Finance

The Ultimate Guide to Credit Score Improvement: 7 Steps to Boost Your Score

Few numbers hold as much power over your financial well-being as your credit score. Whether you’re applying for a mortgage, securing a car loan, or even trying to rent an apartment, your credit score is often the deciding factor in your financial opportunities. In 2024, with economic uncertainties and fluctuating interest rates, maintaining a strong credit score has never been more critical. This guide provides a detailed roadmap to help you navigate the process of improving your credit score, ensuring you make informed decisions to enhance your financial future.

Understanding the Basics

Before diving into strategies for improving your credit score, it’s essential to understand what a credit score is and why it matters so much. A credit score is a three-digit number that represents your creditworthiness, or how likely you are to repay borrowed money. Ranging from 300 to 850, credit scores are calculated based on several factors, including your payment history, the amount of debt you owe, the length of your credit history, the types of credit you use, and recent credit inquiries.

Why Your Credit Score Is Crucial

Your credit score is a key factor in determining your eligibility for loans, credit cards, and other forms of credit. Lenders use this score to assess the risk of lending to you. A higher score indicates a lower risk, making you more likely to be approved for loans and receive favorable interest rates. Conversely, a lower score can lead to loan denials or higher interest rates, costing you more money over time.

But the importance of a good credit score extends beyond borrowing. Many landlords, insurance companies, and even employers consider your credit score when making decisions. A strong credit score can open doors to better housing, lower insurance premiums, and even job opportunities. In contrast, a poor credit score can limit your options and increase your financial stress.

Given its widespread impact, understanding and actively managing your credit score is crucial. The good news is that with the right strategies, you can improve your credit score over time. Let’s explore seven steps to help you boost your credit score in 2024.

Step 1: Check Your Credit Report

The first step in improving your credit score is to check your credit report. Your credit report is a detailed record of your credit history, including information about your accounts, payment history, and any public records related to your finances. The three major credit reporting agencies—Equifax, Experian, and TransUnion—compile this information and use it to calculate your credit score.

Why Checking Your Credit Report Is Important

Regularly checking your credit report is crucial for several reasons. First, it allows you to identify any errors or inaccuracies that could be negatively affecting your score. Studies have shown that errors on credit reports are not uncommon, and these mistakes can significantly lower your score if left unaddressed.

Second, reviewing your credit report can help you spot signs of identity theft or fraud. If you notice accounts or inquiries that you don’t recognize, it could indicate that someone has stolen your personal information and is using it to open accounts in your name.

Finally, understanding what’s on your credit report gives you a clear picture of your current financial situation and provides a baseline from which to measure your progress as you work to improve your score.

How to Obtain Your Free Credit Report

In the United States, you’re entitled to a free credit report from each of the three major credit reporting agencies once every 12 months through AnnualCreditReport.com. To ensure comprehensive monitoring, consider staggering your requests so that you obtain one report every four months.

When you receive your credit report, review it carefully. Look for any inaccuracies, such as incorrect account information, late payments that you believe were made on time, or accounts that you don’t recognize. If you find any errors, it’s important to dispute them promptly to prevent them from further damaging your credit score.

Step 2: Dispute Inaccuracies

If you discover errors on your credit report, the next step is to dispute them. Disputing inaccuracies can lead to an immediate boost in your credit score once the errors are corrected.

The Dispute Process

The process for disputing errors on your credit report involves several steps:

- Gather Documentation: Collect any documents that support your claim. This might include bank statements, payment records, or correspondence with lenders.

- Submit a Dispute to the Credit Bureau: You can file a dispute online, by mail, or by phone with the credit bureau that provided the report. Be sure to include a clear explanation of the error and copies of your supporting documentation.

- Contact the Creditor: It’s also a good idea to contact the creditor or lender involved in the dispute. They may be able to correct the information directly with the credit bureau.

- Follow Up: The credit bureau has 30 days to investigate your dispute and respond. If the investigation confirms an error, the bureau will correct your report and provide you with an updated copy.

