Finance

Retirement Planning for the Next Generation: How to Secure Your Future Without Sacrificing Today

Retirement planning has long been associated with sacrifice—putting away a portion of your earnings today to ensure that you have enough to live on comfortably when you no longer work. This concept, while fundamentally sound, has faced growing scrutiny, particularly from younger generations who often grapple with student debt, high living costs, and the desire to enjoy their lives in the present. The challenge of balancing future security with present satisfaction has never been more acute. Yet, retirement planning remains crucial, especially as life expectancy continues to rise, and the economic landscape evolves rapidly.

This article delves into the nuances of retirement planning for the next generation—those in their 20s, 30s, and 40s—who must navigate the complex interplay between securing their financial future and living fulfilling lives today. We will explore strategies to ensure a comfortable retirement without sacrificing the joys of the present, addressing key financial concepts, investment strategies, and lifestyle adjustments that can lead to a more balanced approach to life and retirement.

The Changing Landscape of Retirement Planning

Retirement planning has undergone significant changes over the past few decades. The traditional model, where individuals worked for a single employer for most of their lives, earning a pension that, combined with Social Security, would provide for their retirement, is largely obsolete. Today, the onus of retirement planning has shifted almost entirely to individuals, with defined contribution plans like 401(k)s replacing defined benefit plans.

This shift has coincided with several key trends that have reshaped the retirement landscape:

Increased Life Expectancy: People are living longer, which means that retirement savings must last longer. The average life expectancy in many developed countries now exceeds 80 years, with many individuals living well into their 90s. This extended lifespan requires more substantial savings to maintain the same standard of living in retirement.

Economic Uncertainty: Economic cycles, market volatility, and changes in the global economy can impact retirement savings. The financial crises of the early 2000s and 2008, along with the COVID-19 pandemic, have highlighted the vulnerability of retirement savings to economic shocks.

Rising Costs of Living: The cost of living, particularly in areas such as healthcare, housing, and education, has risen significantly. This increase places additional pressure on individuals to save more for retirement while managing these expenses during their working years.

The Gig Economy and Career Mobility: With the rise of the gig economy and more frequent job changes, individuals are less likely to stay with a single employer for their entire careers. This mobility can make it harder to build up significant retirement savings through employer-sponsored plans.

Student Debt and Delayed Life Milestones: Younger generations are often burdened with student debt, which can delay major life milestones such as buying a home or starting a family. These delays can also impact retirement savings, as individuals may prioritize debt repayment over investing for the future.

Given these trends, it’s clear that retirement planning today requires a more nuanced approach than in the past. It’s not just about saving a set percentage of income; it’s about making informed choices that balance short-term needs and long-term goals.

The Importance of Early Planning

The power of compound interest cannot be overstated when it comes to retirement savings. Starting early allows investments more time to grow, which can significantly reduce the amount of money that needs to be saved later in life. However, starting early is often easier said than done, especially when facing the financial pressures common among younger adults.

For example, a 25-year-old who starts saving $200 a month at an average annual return of 7% will have nearly $500,000 by age 65. In contrast, a 35-year-old would need to save almost twice as much each month—about $400—to reach the same goal by 65. This example illustrates how time is one of the most valuable assets when it comes to retirement planning.

Despite the clear advantages of early planning, many young adults struggle to prioritize retirement savings. The challenge is to create a plan that incorporates retirement savings without sacrificing the ability to enjoy life today. Here are some strategies to achieve this balance:

Automate Savings: One of the most effective ways to ensure consistent savings is to automate them. Setting up automatic contributions to a retirement account ensures that savings happen regularly and reduces the temptation to spend that money elsewhere.

Start Small, Increase Gradually: It’s okay to start with small contributions, especially when dealing with student debt or other financial obligations. The key is to start. Over time, as income increases, so can contributions.

Take Advantage of Employer Matching: If your employer offers a retirement plan with matching contributions, make sure to contribute enough to get the full match. This is essentially free money that can significantly boost your retirement savings.

Invest in Low-Cost, Diversified Funds: For those who are new to investing, low-cost index funds or target-date funds can be an excellent choice. These funds offer broad diversification at a low cost, which can help maximize returns over the long term.

Consider Roth IRAs for Tax Flexibility: Roth IRAs offer tax-free growth and withdrawals in retirement, which can provide more flexibility in managing tax obligations in the future. This can be particularly advantageous for young savers who may be in a lower tax bracket now than they will be in retirement.

Balancing Retirement Planning with Present Needs

The challenge of retirement planning often lies in balancing the need to save for the future with the desire to enjoy life today. It’s essential to strike a balance that allows for both.

1) Budgeting with a Purpose

Creating a budget is one of the most effective ways to ensure that you’re meeting both your short-term needs and long-term goals. A budget should be a living document that reflects your priorities and adapts to changes in your life.

