Alternative Energy

Super Micro’s $50 Billion Stock Collapse Underscores Risk of AI Hype

Super Micro Computer Inc. has experienced a staggering $50 billion stock collapse, highlighting the potential pitfalls of the artificial intelligence hype. Once a rising star in the tech sector, the company’s stock has plummeted 72% since its peak, raising concerns about governance and financial integrity.

Key Takeaways

- Super Micro’s stock fell 33% after the resignation of its auditor, Ernst & Young.

- The company faces potential delisting from Nasdaq due to compliance issues.

- Concerns about governance and financial reporting have been raised by Ernst & Young.

The Rise and Fall of Super Micro

In March 2024, Super Micro was added to the S&P 500, following a remarkable surge that saw its stock increase by over 2,000% in just two years. This meteoric rise was fueled by the growing demand for AI technologies, particularly those powered by Nvidia’s GPUs. However, the company’s fortunes took a dramatic turn when its stock reached a high of $118.81, only to see a sharp decline thereafter.

The stock’s decline began shortly after the S&P 500 inclusion, with a staggering 33% drop occurring on October 30, 2024, following the announcement of Ernst & Young’s resignation. The auditor cited concerns about the integrity of Super Micro’s financial statements, stating they were "unwilling to be associated" with the company’s management.

Governance Concerns

Ernst & Young’s resignation was not an isolated incident. The firm had previously flagged governance issues back in July, which were exacerbated by a report from short seller Hindenburg Research that suggested potential accounting manipulation. This led to a significant shift in investor sentiment, with Super Micro’s stock experiencing multiple declines since the S&P 500 announcement.

Potential Delisting Risks

Super Micro is now at risk of being delisted from the Nasdaq due to its inability to file an annual report on time. The company has until November 16, 2024, to regain compliance with the exchange’s listing rules. Analysts have expressed concern that the absence of an auditor could complicate efforts to secure a new one, further jeopardizing the company’s standing in the market.

Market Reactions

The market’s reaction to Super Micro’s troubles has been swift and severe. The stock has seen significant volatility, with multiple drops of 10% or more since March. The most alarming decline occurred on August 28, when shares fell 19% after the company announced delays in filing its annual report with the SEC.

Looking Ahead

As Super Micro prepares to provide a business update on November 5, 2024, the company faces a critical juncture. Investors are keenly watching to see how management addresses the concerns raised by Ernst & Young and whether they can restore confidence in their financial reporting. The outcome of this situation could have lasting implications not only for Super Micro but also for the broader tech sector, particularly as it relates to the ongoing AI boom.

In conclusion, Super Micro’s dramatic stock collapse serves as a cautionary tale about the risks associated with the AI hype. As the company navigates these turbulent waters, stakeholders will be closely monitoring developments to gauge the future of this once-promising tech player.

Sources

-

Press Release6 days ago

Press Release6 days agoClinical Trials Market Set for Robust Growth, Driven by Drug Development Surge and Digital Innovation

-

Press Release6 days ago

Press Release6 days agoPediatric Vaccines Market: Safeguarding Futures, Driving Growth

-

Press Release6 days ago

Press Release6 days agoWaterproof Structural Adhesives Market: A Comprehensive Study Towards USD 10.3 Billion in 2035

-

Press Release6 days ago

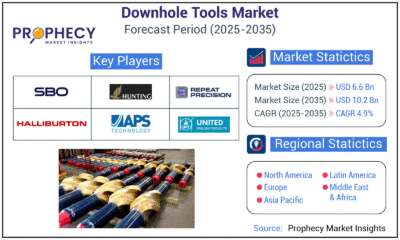

Press Release6 days agoDownhole Tools Market: Navigating Subsurface Frontiers with Precision

-

Press Release6 days ago

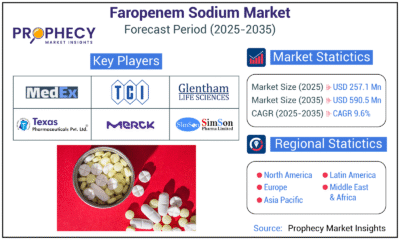

Press Release6 days agoFaropenem Sodium Market: A Potent Weapon in the Fight Against Bacterial Infections