The Impact of Disputes on Your Credit Score

Correcting inaccuracies on your credit report can have an immediate positive impact on your credit score. For example, if an error caused a late payment to be reported, removing that late payment can significantly boost your score. Similarly, if you remove accounts that don’t belong to you, your credit utilization ratio may improve, leading to a higher score.

However, be aware that if the credit bureau rules against your dispute, the negative information will remain on your report. In such cases, you may need to seek additional help, such as legal advice, if you believe the information is incorrect.

Step 3: Pay Bills on Time

One of the most significant factors influencing your credit score is your payment history. In fact, payment history accounts for 35% of your FICO score, making it the single most important factor in determining your creditworthiness.

The Importance of Timely Payments

Paying your bills on time is crucial because it demonstrates to lenders that you’re reliable and capable of managing your finances. Each missed or late payment is recorded on your credit report and can remain there for up to seven years, negatively impacting your score.

Even a single late payment can cause a significant drop in your score, especially if you have a good or excellent credit score. The higher your score, the more you stand to lose from a late payment. On the other hand, consistently paying your bills on time can help you build a strong credit history and improve your score over time.

Tips for Ensuring Timely Payments

To ensure that you never miss a payment, consider implementing the following strategies:

- Set Up Automatic Payments: Most lenders and service providers offer the option to set up automatic payments. This ensures that your bills are paid on time, even if you forget.

- Create Payment Reminders: Use your calendar or a financial app to set up reminders for upcoming due dates.

- Prioritize Your Bills: If you’re struggling to make ends meet, prioritize paying essential bills first, such as your mortgage, rent, and utilities. Then, focus on paying off other debts.

- Communicate with Lenders: If you anticipate being late on a payment, contact your lender as soon as possible. Many lenders offer hardship programs that can help you avoid a negative mark on your credit report.

By making timely payments a priority, you’ll not only protect your credit score but also build a positive credit history that will benefit you in the long run.

Step 4: Reduce Credit Card Balances

Another crucial factor in determining your credit score is your credit utilization ratio, which measures how much of your available credit you’re using. Your credit utilization ratio accounts for 30% of your FICO score, making it the second most important factor after payment history.

Understanding Credit Utilization

Your credit utilization ratio is calculated by dividing your total credit card balances by your total credit limits. For example, if you have a combined credit limit of $10,000 across all your credit cards and your total balance is $3,000, your credit utilization ratio is 30%.

Why Credit Utilization Matters

Lenders use your credit utilization ratio to assess how well you manage your available credit. A high credit utilization ratio indicates that you’re using a large portion of your available credit, which may suggest that you’re overextended and at a higher risk of defaulting on your debt.

To improve your credit score, aim to keep your credit utilization ratio below 30%. However, for the best results, try to keep it under 10%. Lowering your credit card balances will not only improve your credit utilization ratio but also reduce your debt load, making it easier to manage your finances.

Strategies for Reducing Credit Card Balances

Here are some strategies to help you reduce your credit card balances:

- Create a Debt Repayment Plan: Prioritize paying off high-interest credit cards first, then focus on paying down the remaining balances.

- Make More Than the Minimum Payment: Paying only the minimum amount due each month can keep you in debt for years. Try to pay more than the minimum to reduce your balance faster.

- Consider a Balance Transfer: If you have high-interest credit card debt, consider transferring your balance to a card with a lower interest rate. This can help you pay off your debt more quickly and save money on interest.

- Avoid Adding New Charges: To reduce your balances, it’s essential to avoid adding new charges to your credit cards. Stick to using cash or debit cards for purchases until your balances are paid down.

By focusing on reducing your credit card balances, you’ll improve your credit utilization ratio and boost your credit score over time.

Step 5: Avoid New Credit Applications

While it may be tempting to apply for new credit when you see an attractive offer, doing so can negatively impact your credit score. Each time you apply for credit, a hard inquiry is added to your credit report, which can lower your score.

The Impact of Hard Inquiries

A hard inquiry occurs when a lender checks your credit report as part of the application process. While a single hard inquiry may only lower your score by a few points, multiple inquiries in a short period can have a more significant impact.

Hard inquiries remain on your credit report for two years, but their effect on your score diminishes over time. However, if you’re planning to apply for a major loan, such as a mortgage or auto loan, avoid applying for new credit in the months leading up to your application to protect your score.

