Business

Stock Futures Dip As Dow Faces Longest Losing Streak Since 2018

Stock futures dipped on Monday evening as the Dow Jones Industrial Average experienced its longest losing streak since 2018, closing down for the eighth consecutive day. This decline comes amid a mixed trading session on Wall Street, with the Nasdaq Composite reaching a new record high.

Key Takeaways

- The Dow Jones Industrial Average fell 110 points, marking its longest losing streak since June 2018.

- The Nasdaq Composite hit a record high, gaining 1.2% during the session.

- Investors are anticipating a potential Federal Reserve rate cut this week, with a 95% probability priced in.

Market Overview

The Dow Jones Industrial Average closed down 0.25%, or nearly 111 points, finishing at 43,717.48. This marks the first time in history that the Dow has fallen for eight consecutive days, while the Nasdaq Composite surged to a record close of 20,173.89, up 1.2%. The S&P 500 also saw gains, closing up 0.4% at 6,074.08.

Despite the Dow’s struggles, technology stocks led the market’s gains, with major players like Alphabet, Apple, and Tesla reaching all-time highs. However, Nvidia, a key player in the tech sector, saw its shares drop by 1.7%, contributing to a decline of over 4% for the month.

Federal Reserve Anticipation

Traders are closely watching the Federal Reserve’s upcoming policy meeting, which is set to conclude on Wednesday. The market is largely expecting a quarter-point rate cut, which could provide some relief to investors. The Fed’s decision will be accompanied by updated economic projections, including a new "dot plot" indicating future interest rate paths.

Sector Performance

- Technology: The tech sector continues to outperform, with the Nasdaq leading the way.

- Consumer Discretionary: This sector also saw significant gains, contributing to the overall market rise.

- Energy: In contrast, the energy sector lagged, experiencing a decline of 2%.

Global Market Impact

The U.S. market’s performance is being influenced by global economic conditions, including political uncertainty in Europe and trade tensions with China. The recent decision by China to ban exports of certain rare metals has raised concerns about potential trade wars, which could impact U.S. manufacturing.

Looking Ahead

As 2024 draws to a close, investors are hopeful for a year-end rally, despite the current volatility. Analysts suggest that the market’s ability to navigate through concerns about inflation and potential tariffs will be crucial in determining its trajectory heading into 2025. The upcoming Fed meeting will be a key event to watch, as it may set the tone for market expectations in the new year.

Sources

-

Press Release5 days ago

Press Release5 days agoNura Labs Files Revolutionary Patent: AI-Powered Wallet Solves the $180 Billion Crypto Staking Complexity Crisis

-

Press Release3 days ago

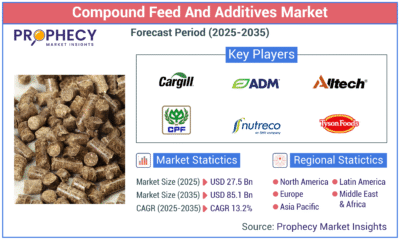

Press Release3 days agoGlobal Compound Feeds and Additives Industry Report: Market Expansion and Competitive Insights to 2035

-

Technology3 days ago

Technology3 days agoWhat to Know Before Switching Cell Phone Network Services in 2025

-

Press Release1 day ago

Press Release1 day agoCrypto WINNAZ Launches First On-Chain Yield Engine for Meme Coins, Enabling 20x–300x Returns