Stock Market

Stock Market Suffers A Halloween Selloff As Tech Investors Get The Chills

It was a spooky Halloween for investors as the stock market experienced a significant selloff, primarily driven by a downturn in technology stocks. The S&P 500 index fell sharply, marking its first monthly decline since April, while the Nasdaq Composite faced its largest one-day drop since early September. This unsettling trend has left many investors feeling anxious about the future of the tech sector and the broader market.

Key Takeaways

- The S&P 500 index dropped significantly, reflecting a tech-led selloff.

- The Nasdaq Composite experienced its largest one-day decline since early September.

- This marks the first monthly decline for the S&P 500 since April.

Market Overview

The selloff on Halloween was characterized by a broad retreat in technology stocks, which have been a driving force behind the market’s gains in recent years. Investors reacted to a combination of factors, including rising interest rates, inflation concerns, and disappointing earnings reports from major tech companies.

The Dow Jones Industrial Average also felt the impact, contributing to a gloomy atmosphere on Wall Street. The overall sentiment among investors was one of caution, as many are reassessing their positions in light of the recent volatility.

Factors Contributing To The Selloff

Several key factors contributed to the Halloween selloff:

- Rising Interest Rates: The Federal Reserve’s ongoing efforts to combat inflation have led to increased interest rates, which can negatively impact growth stocks, particularly in the tech sector.

- Earnings Disappointments: Major tech companies reported earnings that fell short of expectations, raising concerns about future growth prospects.

- Market Sentiment: A general sense of unease among investors, fueled by economic uncertainty, has led to a more cautious approach in trading.

Implications For Investors

The Halloween selloff serves as a reminder of the inherent volatility in the stock market, particularly in the tech sector. Investors are advised to consider the following:

- Diversification: Maintaining a diversified portfolio can help mitigate risks associated with sector-specific downturns.

- Long-Term Perspective: While short-term fluctuations can be unsettling, a long-term investment strategy may yield better results over time.

- Stay Informed: Keeping abreast of market trends and economic indicators can help investors make informed decisions.

Conclusion

As the dust settles from the Halloween selloff, investors are left to ponder the future of the stock market and the tech sector. With rising interest rates and economic uncertainty looming, it remains to be seen how these factors will shape market dynamics in the coming months. Investors are encouraged to remain vigilant and adaptable in this ever-changing landscape.

Sources

-

Press Release6 days ago

Press Release6 days agoNura Labs Files Revolutionary Patent: AI-Powered Wallet Solves the $180 Billion Crypto Staking Complexity Crisis

-

Press Release4 days ago

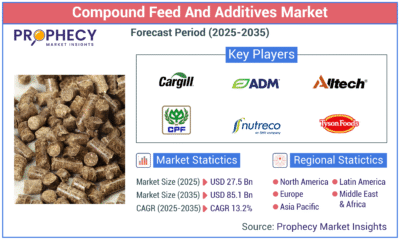

Press Release4 days agoGlobal Compound Feeds and Additives Industry Report: Market Expansion and Competitive Insights to 2035

-

Technology3 days ago

Technology3 days agoWhat to Know Before Switching Cell Phone Network Services in 2025

-

Press Release2 days ago

Press Release2 days agoCrypto WINNAZ Launches First On-Chain Yield Engine for Meme Coins, Enabling 20x–300x Returns