Finance

Cathie Wood Makes Bold Move: Sells $21 Million in Troubled Tech Stock

Cathie Wood, the renowned head of Ark Investment Management, has made headlines by selling off $21 million worth of UiPath stock, a company that has seen its shares plummet nearly 80% since its IPO. This strategic decision comes as Wood adapts her investment strategy in response to the volatile tech market.

Key Takeaways

- Cathie Wood sold 492,266 shares of UiPath over three trading sessions.

- UiPath’s stock has dropped from an IPO price of $56 to $13.98, reflecting a significant decline.

- The Ark Innovation ETF has underperformed compared to the S&P 500 and Nasdaq Composite in recent years.

Cathie Wood’s Investment Strategy

Cathie Wood is known for her aggressive investment approach, focusing on emerging technologies such as artificial intelligence, blockchain, and robotics. Her flagship fund, the Ark Innovation ETF, aims to capitalize on companies that are poised to disrupt traditional industries. However, this strategy has led to significant volatility in fund performance.

Despite a strong return of 153% in 2020, Wood’s longer-term results have raised questions about her ability to manage risk effectively. As of February 11, 2025, the Ark Innovation ETF has delivered a three-year annualized return of -5.15%, compared to the S&P 500’s 12.88%.

Recent Performance of Ark Innovation ETF

- 2024 Return: 8.4%

- Three-Year Annualized Return: -5.15%

- Five-Year Return: 1.7%

- S&P 500 Three-Year Return: 12.88%

- S&P 500 Five-Year Return: 14.34%

The UiPath Situation

UiPath, a leader in enterprise automation and AI software, went public in April 2021 with an initial offering price of $56. However, the stock has struggled to maintain its value, currently trading at $13.98. This represents an 80% decline from its debut price, raising concerns about the company’s profitability and competitive position in a crowded market.

Wood’s decision to sell UiPath shares comes after a series of poor performances, with the company failing to report a full year of net income since its IPO. The automation sector is becoming increasingly competitive, with major players like Microsoft and Automation Anywhere entering the fray.

Market Reactions and Future Outlook

Despite the challenges faced by Ark Innovation ETF and its holdings, some analysts remain optimistic about the potential for recovery, especially with the anticipated changes in regulatory environments under a new administration. Wood has expressed confidence that deregulation could unleash significant market opportunities.

However, investor sentiment has been mixed, with Ark Innovation ETF experiencing nearly $3 billion in net outflows over the past year. This includes $32 million in the last month alone, indicating a lack of confidence among investors in Wood’s strategy.

Conclusion

Cathie Wood’s recent sale of $21 million in UiPath stock highlights the challenges faced by tech investors in a volatile market. As she navigates these turbulent waters, the future performance of her funds will be closely watched by both supporters and critics alike. The ability to adapt and make timely decisions will be crucial for Wood as she seeks to regain investor confidence and deliver on her ambitious investment strategy.

Sources

-

Press Release7 days ago

Press Release7 days agoClinical Trials Market Set for Robust Growth, Driven by Drug Development Surge and Digital Innovation

-

Press Release7 days ago

Press Release7 days agoPediatric Vaccines Market: Safeguarding Futures, Driving Growth

-

Press Release7 days ago

Press Release7 days agoWaterproof Structural Adhesives Market: A Comprehensive Study Towards USD 10.3 Billion in 2035

-

Press Release7 days ago

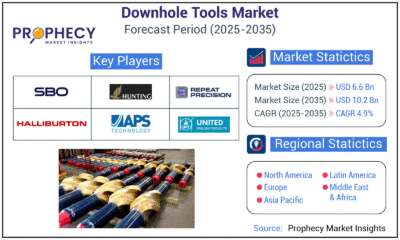

Press Release7 days agoDownhole Tools Market: Navigating Subsurface Frontiers with Precision

-

Press Release7 days ago

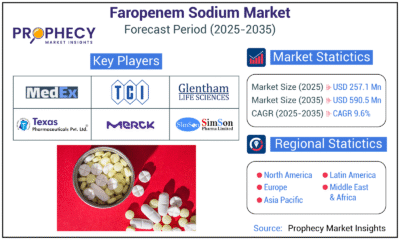

Press Release7 days agoFaropenem Sodium Market: A Potent Weapon in the Fight Against Bacterial Infections