When It’s Okay to Apply for New Credit

While it’s generally advisable to avoid new credit applications when you’re trying to improve your credit score, there are some situations where applying for new credit can be beneficial. For example, if you’re building credit for the first time or rebuilding after a financial setback, obtaining a secured credit card or a credit-builder loan can help you establish a positive credit history.

If you decide to apply for new credit, do so strategically. Limit your applications to only the credit products you genuinely need, and try to space out your applications to minimize the impact on your credit score.

Step 6: Keep Old Accounts Open

The length of your credit history is another important factor in determining your credit score, accounting for 15% of your FICO score. This factor considers how long your credit accounts have been open, with older accounts contributing more positively to your score.

Why Keeping Old Accounts Open Matters

Closing an old credit account can shorten your credit history and reduce your average account age, both of which can negatively impact your credit score. Additionally, closing a credit card account reduces your total available credit, which can increase your credit utilization ratio and lower your score.

When to Close an Account

There are situations where it may be appropriate to close a credit card account, such as if you’re paying high annual fees on a card you no longer use or if the account is tied to an abusive relationship. However, before closing an account, consider the potential impact on your credit score and explore other options, such as downgrading to a no-fee card.

If you decide to close an account, try to do so after you’ve improved your credit score in other areas, such as by paying down debt or disputing inaccuracies on your credit report. This can help mitigate the impact of closing the account on your overall score.

Step 7: Diversify Credit Mix

The types of credit you use, known as your credit mix, account for 10% of your FICO score. Lenders like to see that you can manage different types of credit responsibly, such as credit cards, installment loans, and mortgages.

The Benefits of a Diverse Credit Mix

A diverse credit mix can improve your credit score by demonstrating your ability to handle various forms of credit. For example, if you only have credit card debt, adding an installment loan, such as a personal loan or auto loan, can improve your credit mix and boost your score.

However, it’s important not to open new accounts solely for the sake of improving your credit mix. Each new account adds a hard inquiry to your credit report and can lower your average account age, both of which can negatively impact your score.

How to Improve Your Credit Mix

If you have a limited credit history or only one type of credit, consider adding a different type of credit to your profile. For example, if you have only credit cards, taking out a small personal loan or a credit-builder loan can diversify your credit mix and improve your score.

If you’re not ready to take on new debt, focus on managing your existing accounts responsibly. Pay your bills on time, keep your balances low, and avoid applying for new credit unless necessary.

Monitoring Progress

Improving your credit score is an ongoing process that requires regular monitoring. By keeping an eye on your credit report and score, you can track your progress and catch any issues early before they cause significant damage.

Tools for Monitoring Your Credit Score

Several tools and services can help you monitor your credit score, including:

- Credit Monitoring Services: Many credit monitoring services offer real-time alerts whenever there’s a change to your credit report, helping you stay on top of your credit status.

- Credit Score Tracking: Some financial institutions and credit card issuers offer free credit score tracking as part of their services. Take advantage of these tools to monitor your score regularly.

- Annual Credit Report: As mentioned earlier, you’re entitled to a free credit report from each of the three major credit reporting agencies once every 12 months. Use these reports to review your credit history and ensure everything is accurate.

The Importance of Regular Monitoring

By regularly monitoring your credit report and score, you can identify trends and patterns that may be affecting your score. For example, if you notice a sudden drop in your score, you can investigate the cause and take corrective action before it becomes a more significant problem.

Monitoring your credit also allows you to celebrate your progress as your score improves. Seeing your score increase over time can motivate you to continue practicing good financial habits and keep working toward your financial goals.

The Impact of Debt Settlement

If you’re struggling with high levels of debt, you may consider debt settlement as a way to reduce your financial burden. Debt settlement involves negotiating with your creditors to settle your debt for less than the full amount owed. While this can provide immediate relief, it’s important to understand how debt settlement can impact your credit score.

How Debt Settlement Affects Your Credit Score

Debt settlement can have a significant negative impact on your credit score. When you settle a debt for less than the full amount, it indicates to lenders that you were unable to meet your original repayment obligations. This can lower your credit score and make it more difficult to obtain credit in the future.

