Business

Tech Earnings Propel US Stock Market Amid Tariff Uncertainty

U.S. stock markets experienced a significant rally on May 1, 2025, driven by strong earnings reports from major tech companies Microsoft and Meta Platforms. Despite ongoing concerns regarding tariffs and their impact on the economy, investors reacted positively to the resilience shown by these tech giants, leading to a notable increase in market indices.

Key Takeaways

- Market Performance: The Dow Jones Industrial Average rose by 0.21%, the S&P 500 increased by 0.63%, and the Nasdaq Composite surged by 1.52%.

- Earnings Reports: Microsoft and Meta reported better-than-expected earnings, alleviating fears about the impact of tariffs on their businesses.

- Tariff Concerns: General Motors warned of a potential $5 billion hit from tariffs, while other companies like McDonald’s reported declines in sales due to consumer uncertainty.

Strong Earnings Boost Market Confidence

The stock market’s upward momentum was largely attributed to the impressive quarterly results from Microsoft and Meta. Microsoft saw a 7.6% increase in its stock price after announcing robust growth in its cloud-computing segment, Azure. Meta’s shares rose by 4.2% following a strong performance in digital advertising, which is crucial given the company’s exposure to Chinese markets.

- Microsoft Highlights:

- Meta Highlights:

Mixed Economic Signals

While the tech sector thrived, other economic indicators painted a more cautious picture. Weekly jobless claims rose to a two-month high, suggesting potential job cuts as companies navigate the challenges posed by tariffs. Additionally, the ISM manufacturing index indicated a contraction in the manufacturing sector, albeit slightly less severe than anticipated.

Tariff Impact on Other Sectors

The ongoing trade tensions and tariffs have had a mixed impact across various sectors:

- General Motors: Cut its earnings guidance for 2025, citing a potential $4 to $5 billion impact from tariffs.

- McDonald’s: Reported a surprise drop in sales, attributing it to consumer caution amid economic uncertainty.

- Qualcomm: Forecasted revenue declines due to the trade war, leading to an 8.9% drop in its stock price.

Market Outlook

Despite the mixed economic signals, the stock market’s performance suggests a degree of optimism among investors. The S&P 500 has now recorded eight consecutive days of gains, marking its longest winning streak since August of the previous year. Analysts remain cautiously optimistic, noting that strong earnings from major companies could help offset the negative effects of tariffs.

- Future Earnings Reports: Investors are keenly awaiting results from other major players like Amazon and Apple, which could further influence market sentiment.

Conclusion

The U.S. stock market’s rally, fueled by strong tech earnings, reflects a complex interplay between corporate performance and economic uncertainties. As companies navigate the challenges posed by tariffs, the resilience shown by tech giants may provide a buffer against broader economic headwinds. Investors will be closely monitoring upcoming earnings reports and economic data to gauge the market’s direction in the coming weeks.

Sources

- Dow jumps 300 points on tariff deal hopes, S&P 500 rises for a sixth session, CNBC TV18.

- Stock Market News, May 1, 2025: Meta, Microsoft Earnings Help Ease Fears of Tariff Hit to Magnificent Seven, WSJ.

- Stocks close higher, lifted by Microsoft, Meta earnings, Reuters.

- US Stocks Past Their Peak After Permanent Tariff Damage: Jefferies, Business Insider.

- US stocks gain, led by Microsoft and Meta after strong results., USA Today.

-

Press Release3 days ago

Press Release3 days agoNura Labs Files Revolutionary Patent: AI-Powered Wallet Solves the $180 Billion Crypto Staking Complexity Crisis

-

Press Release1 day ago

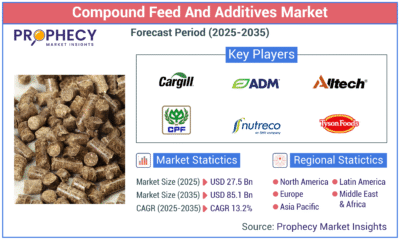

Press Release1 day agoGlobal Compound Feeds and Additives Industry Report: Market Expansion and Competitive Insights to 2035

-

Technology1 day ago

Technology1 day agoWhat to Know Before Switching Cell Phone Network Services in 2025