Business

Stock Market Opens With Key Updates: What Investors Need to Know

The stock market opened on November 1, 2024, with significant updates that could influence trading decisions. Following a turbulent October, traders are keenly observing key earnings reports and economic indicators that may shape market sentiment in the coming days.

Key Takeaways

- Earnings Reports: Major companies like Chevron, Exxon Mobil, Amazon, and Apple are set to report their earnings, impacting stock prices.

- Job Market Data: A disappointing jobs report showed only 12,000 jobs added in October, raising concerns about economic growth.

- Market Futures: Stock futures are up, indicating a positive start to November despite recent volatility.

Earnings Reports to Watch

Investors are particularly focused on earnings reports from several major companies:

- Chevron and Exxon Mobil: Both companies are expected to report their quarterly earnings before the market opens. Chevron has seen a 6.8% decline since its last report, while Exxon Mobil is down 1.5% over the same period.

- Amazon: The e-commerce giant has exceeded analysts’ expectations, with shares rising 5.7% after hours. Amazon Web Services continues to show strong growth, contributing to overall positive sentiment.

- Apple: Despite surpassing earnings expectations, Apple shares fell about 2% after hours. The company reported a 6% increase in iPhone sales compared to the previous year.

- Wayfair and Simon Property: Both companies are also set to report earnings, with Wayfair struggling significantly since its pandemic highs.

Economic Indicators Impacting the Market

The latest jobs report revealed that the U.S. economy added only 12,000 jobs in October, far below the expected 100,000. This marks the weakest job creation since December 2020. The unemployment rate remained steady at 4.1%. Analysts suggest that the disappointing figures may be influenced by external factors such as hurricanes and labor strikes.

Market Sentiment and Future Outlook

Despite the weak jobs report, stock futures climbed as traders looked past the data, buoyed by strong performances from tech giants like Amazon and Intel. The Dow Jones Industrial Average futures rose by 219 points, or 0.5%, while S&P 500 and Nasdaq 100 futures also increased by 0.5%.

Investors are also keeping an eye on the upcoming U.S. Presidential election on November 5, which is expected to add volatility to the markets. Additionally, the Federal Reserve’s policy meeting on November 6 and 7 will be crucial for determining future interest rate movements.

Sector Performance Overview

In October, various sectors experienced different levels of performance:

- Financials: Up 2.55%

- Communication Services: Gained 1.8%

- Energy: Advanced by 0.7%

- Health Care and Materials: Both sectors saw declines of over 3%.

Conclusion

As the stock market opens for November, investors are faced with a mix of optimism and caution. Key earnings reports and economic indicators will play a significant role in shaping market dynamics. With the upcoming election and Federal Reserve meeting, volatility is expected to continue in the near term.

Sources

- Stock Chart Icon, CNBC.

- Stock Chart Icon, CNBC.

-

Press Release6 days ago

Press Release6 days agoNura Labs Files Revolutionary Patent: AI-Powered Wallet Solves the $180 Billion Crypto Staking Complexity Crisis

-

Press Release4 days ago

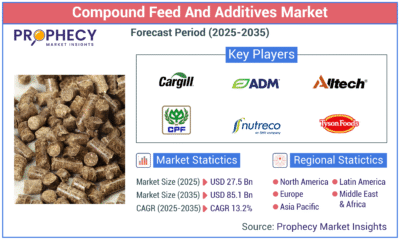

Press Release4 days agoGlobal Compound Feeds and Additives Industry Report: Market Expansion and Competitive Insights to 2035

-

Technology4 days ago

Technology4 days agoWhat to Know Before Switching Cell Phone Network Services in 2025

-

Press Release2 days ago

Press Release2 days agoCrypto WINNAZ Launches First On-Chain Yield Engine for Meme Coins, Enabling 20x–300x Returns