Additionally, the process of negotiating a debt settlement often involves missing payments, which can further damage your credit score. Late payments remain on your credit report for up to seven years, making it challenging to rebuild your credit after settling a debt.

Alternatives to Debt Settlement

Before pursuing debt settlement, consider other options that may be less damaging to your credit score, such as:

- Debt Management Plans: Working with a credit counseling agency to create a debt management plan can help you pay off your debt over time without settling for less than the full amount.

- Debt Consolidation: Consolidating your debt into a single loan with a lower interest rate can make it easier to manage your payments and pay off your debt more quickly.

- Bankruptcy: While bankruptcy can have a severe impact on your credit score, it may be a better option than debt settlement in some cases. Consult with a financial advisor or attorney to explore your options.

The Role of Authorized Users

One way to boost your credit score, especially if you’re new to credit or rebuilding after a financial setback, is to become an authorized user on someone else’s credit account.

How Authorized Users Can Improve Your Score

When you’re added as an authorized user on a credit card account, the account’s payment history and credit utilization are added to your credit report. If the account is in good standing, this can improve your credit score by increasing your credit history and lowering your credit utilization ratio.

However, it’s important to choose the right account to be added to. If the account has a history of late payments or high balances, it could negatively impact your score instead of helping it. Make sure the primary account holder has a strong credit history and manages the account responsibly.

How to Become an Authorized User

To become an authorized user, ask a trusted friend or family member to add you to their credit card account. The primary account holder remains responsible for the debt, but you’ll benefit from their positive credit history. Be sure to discuss expectations and responsibilities with the account holder before being added as an authorized user.

Debt Snowball vs. Debt Avalanche

When it comes to paying off debt, there are two popular strategies: the debt snowball and the debt avalanche. Both approaches can help you pay off your debt faster and improve your credit score, but they take different paths to get there.

The Debt Snowball Method

The debt snowball method involves paying off your smallest debts first, regardless of interest rate. Once the smallest debt is paid off, you move on to the next smallest, and so on. This method is effective because it provides quick wins that can motivate you to continue paying off your debt.

The Debt Avalanche Method

The debt avalanche method, on the other hand, involves paying off your debts with the highest interest rates first. This approach can save you more money on interest over time, but it may take longer to see progress compared to the debt snowball method.

Choosing the Right Method for You

The best debt repayment strategy depends on your financial situation and personal preferences. If you’re motivated by quick wins and need to build momentum, the debt snowball method may be the best choice. If you’re focused on saving money on interest and are willing to wait longer for results, the debt avalanche method may be more effective.

Regardless of which method you choose, the key is to stick with your plan and make consistent progress toward paying off your debt.

The Importance of Financial Planning

Improving your credit score requires more than just paying off debt and disputing inaccuracies. It also involves creating a solid financial plan that helps you manage your money effectively and avoid future financial pitfalls.

Creating a Budget

A budget is a fundamental tool for managing your finances. It helps you track your income and expenses, prioritize your spending, and ensure that you have enough money to cover your bills and save for the future.

When creating a budget, start by listing your monthly income and fixed expenses, such as rent, utilities, and loan payments. Then, allocate funds for variable expenses, such as groceries, entertainment, and transportation. Finally, set aside money for savings and debt repayment.

Sticking to Your Budget

Once you’ve created a budget, it’s important to stick to it. Review your budget regularly and make adjustments as needed to ensure that you’re staying on track. If you find that you’re overspending in certain areas, look for ways to cut back and redirect those funds toward your financial goals.

Planning for the Future

In addition to managing your day-to-day finances, it’s important to plan for the future. This includes building an emergency fund, saving for retirement, and setting financial goals, such as buying a home or paying for college.

By creating a financial plan and sticking to it, you’ll be better equipped to manage your money, avoid financial stress, and improve your credit score over time.

Credit Counseling Services

If you’re struggling to manage your debt or improve your credit score, consider seeking help from a credit counseling service. Credit counseling agencies offer a range of services, including debt management plans, budgeting assistance, and financial education.

