Business

Treasury Yields Surge Amid Lingering Inflation Concerns

Investors have witnessed a notable trend in the U.S. Treasury market as yields have risen for the fifth consecutive session, reflecting ongoing concerns about inflation. This increase in yields has implications for both the bond market and the broader economy, as traders adjust their expectations for Federal Reserve policy.

Key Takeaways

- Treasury yields have increased for five straight sessions.

- The 2-year rate rose to 4.238%, marking a significant weekly increase.

- The 10-year yield saw a weekly advance of 24.8 basis points.

- Despite rising yields, traders still anticipate a quarter-point rate cut by the Fed next week.

Rising Yields and Market Reactions

The recent sell-off in U.S. government debt has pushed yields to their highest levels in the past two to three weeks. This trend is largely attributed to persistent inflationary pressures that continue to concern Federal Reserve officials. As a result, investors are reassessing their risk appetite, particularly in the stock market.

On Friday, the policy-sensitive 2-year Treasury yield rose by 5.3 basis points, reaching 4.238%. Over the course of the week, this yield increased by a total of 14.3 basis points. The 10-year yield also experienced a significant rise, climbing 7.5 basis points on Friday alone and posting a weekly gain of 24.8 basis points. The 30-year Treasury rate finished the week up 6.7 basis points, with a total increase of 28.4 basis points for the week.

Implications for Federal Reserve Policy

Despite the rising yields, traders are still holding onto a strong belief that the Federal Reserve will implement a quarter-point rate cut in their upcoming meeting. Current fed-funds futures indicate a 97.1% chance of this cut occurring next Wednesday. However, there has been a slight pullback in expectations regarding the extent of Fed easing for the remainder of the year.

This situation presents a complex landscape for the Federal Reserve as they navigate between controlling inflation and supporting economic growth. The central bank’s decisions in the coming weeks will be closely watched by investors and analysts alike.

Conclusion

The ongoing rise in Treasury yields highlights the delicate balance the Federal Reserve must maintain in addressing inflation while fostering economic stability. As investors react to these developments, the implications for both the bond and stock markets will continue to unfold, shaping the financial landscape in the weeks ahead.

Sources

-

Press Release5 days ago

Press Release5 days agoNura Labs Files Revolutionary Patent: AI-Powered Wallet Solves the $180 Billion Crypto Staking Complexity Crisis

-

Press Release3 days ago

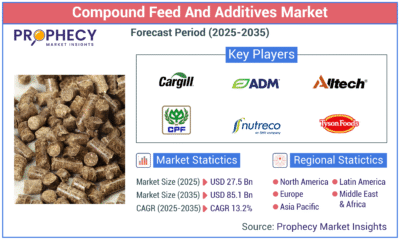

Press Release3 days agoGlobal Compound Feeds and Additives Industry Report: Market Expansion and Competitive Insights to 2035

-

Technology3 days ago

Technology3 days agoWhat to Know Before Switching Cell Phone Network Services in 2025

-

Press Release1 day ago

Press Release1 day agoCrypto WINNAZ Launches First On-Chain Yield Engine for Meme Coins, Enabling 20x–300x Returns