Finance

Minimizing Longevity Risk with Fixed Index Annuities

As people are living longer, ensuring a secure retirement becomes even more crucial. Longevity risk, the potential of outliving one’s retirement savings, is a significant concern for many individuals. However, there are financial instruments available that can help mitigate this risk, such as fixed index annuities. In this article, we will explore how fixed index annuities can be utilized to minimize longevity risk and secure a stable income during retirement.

- Understanding Longevity Risk:

Longevity risk refers to the possibility of running out of money during retirement due to living longer than expected. With advancements in healthcare and lifestyle improvements, life expectancy has steadily increased. As a result, individuals need to plan for a retirement period that may last for several decades. Fixed index annuities offer a potential solution to this challenge. To search deeper about Longevity Risk, feel free to tap into this additional resource.

- What is a Fixed Index Annuity?

A fixed index annuity is a type of annuity contract that provides a guaranteed income stream, typically for life, while also offering the potential for growth based on the performance of a specified index, such as the S&P 500. This hybrid feature distinguishes fixed index annuities from other retirement investment tools. The guarantees provided by fixed index annuities can help retirees mitigate longevity risk.

- Benefit #1: Lifetime Income Stream:

One of the primary advantages of fixed index annuities is the ability to generate a guaranteed lifetime income stream. By purchasing an annuity contract, individuals can receive regular payments for the rest of their lives, no matter how long they live. This ensures that they will not outlive their retirement savings, effectively minimizing the longevity risk.

- Benefit #2: Protection from Market Volatility:

Fixed index annuities offer protection from market volatility, which is crucial for minimizing longevity risk. Unlike other investment vehicles, fixed index annuities provide a guaranteed minimum interest rate, ensuring that the principal investment is protected. This feature shields retirees from potential market downturns, ensuring a stable income during retirement.

- Benefit #3: Potential for Growth:

While fixed index annuities provide protection from market downturns, they also offer the potential for growth. The annuity’s performance is linked to a specified index, such as the stock market, allowing individuals to benefit from market upturns. This growth potential can help retirees keep pace with inflation and maintain their purchasing power throughout their retirement years.

- Flexibility and Customization:

Fixed index annuities also offer flexibility and customization options. Retirees can choose from various payout options, such as lifetime income, joint income, or a combination of both. Additionally, some annuity contracts include features such as inflation protection or long-term care benefits, further enhancing their ability to minimize longevity risk.

- Considerations and Caveats:

While fixed index annuities have numerous benefits, it’s essential to consider a few factors before investing. These may include surrender charges, potential caps on index returns, and fees associated with the annuity contract. It is prudent to consult with a financial advisor to assess individual goals and determine if a fixed index annuity is suitable.

Conclusion:

Securing a stable income during retirement is paramount in minimizing longevity risk. Fixed index annuities offer an effective solution by providing a guaranteed income stream, protection from market volatility, and potential for growth. By understanding the benefits and caveats associated with fixed index annuities, individuals can make informed decisions to ensure a financially secure and worry-free retirement.

-

Press Release7 days ago

Press Release7 days agoClinical Trials Market Set for Robust Growth, Driven by Drug Development Surge and Digital Innovation

-

Press Release7 days ago

Press Release7 days agoPediatric Vaccines Market: Safeguarding Futures, Driving Growth

-

Press Release7 days ago

Press Release7 days agoWaterproof Structural Adhesives Market: A Comprehensive Study Towards USD 10.3 Billion in 2035

-

Press Release7 days ago

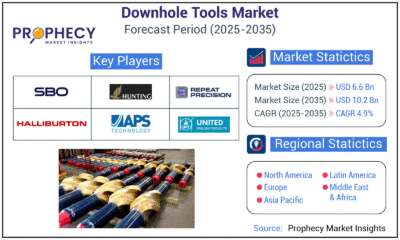

Press Release7 days agoDownhole Tools Market: Navigating Subsurface Frontiers with Precision

-

Press Release7 days ago

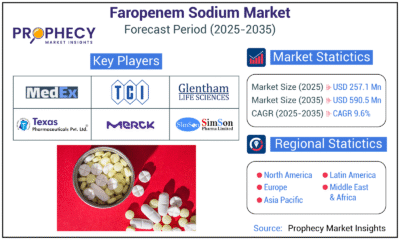

Press Release7 days agoFaropenem Sodium Market: A Potent Weapon in the Fight Against Bacterial Infections