Finance

Credit Repair: Key Insights for Financial Growth

In an increasingly complex financial world, understanding credit repair is more critical than ever. This news release delves into fascinating and vital aspects of credit repair, drawing from comprehensive data within the provided knowledge center, to offer insights that can significantly impact and enhance one’s financial journey.

Credit Repair: More Than Just Error Correction

While many perceive credit repair as a mere process of correcting errors on credit reports, it’s far more expansive. It involves a deep understanding of credit scoring models and strategies to optimize them. By engaging in credit repair, consumers learn the intricacies of credit scores, such as the impact of payment history, credit utilization, and the importance of maintaining a diverse mix of credit accounts.

The Ripple Effect of a Single Score

Credit scores do not exist in a vacuum. They influence various aspects of a person’s financial life, from the interest rates on loans to insurance premiums and even employment opportunities. A higher credit score can mean the difference between affordable mortgage rates and unattainable homeownership dreams, illustrating the broader impact of what may seem like just a number.

Credit Repair’s Role in Financial Education

One of the less discussed but equally important aspects of credit repair is its role in financial education. Engaging in the credit repair process often leads to a better understanding of personal finance, budgeting, and debt management. This knowledge is invaluable, empowering individuals to make more informed financial decisions and avoid pitfalls that can lead to credit damage.

The Long Road to Recovery

Credit repair is not an overnight fix. It’s a journey that requires patience, dedication, and consistency. The time frame for repairing credit can vary depending on the individual’s specific circumstances, but it often involves months or even years of disciplined financial behavior. This process underscores the importance of long-term financial planning and goal setting.

Impact Beyond the Individual

Credit repair’s impact extends beyond individual benefits. Improved credit health can contribute to community-level economic growth, particularly in underserved areas where access to credit is limited. By empowering individuals with better credit, entire communities can benefit from increased economic activity and opportunities.

Credit Repair and Homeownership

Homeownership is a cornerstone of the American dream and a critical component of wealth building. Credit repair plays a crucial role in this aspect, as it can significantly improve the chances of mortgage approval and access to favorable loan terms. For many, credit repair is the first step toward achieving this long-term goal.

The Myth of Credit Repair Scams

While the industry has its share of fraudulent players, many reputable credit repair companies operate legally and ethically. It’s crucial for consumers to conduct thorough research to differentiate between legitimate services and scams. Understanding the signs of a credible credit repair service, such as transparency in pricing and services, can guide consumers in making the right choice.

Conclusion

Credit repair is a multifaceted process with far-reaching implications. From its impact on personal financial health to its role in community economic development, the importance of understanding and effectively managing credit repair is undeniable. As individuals embark on their credit repair journey, they not only improve their financial standing but also contribute to a broader narrative of financial empowerment and growth.

-

Press Release3 days ago

Press Release3 days agoNura Labs Files Revolutionary Patent: AI-Powered Wallet Solves the $180 Billion Crypto Staking Complexity Crisis

-

Press Release1 day ago

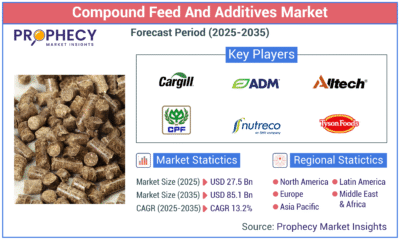

Press Release1 day agoGlobal Compound Feeds and Additives Industry Report: Market Expansion and Competitive Insights to 2035

-

Technology1 day ago

Technology1 day agoWhat to Know Before Switching Cell Phone Network Services in 2025