How Credit Counseling Can Help

Credit counseling can help you develop a plan to pay off your debt, improve your credit score, and achieve your financial goals. A credit counselor can work with you to create a budget, negotiate with your creditors, and develop a debt repayment plan that fits your financial situation.

In addition to providing personalized financial advice, credit counseling agencies often offer educational resources and workshops to help you improve your financial literacy and make informed decisions about your money.

Choosing a Credit Counseling Agency

When choosing a credit counseling agency, it’s important to do your research and select a reputable organization. Look for agencies that are accredited by the National Foundation for Credit Counseling (NFCC) or the Financial Counseling Association of America (FCAA). Be sure to ask about fees and services before committing to a credit counseling program.

The Impact of Closing Accounts

As mentioned earlier, closing a credit card account can have a negative impact on your credit score by reducing your available credit and shortening your credit history. However, there are some situations where closing an account may be the right choice.

When to Close an Account

If you’re paying high annual fees on a credit card that you no longer use or if the account is tied to a negative experience, such as a divorce or financial hardship, it may be worth closing the account. However, before doing so, consider the potential impact on your credit score and explore other options, such as downgrading to a no-fee card.

Minimizing the Impact of Closing an Account

If you decide to close an account, there are steps you can take to minimize the impact on your credit score. First, make sure that you’ve paid off the balance in full before closing the account. Next, consider closing newer accounts rather than older ones to preserve your credit history. Finally, be sure to monitor your credit report after closing the account to ensure that the closure is reported accurately.

Dealing with Collection Accounts

If you have accounts in collections, it’s important to address them as soon as possible. Collection accounts can have a significant negative impact on your credit score, but there are steps you can take to resolve them.

Strategies for Handling Collection Accounts

- Negotiate a Settlement: If you can’t afford to pay the full amount owed, consider negotiating a settlement with the collection agency. In some cases, you may be able to settle the debt for less than the full amount.

- Request a Pay-for-Delete Agreement: Some collection agencies may agree to remove the collection account from your credit report in exchange for payment. This is known as a pay-for-delete agreement. Be sure to get the agreement in writing before making any payments.

- Pay the Debt in Full: If possible, pay the debt in full to resolve the collection account. While the account will remain on your credit report, it will be marked as paid, which is better for your credit score than an unpaid collection.

Monitoring Your Credit Report After Resolving Collection Accounts

After resolving a collection account, it’s important to monitor your credit report to ensure that the account is reported accurately. If the account is not updated to reflect the settlement or payment, you may need to dispute the error with the credit bureau.

The Role of Secured Credit Cards

If you have poor or no credit history, a secured credit card can be a valuable tool for rebuilding your credit. A secured credit card requires a cash deposit, which serves as your credit limit. By using the card responsibly and making on-time payments, you can build a positive credit history and improve your credit score.

How Secured Credit Cards Work

With a secured credit card, you make a cash deposit that typically ranges from $200 to $1,000. This deposit serves as your credit limit, meaning that if you deposit $500, you can charge up to $500 on the card. Your deposit is held as collateral in case you default on your payments.

As you use the card and make payments, the card issuer reports your activity to the credit bureaus. Over time, this positive payment history can help you build or rebuild your credit.

Choosing a Secured Credit Card

When choosing a secured credit card, look for one that reports to all three major credit bureaus, has reasonable fees, and offers the option to upgrade to an unsecured card after a period of responsible use. Be sure to read the terms and conditions carefully before applying.

How Bankruptcy Affects Credit Scores

Bankruptcy is a last resort for dealing with overwhelming debt, and it can have a severe impact on your credit score. However, for some individuals, bankruptcy may be the best option for getting a fresh start.

The Impact of Bankruptcy on Your Credit Score

When you file for bankruptcy, it becomes a public record and is reported on your credit report. A Chapter 7 bankruptcy remains on your credit report for 10 years, while a Chapter 13 bankruptcy remains for seven years. During this time, your credit score will likely drop significantly, making it difficult to obtain new credit.

Rebuilding Your Credit After Bankruptcy

While bankruptcy can have a devastating impact on your credit score, it is possible to rebuild your credit over time. Here are some steps you can take to improve your credit after bankruptcy:

- Establish a Budget: Creating and sticking to a budget is essential for managing your finances and avoiding future debt problems.

