Elections

Stock Futures Dip As Wall Street Prepares For Presidential Election Uncertainty

As the U.S. presidential election approaches, stock futures have inched lower, reflecting investor anxiety over potential volatility in the markets. With the election set for Tuesday, November 5, 2024, traders are closely monitoring polling data and market trends, anticipating how the results could impact the economy and financial markets.

Key Takeaways

- Stock futures are down as investors brace for election-related volatility.

- Polling data shows a tight race between Kamala Harris and Donald Trump.

- Federal Reserve Chairman Jerome Powell’s upcoming press conference could influence market sentiment.

- The dollar has weakened against major currencies amid election uncertainty.

Market Reactions To Election Polls

Investors are reacting to the latest polling data, which indicates a lack of clear advantage for either candidate. This uncertainty has led to a cautious approach in the markets, with many traders opting to reduce their risk exposure ahead of the election.

- Dollar Performance: The dollar has fallen against major currencies, including the yen and the Australian dollar, as traders reassess their positions based on the latest election forecasts.

- Oil Prices: In contrast, oil prices have seen an uptick following OPEC+’s decision to delay a hike in output, adding another layer of complexity to the market dynamics.

Federal Reserve’s Role In The Election

The Federal Reserve’s actions and statements are also in focus as the election approaches. Jerome Powell, the Fed Chairman, is expected to address the media shortly after the election, and his comments could significantly sway market sentiment.

- Interest Rate Speculation: Analysts suggest that an uncertain election outcome might prompt the Fed to consider more aggressive interest rate cuts, depending on the economic implications of the election results.

Volatility Across Markets

As the election draws near, volatility is expected not just in the stock market but across various asset classes, including cryptocurrencies. Options traders are preparing for potential swings in the market, reflecting a broader trend of risk aversion.

- Options Market Activity: Equity options volatility has increased, indicating that traders are bracing for significant market movements in the wake of the election results.

- Investor Sentiment: The sentiment among investors is mixed, with some betting on a Trump victory while others remain cautious, leading to a quieter trading environment despite the heightened anticipation.

Conclusion

With just days left until the U.S. presidential election, Wall Street is on edge, reflecting the uncertainty that surrounds the potential outcomes. As traders navigate this complex landscape, the focus remains on how the election results will shape the economic landscape for the next four years. The interplay between political developments and market reactions will be closely watched in the coming days, as investors prepare for what could be a tumultuous period ahead.

Sources

- Harris and Trump command the market’s attention — but Jerome Powell may steal the spotlight – MarketWatch, MarketWatch.

- Stock Market Today: Dow, S&P Live Updates for November 3 – Bloomberg, Bloomberg.

- Wall Street’s Eyes Are On the Election, Its Money Not So Much – Bloomberg, Bloomberg.

- Investors From Stocks to Crypto Brace for US Election Volatility – Bloomberg, Bloomberg.

-

Press Release7 days ago

Press Release7 days agoClinical Trials Market Set for Robust Growth, Driven by Drug Development Surge and Digital Innovation

-

Press Release7 days ago

Press Release7 days agoPediatric Vaccines Market: Safeguarding Futures, Driving Growth

-

Press Release7 days ago

Press Release7 days agoWaterproof Structural Adhesives Market: A Comprehensive Study Towards USD 10.3 Billion in 2035

-

Press Release7 days ago

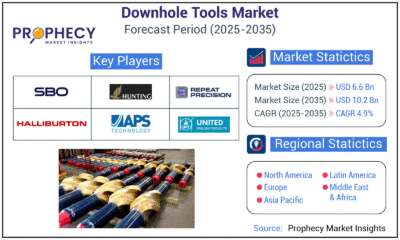

Press Release7 days agoDownhole Tools Market: Navigating Subsurface Frontiers with Precision

-

Press Release7 days ago

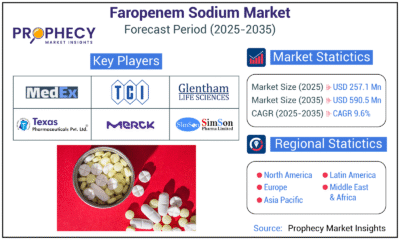

Press Release7 days agoFaropenem Sodium Market: A Potent Weapon in the Fight Against Bacterial Infections