Business

Stock Futures Steady Amid Market Concerns

Stock futures remained steady on December 17, 2024, as investors grappled with ongoing market concerns, particularly surrounding the Dow Jones Industrial Average’s recent performance. The index has experienced its longest losing streak since 1978, raising questions about the underlying factors driving this downturn and the potential implications for the broader market.

Key Takeaways

- The Dow Jones Industrial Average has fallen for nine consecutive days.

- This marks the longest losing streak for the index in over four decades.

- Investors are concerned about the impact of upcoming Federal Reserve decisions on interest rates.

Understanding The Dow’s Losing Streak

The Dow’s recent decline can be attributed to several factors:

- Economic Uncertainty: Investors are increasingly worried about economic indicators that suggest a slowdown.

- Interest Rate Speculation: The Federal Reserve is expected to make significant interest rate decisions soon, which could affect market liquidity and borrowing costs.

- Post-Election Rally Correction: Following a strong rally after the recent elections, the market appears to be correcting itself, leading to profit-taking among investors.

Market Reactions

The market’s reaction to these developments has been mixed:

- Investor Sentiment: Many investors are adopting a cautious approach, leading to reduced trading volumes.

- Sector Performance: Some sectors, particularly technology and consumer discretionary, have seen sharper declines compared to others.

What To Expect From The Federal Reserve

The Federal Reserve’s upcoming meeting is a focal point for investors:

- Interest Rate Decisions: Analysts are closely watching for any signals regarding future interest rate hikes or cuts.

- Market Impact: Depending on the Fed’s stance, the market could either stabilize or face further volatility.

Conclusion

As the market navigates these turbulent waters, investors are advised to stay informed and consider the potential impacts of economic indicators and Federal Reserve policies. The current environment calls for a balanced approach, weighing risks against opportunities as the market seeks to find its footing amid uncertainty.

Sources

-

Press Release4 days ago

Press Release4 days agoNura Labs Files Revolutionary Patent: AI-Powered Wallet Solves the $180 Billion Crypto Staking Complexity Crisis

-

Press Release2 days ago

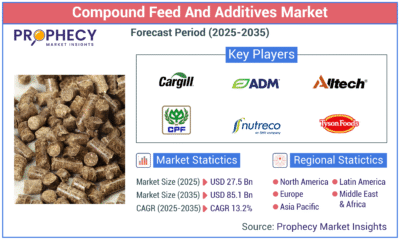

Press Release2 days agoGlobal Compound Feeds and Additives Industry Report: Market Expansion and Competitive Insights to 2035

-

Technology2 days ago

Technology2 days agoWhat to Know Before Switching Cell Phone Network Services in 2025

-

Press Release16 hours ago

Press Release16 hours agoCrypto WINNAZ Launches First On-Chain Yield Engine for Meme Coins, Enabling 20x–300x Returns