Business

Market Reactions to Fed’s Easing Path and Economic Indicators

The recent market reactions to the Federal Reserve’s easing path and various economic indicators have sparked significant discussions among investors and analysts. As the Fed signals a potential shift in monetary policy, concerns about the economy’s resilience are growing, particularly in light of recent labor market data that fell short of expectations.

Key Takeaways

- The Federal Reserve’s easing path is under scrutiny as market optimism wanes.

- Recent labor market indicators suggest potential economic challenges ahead.

- Analysts warn of a possible recession impacting stock market performance.

Fed’s Easing Path Under Scrutiny

The Federal Reserve’s approach to monetary policy has always been a focal point for investors. Recently, top Wall Street executives have expressed skepticism regarding the Fed’s easing path. This skepticism is fueled by a combination of economic indicators that suggest a cooling economy and the potential for rising inflation.

Investors are closely monitoring the Fed’s next moves, as any changes in interest rates could significantly impact market dynamics. The uncertainty surrounding the Fed’s decisions has led to increased volatility in the stock market, with many investors reassessing their strategies.

Labor Market Indicators Raise Concerns

The October U.S. jobs report revealed disappointing figures, with job growth falling below expectations. This report has raised alarms among economists and investors alike, as it may signal the beginning of labor market troubles. Doug Ramsey, chief investment officer at The Leuthold Group, suggests that this could be an early warning sign of a recession by mid-next year.

Key points from the jobs report include:

- Job growth was significantly lower than anticipated.

- The unemployment rate remains stable, but wage growth is slowing.

- Analysts are concerned about the implications for consumer spending and overall economic health.

Potential Recession and Market Impact

As the market reacts to these economic indicators, the possibility of a recession looms large. Analysts have identified several clues that could indicate a downturn:

- Weakening Labor Market: Continued job growth below expectations could lead to reduced consumer spending.

- Rising Treasury Yields: Investors are bracing for potential increases in U.S. Treasury yields, which could affect borrowing costs and investment decisions.

- Market Sentiment: A shift in investor sentiment from bullish to cautious could trigger sell-offs in the stock market.

- Inflation Pressures: Persistent inflation could lead the Fed to adopt a more aggressive stance, impacting economic growth.

Conclusion

The interplay between the Federal Reserve’s monetary policy and economic indicators is critical for market stability. As investors navigate this uncertain landscape, the focus remains on how these factors will shape the economy in the coming months. With recession fears on the rise, market participants are urged to stay vigilant and prepared for potential shifts in the economic environment.

Sources

-

Press Release6 days ago

Press Release6 days agoNura Labs Files Revolutionary Patent: AI-Powered Wallet Solves the $180 Billion Crypto Staking Complexity Crisis

-

Press Release4 days ago

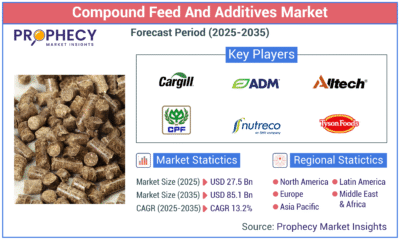

Press Release4 days agoGlobal Compound Feeds and Additives Industry Report: Market Expansion and Competitive Insights to 2035

-

Technology4 days ago

Technology4 days agoWhat to Know Before Switching Cell Phone Network Services in 2025

-

Press Release2 days ago

Press Release2 days agoCrypto WINNAZ Launches First On-Chain Yield Engine for Meme Coins, Enabling 20x–300x Returns