Business

Stock Futures Steady As Investors Anticipate Inflation Data

Stock futures remained stable on Tuesday as investors braced for crucial inflation data that could influence the Federal Reserve’s upcoming interest rate decisions. With the Consumer Price Index (CPI) report set to be released, market participants are keenly watching for signs that could impact monetary policy in the near future.

Key Takeaways

- Investors are awaiting the CPI report, expected to show a slight increase in inflation.

- Wall Street indexes closed lower, reflecting caution ahead of the economic data.

- Traders are anticipating a potential rate cut from the Federal Reserve next week.

Market Overview

On December 10, 2024, Wall Street’s main indexes experienced a decline as technology sector losses overshadowed gains in communications services. The Dow Jones Industrial Average fell by 154.10 points, or 0.35%, closing at 44,247.83. The S&P 500 lost 17.94 points, or 0.30%, ending at 6,034.91, while the Nasdaq Composite dropped 49.45 points, or 0.25%, to close at 19,687.24.

Among the S&P 500’s 11 major sectors, only three ended the day with gains. The communication services sector saw a notable increase of 2.6%, driven by a 5.6% rally in shares of Alphabet, the parent company of Google, following the announcement of a new chip.

Inflation Data Expectations

Investors are particularly focused on the upcoming CPI report, which is expected to show a slight rise in inflation from 2.6% in October to 2.7% in November. This report is one of the last major indicators before the Federal Reserve’s meeting on December 17-18, where interest rate decisions will be made.

Mona Mahajan, head of investment strategy at Edward Jones, noted, "There’s a little bit of wait-and-see in the market ahead of the CPI and PPI data this week. Markets want to see a number that won’t be too disruptive to the Fed next week."

Federal Reserve Rate Cut Anticipation

Traders are currently pricing in an 86% chance of a 25 basis point rate cut by the Federal Reserve next week, according to CME’s FedWatch Tool. This sentiment has been bolstered by recent economic data, including an uptick in unemployment and a rebound in job growth.

Lindsey Bell, chief strategist at 248 Ventures, commented on the cautious approach of investors, stating, "We’re in a seasonally strong period of the year and investors are just kind of taking a breather."

Individual Stock Movements

Several individual stocks made headlines on Tuesday:

- Walgreens Boots Alliance saw a significant increase of 17.7% after reports emerged that it is in talks to sell itself to private equity firm Sycamore Partners.

- Oracle shares fell by 6.7% after the company missed Wall Street estimates for its second-quarter results.

- Alaska Airlines shares rose by 13% following an upward revision of its fourth-quarter profit forecast.

In contrast, Moderna Inc. experienced a decline of 9.1% after Bank of America reinstated coverage with an ‘underperform’ rating.

Conclusion

As investors await the inflation data, the market remains in a state of cautious anticipation. The upcoming CPI report will be pivotal in shaping the Federal Reserve’s monetary policy and influencing market sentiment in the weeks to come.

Sources

-

Press Release7 days ago

Press Release7 days agoClinical Trials Market Set for Robust Growth, Driven by Drug Development Surge and Digital Innovation

-

Press Release7 days ago

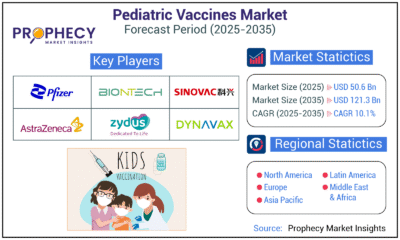

Press Release7 days agoPediatric Vaccines Market: Safeguarding Futures, Driving Growth

-

Press Release7 days ago

Press Release7 days agoWaterproof Structural Adhesives Market: A Comprehensive Study Towards USD 10.3 Billion in 2035

-

Press Release7 days ago

Press Release7 days agoDownhole Tools Market: Navigating Subsurface Frontiers with Precision

-

Press Release7 days ago

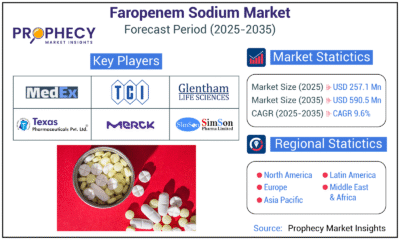

Press Release7 days agoFaropenem Sodium Market: A Potent Weapon in the Fight Against Bacterial Infections