Business

Nokia Defies Tech Market Trends With Surprising Stock Rally

Shares of Nokia surged 4.4% on a day when the tech sector faced significant declines, particularly the Nasdaq Composite, which fell by 2.64%. This unexpected rally can be attributed to a strategic partnership announcement and recent acquisitions that position Nokia favorably in the telecommunications and defense markets.

Key Takeaways

- Nokia’s stock rose 4.4% despite a broader tech market downturn.

- The company announced a partnership with Verizon and Lockheed Martin focused on hybrid 5G communications.

- Nokia integrated its 5G technology into Lockheed Martin’s telecommunications base stations, marking a significant milestone.

- The recent acquisition of Infinera for $2.3 billion enhances Nokia’s capabilities in optical communications.

- Nokia’s stock has increased over 40% in the past year, showcasing resilience in a challenging market.

Partnership With Verizon And Lockheed Martin

Nokia’s recent collaboration with Verizon and Lockheed Martin is a pivotal development. The partnership aims to advance hybrid 5G communications, which could significantly expand Nokia’s reach into the defense sector. This integration of commercial 5G technology into military-grade equipment is expected to open new avenues for sales in government-oriented mobile networks.

Breakthrough In Defense Communications

The integration of Nokia’s 5G technology into Lockheed Martin’s telecommunications base stations is a notable achievement. According to a Nokia engineer, this integration represents a "significant milestone," demonstrating that commercial 5G equipment can meet the stringent security and performance requirements of military applications. This breakthrough not only enhances Nokia’s product offerings but also positions the company as a key player in the defense communications market.

Recent Acquisition Of Infinera

In addition to the partnership, Nokia recently completed its acquisition of Infinera for $2.3 billion, including debt. Infinera is recognized for its advanced optical transceivers, which facilitate ultra-fast optical communications. This acquisition is expected to bolster Nokia’s capabilities in the telecom market and may play a crucial role in the evolving data center interconnect markets, particularly as demand for AI-driven solutions grows.

Financial Performance And Market Position

Despite being perceived as a less glamorous option in the telecommunications sector, Nokia has shown impressive resilience. The company’s stock has appreciated over 40% in the past year, even as revenues have not yet returned to 2023 levels. Recent financial reports indicate a 9% increase in sales last quarter, alongside improved profit margins.

Nokia’s strong balance sheet, with net cash of €4.9 billion as of December 31, further supports its position in a market characterized by rising interest rates and volatility among high-growth tech stocks. This financial stability allows Nokia to pursue strategic initiatives that can drive future growth.

Conclusion

Nokia’s ability to rally on a challenging day for the tech sector highlights its strategic positioning and operational resilience. With significant partnerships and acquisitions, the company is not only navigating the current market landscape but also setting the stage for future growth in both telecommunications and defense sectors. As the tech market continues to fluctuate, Nokia’s prudent management and innovative approaches may well keep it ahead of the curve.

Sources

- Why Nokia Rallied Even on a Terrible Day for Tech Stocks, The Motley Fool.

- Why Nokia Rallied Even on a Terrible Day for Tech Stocks, Nasdaq.

-

Press Release6 days ago

Press Release6 days agoClinical Trials Market Set for Robust Growth, Driven by Drug Development Surge and Digital Innovation

-

Press Release6 days ago

Press Release6 days agoPediatric Vaccines Market: Safeguarding Futures, Driving Growth

-

Press Release6 days ago

Press Release6 days agoWaterproof Structural Adhesives Market: A Comprehensive Study Towards USD 10.3 Billion in 2035

-

Press Release6 days ago

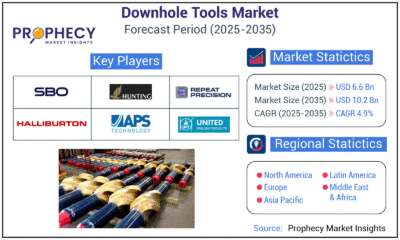

Press Release6 days agoDownhole Tools Market: Navigating Subsurface Frontiers with Precision

-

Press Release6 days ago

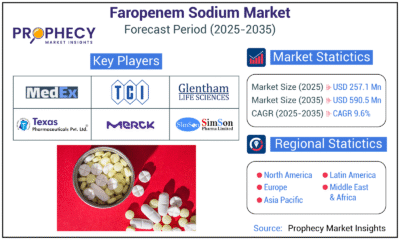

Press Release6 days agoFaropenem Sodium Market: A Potent Weapon in the Fight Against Bacterial Infections