- Open a Secured Credit Card: A secured credit card can help you rebuild your credit by establishing a positive payment history.

- Make All Payments on Time: Timely payments are crucial for rebuilding your credit. Be sure to pay all of your bills on time, including utilities, rent, and any remaining debts.

- Monitor Your Credit Report: Regularly monitor your credit report to track your progress and ensure that all information is accurate.

Rebuilding your credit after bankruptcy takes time, but with patience and discipline, you can improve your credit score and regain control of your financial future.

The Importance of Patience

Improving your credit score is not a quick fix; it requires time, persistence, and consistent financial habits. While you may see some immediate improvements by disputing inaccuracies or paying off debt, building a strong credit score is a long-term process.

Staying Focused on Your Goals

It’s important to stay focused on your financial goals and remain patient as you work to improve your credit score. Celebrate small victories along the way, such as paying off a credit card or seeing your score increase by a few points. These milestones can help keep you motivated and committed to your financial journey.

Avoiding Quick Fixes

Be wary of any company or service that promises to improve your credit score overnight. Quick fixes, such as credit repair scams or illegal practices like creating a new credit identity, can do more harm than good. Instead, focus on building a solid financial foundation through responsible credit management and financial planning.

2024-Specific Considerations

As you work to improve your credit score in 2024, it’s important to stay informed about any new laws, credit reporting changes, or financial trends that could affect your strategies.

New Laws and Regulations

In 2024, there may be new laws and regulations that impact credit reporting and lending practices. For example, changes to how medical debt is reported on credit reports could affect your score. Stay informed about these changes and adjust your strategies accordingly.

Economic Trends

Economic trends, such as rising interest rates or changes in the job market, can also impact your credit score. For example, if interest rates increase, it may become more expensive to carry a balance on your credit cards. Keep an eye on economic trends and adjust your financial plans as needed to protect your credit score.

Technological Advances

Advances in technology may offer new tools and resources for managing your credit and improving your score. For example, new financial apps or credit monitoring services may provide better insights into your credit report and help you stay on track with your goals.

Conclusion

Improving your credit score is a critical step toward achieving financial stability and unlocking opportunities for a better future. By following the seven steps outlined in this guide, checking your credit report, disputing inaccuracies, paying bills on time, reducing credit card balances, avoiding new credit applications, keeping old accounts open, and diversifying your credit mix; you can boost your credit score and take control of your financial destiny.

Remember, improving your credit score is a journey that requires patience, persistence, and careful planning. Stay focused on your goals, monitor your progress, and make informed decisions that support your financial well-being. With the right strategies and a commitment to responsible credit management, you can achieve a strong credit score and enjoy the financial benefits that come with it.

-

Press Release7 days ago

Press Release7 days agoClinical Trials Market Set for Robust Growth, Driven by Drug Development Surge and Digital Innovation

-

Press Release7 days ago

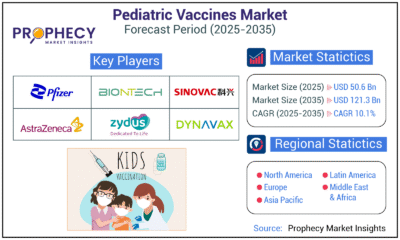

Press Release7 days agoPediatric Vaccines Market: Safeguarding Futures, Driving Growth

-

Press Release7 days ago

Press Release7 days agoWaterproof Structural Adhesives Market: A Comprehensive Study Towards USD 10.3 Billion in 2035

-

Press Release7 days ago

Press Release7 days agoDownhole Tools Market: Navigating Subsurface Frontiers with Precision

-

Press Release7 days ago

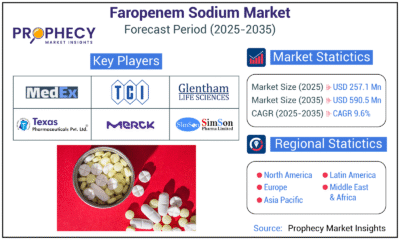

Press Release7 days agoFaropenem Sodium Market: A Potent Weapon in the Fight Against Bacterial Infections