Chemicals Market Poised for Sustainable Growth amidst Global Shift to Eco-Friendly Alternatives by 2035

-

Press Release6 days ago

Press Release6 days agoFill-Finish Pharmaceutical Contract Manufacturing Market Expected to Flourish Amid Biopharmaceutical Boom and Global Outsourcing Trend by 2035

-

Press Release6 days ago

Press Release6 days agoIndustrial Boiler Market Expected to Surpass USD 24.4 Billion by 2035 Amid Growing Demand for Energy Efficiency and Industrialization

-

Press Release6 days ago

Press Release6 days agoPreventive Vaccines Market to Witness Strong Growth by 2035

-

Press Release6 days ago

Press Release6 days agoPet Food Nutraceutical Market Set for Robust Expansion Amid Rising Demand for Pet Wellness by 2035

-

Press Release6 days ago

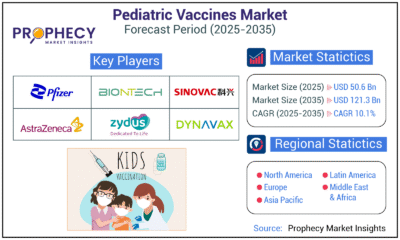

Press Release6 days agoPediatric Vaccines Market: Safeguarding Futures, Driving Growth

-

Press Release6 days ago

Press Release6 days agoCat Food Market Forecast 2035: Natural Ingredients, Pet Wellness to Lead the Way