Blockchain Technology

CARBON CREDITS IN BLOCKCHAIN. Focus on Carboncoin, Flowcarbon and 2G Carbon Coin

There are more and more start-ups and projects that promote awareness of the climate issue, especially those that aim to decline the Carbon Credits market into the blockchain. A market that responds to the increasingly urgent need to compensate for the CO2 emissions that an increasingly large world population with the relative consumption pours into the climate every day, generating very dangerous imbalances. Although the market is immense, awareness of this issue is not yet sufficiently widespread nor sufficiently applied.

In the crypto and blockchain market, as we said, there are many initiatives that attempt to structure certified and efficient CO2 compensation processes, but very few are those that can really have an effective impact and success in terms of diffusion and application. Today we have chosen 3 cases, different from each other in terms of approach, proposal and result. As we will see, the market undoubtedly rewards projects that show concreteness.

Carboncoin (CXRBN)

The first case is representative of a failure. Talking about failure when it comes to climate initiatives undoubtedly generates a sense of sadness. While its namesake Carboncoin (CARBON) even has its website offline and the community hasn’t posted news since 2019, $CXRBN hasn’t shown any signs of life since February 2022 and on Coingecko or Coinmarketcap the token shows no transactions, revealing a sense of evident abandonment.

Flowcarbon (GNT)

The second is indicative of great potential. Generated by billionaire entrepreneur and WeWork co-founder Adam Newmann, the Flowcarbon project has just finished the presale phase, raising over 70 million dollars, despite nearly all recent projects showing that carbon-backed crypto tokens seem increasingly disconnected from the carbon credit market.

Flowcarbon brings carbon credits on chain and converts them to tokens, making the voluntary carbon market more transparent, liquid and accessible. The flagship token GNT is backed by corporate-grade carbon credits, suitable for individual and corporate offsetting needs. Each GNT token is backed by 1 voluntary carbon credit from a carbon removal or reduction project. GNT is a bundle token, meaning it’s fully fungible and can be retired, redeemed, or unwrapped.

2G Carbon Coin (2GCC)

The third project we present today is very different from the previous two. In fact, while the first two cryptocurrencies are born from the blockchain to land on the Carbon Credits market, this token comes from the reverse process. 2G Carbon Coin (2GCC) was born from a large agro-industrial project in Tunisia with government approval since 2016. The Tunisian group, from an “Arundo Donax” plantation developed on 100,000 hectares, has obtained certification for the issue of over 1.7 million Carbon Credits for the first 12,500 hectares cultivated.

The Swiss Company of the group, responsible for the marketing of Carbon Credits of the Tunisian Group, has decided to issue the $2GCC to facilitate the marketing of the Carbon Credits already in its portfolio as well as the acquisition of new projects.

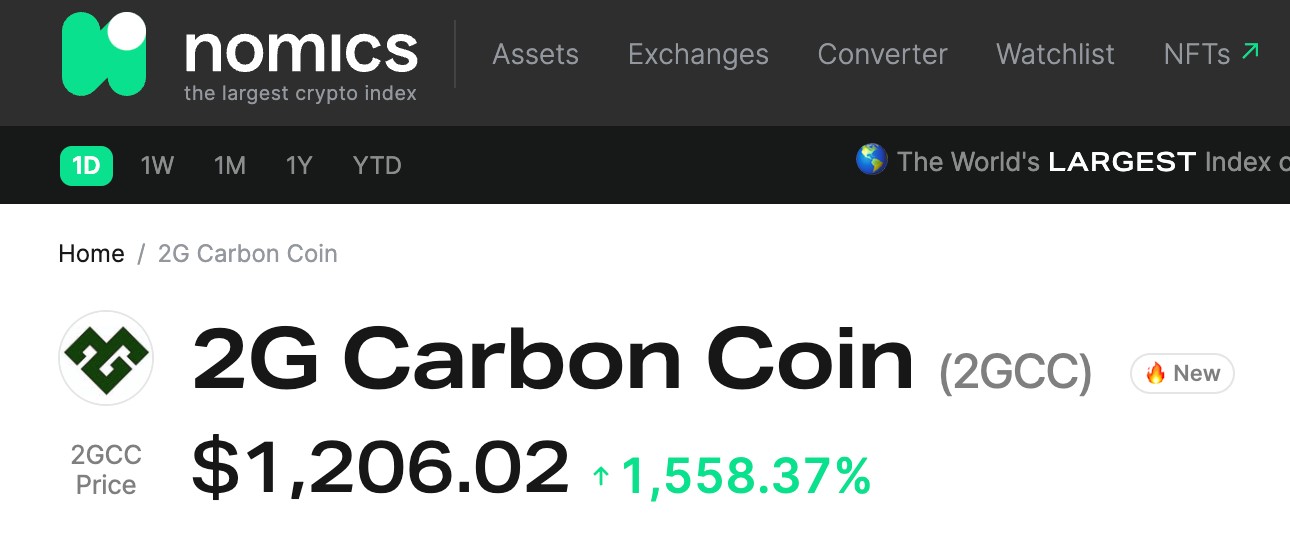

The 2G Carbon Coin was listed on the DEX on July 8, 2022. In a few hours from the listing, the token price jumped from the initial $ 19 to over $ 1,200. While on the one hand it is true that the market rewards the solidity of projects in progress, on the other it should be noted that the 2GCC team has included little availability of initial tokens in DEX compared to the request and the impact that the project had on the market. The decisions of the 2GCC Team will therefore be decisive in the coming hours and days to verify if they will be able to implement solutions that will allow them to maintain a record price and capitalization. In this case of $2GCC we will certainly hear more about it.

-

Press Release5 days ago

Press Release5 days agoClinical Trials Market Set for Robust Growth, Driven by Drug Development Surge and Digital Innovation

-

Press Release5 days ago

Press Release5 days agoGreen Bio Chemicals Market Poised for Sustainable Growth amidst Global Shift to Eco-Friendly Alternatives by 2035

-

Press Release5 days ago

Press Release5 days agoFill-Finish Pharmaceutical Contract Manufacturing Market Expected to Flourish Amid Biopharmaceutical Boom and Global Outsourcing Trend by 2035

-

Press Release5 days ago

Press Release5 days agoIndustrial Boiler Market Expected to Surpass USD 24.4 Billion by 2035 Amid Growing Demand for Energy Efficiency and Industrialization

-

Business6 days ago

Business6 days agoHow Managed IT Solutions Help Small Teams Compete at Enterprise Scale

-

Press Release5 days ago

Press Release5 days agoPreventive Vaccines Market to Witness Strong Growth by 2035

-

Press Release5 days ago

Press Release5 days agoPet Food Nutraceutical Market Set for Robust Expansion Amid Rising Demand for Pet Wellness by 2035

-

Press Release5 days ago

Press Release5 days agoWaterproof Structural Adhesives Market: A Comprehensive Study Towards USD 10.3 Billion in 2035