Categorize Expenses: Start by categorizing your expenses into needs, wants, and savings. Needs include essentials like housing, utilities, groceries, and debt payments. Wants are non-essential items such as dining out, entertainment, and vacations. Savings should include contributions to retirement accounts, emergency funds, and other financial goals.

The 50/30/20 Rule: This rule suggests allocating 50% of your income to needs, 30% to wants, and 20% to savings. While this may not be feasible for everyone, it’s a good starting point. Adjust the percentages based on your individual circumstances.

Prioritize Debt Repayment: High-interest debt, such as credit card debt, should be a priority. Paying off debt not only reduces financial stress but also frees up more money for savings and other goals.

Reevaluate Regularly: Your budget should be reviewed regularly to ensure it still aligns with your goals. Life changes such as a new job, a raise, or a change in living situation may require adjustments.

2) Building an Emergency Fund

An emergency fund is a crucial component of any financial plan. It provides a safety net that can prevent you from dipping into retirement savings in case of unexpected expenses such as medical bills, car repairs, or job loss.

How Much to Save: Aim to save three to six months’ worth of living expenses in an easily accessible account. If you’re in a stable job and have few financial obligations, three months may be sufficient. If your income is variable or you have dependents, aim for six months or more.

Where to Save: Keep your emergency fund in a high-yield savings account or a money market account. These accounts offer easy access to your funds while providing some interest.

3) Managing Lifestyle Inflation

As your income increases, it’s tempting to upgrade your lifestyle—a phenomenon known as lifestyle inflation. While it’s natural to want to enjoy the fruits of your labor, unchecked lifestyle inflation can impede your ability to save for the future.

Set Limits on Discretionary Spending: As your income grows, decide in advance how much of the increase will go toward lifestyle upgrades and how much will go toward savings. For example, you might allocate 50% of a raise to increased spending and the other 50% to savings.

Avoid Debt-Fueled Lifestyle Upgrades: Avoid financing lifestyle upgrades with debt, such as buying a more expensive car or taking lavish vacations on credit. Instead, save up for these purchases, or consider if they’re necessary at all.

Focus on Experiences, Not Things: Research shows that spending on experiences rather than material possessions often leads to greater happiness. Prioritize spending on activities and experiences that bring you joy and fulfillment.

Investing for the Future

Investing is a critical component of retirement planning. While saving is important, investing allows your money to grow over time, helping you build a nest egg that can support you in retirement.

1) Understanding Investment Options

Investing can seem intimidating, especially with the wide range of options available. Here’s a brief overview of some common investment vehicles:

Stocks: Stocks represent ownership in a company. When you buy a stock, you’re buying a share of that company’s future profits. Stocks have the potential for high returns but also come with higher risk.

Bonds: Bonds are essentially loans that you make to a government or corporation. In return, you receive interest payments over time. Bonds are generally considered safer than stocks but offer lower returns.

Mutual Funds and ETFs: Mutual funds and exchange-traded funds (ETFs) pool money from many investors to buy a diversified portfolio of stocks, bonds, or other assets. These funds offer diversification, which can reduce risk.

Real Estate: Real estate can be a good investment, particularly if you’re looking for income-producing assets. However, real estate requires significant capital and ongoing management.

Retirement Accounts (401(k), IRA): Retirement accounts offer tax advantages that can help your investments grow faster. Contributions to a 401(k) or traditional IRA are tax-deductible, while Roth IRA contributions are made with after-tax dollars but grow tax-free.

2) Risk Tolerance and Asset Allocation

Understanding your risk tolerance is key to choosing the right investment strategy. Your risk tolerance is your ability and willingness to lose some or all of your investment in exchange for higher potential returns.

Conservative: A conservative investor prefers to minimize risk, even if it means lower returns. This strategy typically involves a higher allocation to bonds and a smaller allocation to stocks.

Moderate: A moderate investor is comfortable with some risk in exchange for potentially higher returns. This strategy might involve a balanced mix of stocks and bonds.

Aggressive: An aggressive investor is willing to take on significant risk for the possibility of high returns. This strategy usually involves a high allocation to stocks and a smaller allocation to bonds.

3) The Importance of Diversification

Diversification is a risk management strategy that involves spreading your investments across different assets to reduce the impact of any single investment’s poor performance.

Diversify Across Asset Classes: Invest in a mix of asset classes, such as stocks, bonds, and real estate, to reduce risk.

Diversify Within Asset Classes: Within each asset class, invest in a variety of sectors, industries, and geographies. For example, if you invest in stocks, choose companies from different industries and countries.

Rebalance Regularly: Over time, the performance of your investments will cause your asset allocation to shift. Rebalancing involves adjusting your portfolio back to your original target allocation to maintain your risk level.

4) Keeping Costs Low

Investment fees can eat into your returns over time. It’s important to keep these costs as low as possible.

Choose Low-Cost Funds: Index funds and ETFs typically have lower fees than actively managed funds. Over time, these savings can add up.

