Finance

Navigating the Landscape of Debt Relief Programs

In today’s economic climate, understanding the intricacies of debt relief programs is paramount for those seeking financial liberation. This comprehensive overview, courtesy of 3d Chess Media, dives into the world of debt settlement companies, best practices in debt management, and essential insights into top debt relief strategies.

The Essentials of Debt Settlement Companies

Debt settlement companies offer a beacon of hope for individuals grappling with substantial unsecured debts. These entities negotiate with creditors on behalf of debtors, aiming to reduce the total owed amount.

- Negotiation Expertise: Specializing in creditor negotiations, these companies seek reductions in debt amounts.

- Customized Plans: Tailored solutions are provided based on individual financial situations.

Debt settlement involves ceasing payments to creditors, channeling funds to a dedicated account instead. Once a significant sum accumulates, the debt relief company negotiates with creditors to accept a lesser amount as full settlement.

Understanding Best Debt Settlement Practices

The approach of debt settlement companies involves nuanced strategies to alleviate financial burdens effectively.

- Stopping Payments: A strategic halt in payments can leverage negotiations.

- Dedicated Savings: Funds accumulate in a separate account for lump-sum settlements.

However, this strategy has implications. Credit scores may be affected due to halted payments. Moreover, there’s no guarantee of acceptance by creditors, potentially leading to legal actions.

Analyzing Top Debt Relief Companies

Top debt relief companies stand out through their comprehensive services, transparency, and customer satisfaction.

- Comprehensive Services: Offering a range of solutions beyond simple negotiations.

- Transparency and Customer Satisfaction: Clear communication and positive client feedback are crucial.

These companies assess individual cases, offering personalized plans. They provide clarity on their fee structure, avoiding hidden costs, and prioritize client education about the debt settlement process.

Exploring the Nuances of Debt Relief Programs

Debt relief programs encompass a spectrum of strategies beyond settlement, including debt consolidation and management plans.

- Debt Consolidation: Combining multiple debts into a single loan with potentially lower interest rates.

- Management Plans: Structured payment arrangements with creditors, often facilitated by credit counseling agencies.

These alternatives, while not reducing the owed amount, can simplify payments and potentially improve credit scores in the long run.

Conclusion: Charting a Path to Financial Freedom

In conclusion, understanding the landscape of debt relief programs is crucial for those seeking to navigate the complex terrain of financial obligations. While debt settlement companies offer a pathway to potentially reduce debt burdens, it’s essential to approach with a comprehensive understanding of the process and its implications. By exploring various debt relief strategies, individuals can make informed decisions aligned with their financial goals, ultimately steering towards a more stable and secure financial future.

-

Press Release3 days ago

Press Release3 days agoNura Labs Files Revolutionary Patent: AI-Powered Wallet Solves the $180 Billion Crypto Staking Complexity Crisis

-

Press Release1 day ago

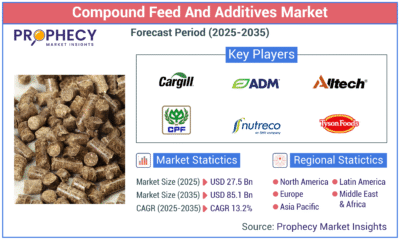

Press Release1 day agoGlobal Compound Feeds and Additives Industry Report: Market Expansion and Competitive Insights to 2035

-

Technology1 day ago

Technology1 day agoWhat to Know Before Switching Cell Phone Network Services in 2025