Finance

Texas Insurance License State Requirements: 2021 Update

According to IBISWorld, the market size for insurance agents and agencies in Texas is $14 billion with there being 41,182 businesses in the state. This large market may be able to prove a bounty of opportunities for aspiring insurance agents in the state. In Texas, insurance agents can sell property and casualty insurance, life insurance, health insurance, or any combination of those lines of authority. To do so, and to reap the range of possible benefits in the state, aspiring insurance professionals would need to obtain an insurance license in Texas.

Becoming an insurance agent in Texas

To become an insurance agent in Texas, individuals would need to obtain at least one Texas insurance license. Individuals are offered the opportunity to sell property and casualty insurance, life insurance, health insurance, or any combination of those lines of authority. To do so, individuals would have to follow a 6-step process outlined by The Texas Department of Insurance:

1. Selecting the licenses needed

The types of insurance products and policies individuals would like to sell in Texas will determine which licenses they will be required to obtain. The most common licenses new insurance agents choose to obtain are the property & casualty license (P&C), as well as the life and health insurance license (L&H). For example, if insurance professionals would like to sell auto insurance, home insurance, or business insurance, they would need to obtain property and casualty insurance licenses. If insurance professionals would like to sell life insurance, annuities, Medicare, and health insurance, they would need to obtain life and health insurance licenses.

2. Pre-license education

Aspiring insurance professionals will have to study for the exams to obtain the licenses. Texas does not require pre-license credits, this means that studying for the licensing exams is solely up to the aspiring insurance agent. Individuals have the option of taking an insurance pre-license course online. They also have the option of purchasing books or other self-study tools.

3. The exam

Once individuals feel prepared, they will write the insurance license exam. Each license requires one exam. The exams take place in a controlled environment with an invigilator. Each attempt costs $62 and writers are required to have a photo ID as well as any other documents that the testing facility requires.

The Life & Health exam, as well as the Property and Casualty exam, consisting of 125 questions. The passing score, which was set by the Texas Department of Insurance, is 70. This score is determined by the raw scores which are converted into scaled scores that range from 0 to 100.

4. Fingerprinting And Background Check

The State of Texas requires fingerprints before licensing. This will initiate a background check. Individuals who have prior misdemeanors or felonies may face obstacles when pursuing licensing.

5. License Application

Once the exam and fingerprinting have been completed, aspiring Texan insurance agents will be able to apply for a license. Online application fees are $50 per license.

6. Application Review

Once the prior steps have been completed, the license application will be reviewed by the state, as well as the background check. If the application is accepted, the license would be issued within 3-5 weeks.

After getting a Texas insurance license

Insurance professionals who would like to sell advanced life insurance products would need specific licenses. The most common licenses obtained by insurance agents are:

- The Series 6 license. The Investment Company and Variable Contracts Products Representative Qualification Examination, known as the FINRA Series 6 license, allows the license holder to include mutual funds within the investment and insurance products that they offer.

- The Series 7 license. The General Securities Representative Exam, known as the FINRA Series 7 License, is a more comprehensive securities license. This license allows holders to market and sell more securities-based products such as public offerings and or private placements of corporate securities (stocks and bonds), rights, warrants, and mutual funds to name a few.

- The Series 63 license. The Series 63 licensing exam, by NASAA, focuses on state laws and regulations. This licenses securities agents to take and process orders.

Insurance professionals also need to note that they would have to renew their license or licenses once every two years to be able to operate in Texas.

The takeaway

Obtaining insurance agent licensing may prove to be a worthwhile investment for individuals depending on their education, certifications, additional skills, and the number of years they have spent in the profession. For aspiring insurance professionals looking for more information, The Useful Information Company (TRUiC) can assist and offer more information on this matter.

-

Technology4 days ago

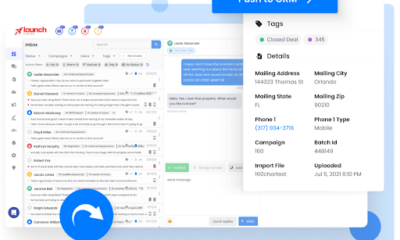

Technology4 days agoEnhancing Lead Management and Text Marketing with Launch Control’s All-in-One CRM

-

Destinations3 days ago

Destinations3 days agoSave Money in London: Insider Tips for Budget Travellers

-

USA News3 days ago

USA News3 days agoWhat Is The Current Us Elections Rating And Who Is Leading The Polls?

-

Europe News3 days ago

Europe News3 days agoSee Rome on a Budget: History and Culture Without the Cost

-

Travel3 days ago

Travel3 days agoHow to Make Friends in Southeast Asia Hostels: A Guide for Solo Travellers

-

Climate Change3 days ago

Climate Change3 days agoCuba Faces Nationwide Power Grid Collapse Amidst Ongoing Crisis

-

Travel3 days ago

Travel3 days agoSafe Travel in Mexico: Tips for a Hassle-Free Trip

-

Destinations3 days ago

Destinations3 days agoArgentina Travel Guide: Tango, Wine, and Natural Wonders