Avoid Frequent Trading: Frequent trading can lead to high transaction costs and tax liabilities. Adopt a buy-and-hold strategy to minimize these costs.

Planning for Retirement Income

As you approach retirement, your focus will shift from accumulating wealth to generating income from your investments. This transition requires careful planning to ensure that your savings last throughout your retirement.

1) Understanding Withdrawal Strategies

Your withdrawal strategy determines how much you’ll take from your retirement accounts each year. The goal is to withdraw enough to cover your living expenses without depleting your savings too quickly.

The 4% Rule: The 4% rule suggests withdrawing 4% of your retirement savings in the first year of retirement, then adjusting that amount for inflation each year. This strategy is designed to ensure that your savings last for at least 30 years.

Bucket Strategy: The bucket strategy involves dividing your retirement savings into three “buckets” based on time horizon. The first bucket holds cash and short-term investments for immediate needs. The second bucket holds bonds and other income-producing assets for the next 5-10 years. The third bucket holds stocks and other growth-oriented investments for the long term.

Required Minimum Distributions (RMDs): Once you reach age 72, the IRS requires you to start taking minimum distributions from your retirement accounts. It’s important to plan for these withdrawals to avoid penalties.

2) Maximizing Social Security Benefits

Social Security is a key source of retirement income for many people. The amount you receive depends on your earnings history and the age at which you start taking benefits.

Delaying Benefits: For every year you delay taking Social Security beyond your full retirement age (up to age 70), your benefit increases by about 8%. If you can afford to wait, delaying benefits can significantly increase your lifetime payout.

Spousal Benefits: If you’re married, you may be eligible for spousal benefits based on your spouse’s earnings record. This can be especially beneficial if one spouse earned significantly more than the other.

Taxation of Benefits: Social Security benefits may be subject to federal income tax, depending on your total income. It’s important to understand how your benefits will be taxed and plan accordingly.

3) Considering Health Care Costs

Health care is one of the biggest expenses in retirement. It’s important to plan for these costs to avoid depleting your savings.

Medicare: Medicare is a federal health insurance program for people age 65 and older. It covers a portion of your health care costs, but it doesn’t cover everything. You’ll need to plan for out-of-pocket expenses and consider purchasing supplemental insurance (Medigap) or a Medicare Advantage plan.

Long-Term Care: Long-term care, such as nursing home care or in-home care, is not covered by Medicare. Consider purchasing long-term care insurance or setting aside savings specifically for this purpose.

4) Legacy Planning

Legacy planning involves making arrangements for the distribution of your assets after your death. This includes creating a will, setting up trusts, and considering the tax implications of your estate.

Wills and Trusts: A will outlines how your assets will be distributed after your death. Trusts can provide more control over how your assets are distributed and may offer tax advantages.

Beneficiary Designations: Review and update the beneficiary designations on your retirement accounts, life insurance policies, and other financial accounts. These designations override your will, so it’s important to keep them current.

Estate Taxes: Depending on the size of your estate, it may be subject to federal or state estate taxes. Consult with a financial advisor or estate planning attorney to develop a plan to minimize these taxes.

Conclusion

Retirement planning for the next generation is about striking a balance between enjoying life today and securing your future. By starting early, making informed investment choices, and creating a plan that reflects your unique circumstances, you can build a retirement that allows you to live the life you want both now and in the future.

The key is to approach retirement planning as a dynamic, ongoing process that adapts to changes in your life and the world around you. With careful planning and a commitment to your goals, you can create a retirement that doesn’t require sacrificing today for tomorrow.

-

Press Release7 days ago

Press Release7 days agoClinical Trials Market Set for Robust Growth, Driven by Drug Development Surge and Digital Innovation

-

Press Release7 days ago

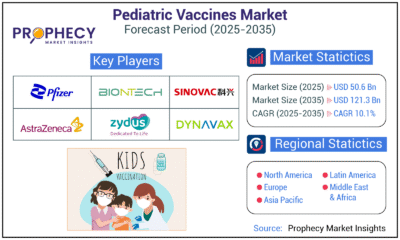

Press Release7 days agoPediatric Vaccines Market: Safeguarding Futures, Driving Growth

-

Press Release7 days ago

Press Release7 days agoWaterproof Structural Adhesives Market: A Comprehensive Study Towards USD 10.3 Billion in 2035

-

Press Release7 days ago

Press Release7 days agoDownhole Tools Market: Navigating Subsurface Frontiers with Precision

-

Press Release7 days ago

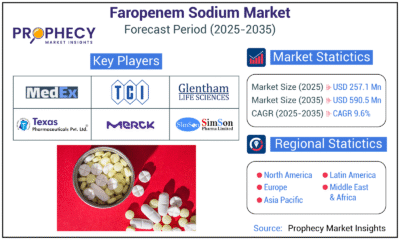

Press Release7 days agoFaropenem Sodium Market: A Potent Weapon in the Fight Against Bacterial Infections