Business

Cannabis Stocks: High Growth Potential in 2024

The cannabis industry is experiencing rapid growth, driven by changing laws and increasing consumer demand. As more states and countries legalise cannabis, investors are taking notice of the potential for significant returns. However, investing in cannabis stocks comes with its own set of challenges and risks. This article explores the current state of cannabis stocks, the factors influencing their growth, and the best strategies for investing in this dynamic market.

Key Takeaways

- The cannabis market is expanding quickly, with a projected annual growth rate of 34% until 2030.

- Legal changes, especially in the U.S., are likely to boost cannabis stocks significantly.

- Investing in cannabis stocks carries unique risks, including legal issues and market fluctuations.

- Top companies to watch include Green Thumb Industries, Trulieve Cannabis, and Innovative Industrial Properties.

- Understanding the differences between U.S. and Canadian cannabis markets can reveal valuable investment opportunities.

The Current Landscape of Cannabis Stocks

Market Overview

The cannabis industry is rapidly evolving, with significant growth in recent years. As of now, recreational marijuana is legal in 24 states and Washington D.C., while 14 states allow medical use. This shift has transformed cannabis from a niche market into a booming industry.

Key Players in the Industry

Several companies are leading the charge in the cannabis sector. Here are some of the most notable:

- Curaleaf

- Green Thumb Industries

- Trulieve

- Canopy Growth

- Aurora Cannabis

These companies are involved in various aspects of the cannabis market, from cultivation to retail.

Recent Trends and Developments

The cannabis market is witnessing several trends that could shape its future:

- Increased Legalisation: More states are considering legalising cannabis, which could expand the market.

- Investment Growth: There is a surge in investments, with many investors looking for the best marijuana stocks for 2024.

- Technological Innovations: Advances in cultivation and product development are enhancing efficiency and product quality.

The cannabis industry is still in its early stages, and while there are great opportunities, investors should be aware of the risks involved.

| Company Name | Market Cap (in billions) | Yearly Growth (%) |

|---|---|---|

| Curaleaf | 4.5 | 20 |

| Green Thumb Industries | 3.2 | 15 |

| Trulieve | 2.8 | 18 |

This table highlights some of the leading companies in the cannabis market, showcasing their market cap and growth rates.

Overall, the landscape of cannabis stocks is dynamic and full of potential, but investors must conduct thorough research before making any decisions.

Factors Driving the Growth of Cannabis Stocks

Legalisation and Regulation

The legalisation of cannabis across various states has significantly boosted the market. As more states adopt laws allowing cannabis use, the industry is expected to expand rapidly. Currently, cannabis is legal for medical use in 37 states and fully legal in 23 states. This trend is likely to continue, creating a more stable environment for investors.

Market Demand

The demand for cannabis products is on the rise, driven by changing public perceptions and increased acceptance. Key factors include:

- Growing consumer base: More people are using cannabis for both recreational and medicinal purposes.

- Diverse product offerings: Companies are innovating with various products, from edibles to oils, catering to different consumer preferences.

- Increased accessibility: As more dispensaries open, consumers have easier access to cannabis products.

Technological Advancements

Technological improvements are also playing a crucial role in the growth of cannabis stocks. Innovations in cultivation and production methods are leading to higher quality products and increased efficiency. Some notable advancements include:

- Hydroponic systems: These allow for faster growth cycles and better yields.

- Genetic research: Developing new strains with specific benefits, such as higher CBD content.

- Supply chain technology: Enhancing distribution and inventory management, ensuring products reach consumers more efficiently.

The cannabis industry is evolving rapidly, and understanding these driving factors is essential for investors looking to capitalise on this growth.

| Factor | Impact on Growth |

|---|---|

| Legalisation | High |

| Market Demand | High |

| Technological Advancements | Medium |

Risks Associated with Investing in Cannabis Stocks

Investing in cannabis stocks comes with unique challenges that every investor should be aware of. Understanding these risks is crucial for making informed decisions.

Legal and Political Risks

- The legality of cannabis varies widely across the U.S. and other countries. While some states have legalised it, others still enforce strict prohibitions.

- Federal laws in the U.S. classify marijuana as illegal, creating uncertainty for businesses and investors alike.

- Changes in government policies can significantly impact the market.

Financial Constraints

- Many cannabis companies struggle to access traditional banking services due to federal restrictions. This can limit their growth potential.

- Investors should be cautious as some companies may face cash flow issues, leading to potential losses.

- If supply exceeds demand, the prices of marijuana products may fall, causing businesses and investors to lose money.

Market Volatility

- The cannabis market is still relatively new and can be unpredictable. Prices can fluctuate widely based on market trends and consumer demand.

- Investors should be prepared for sudden changes in stock prices, which can lead to significant financial risks.

Investing in cannabis stocks requires careful consideration of the associated risks. Always do thorough research before making any investment decisions.

Top Cannabis Stocks to Watch in 2024

Green Thumb Industries

Green Thumb Industries (GTBIF) is a leading player in the cannabis market, known for its strong retail presence and diverse product offerings. With a market capitalisation of approximately $2.6 billion, it has shown consistent growth and innovation in its operations.

Trulieve Cannabis

Trulieve Cannabis (TCNNF) stands out with its extensive dispensary network and focus on customer experience. The company has a market capitalisation of around $1.8 billion and is well-positioned to benefit from increasing demand in the cannabis sector.

Innovative Industrial Properties

Innovative Industrial Properties (IIPR) operates in the ancillary space, providing real estate solutions for cannabis businesses. With a market capitalisation of about $1.4 billion, it offers a unique investment opportunity by focusing on the infrastructure side of the cannabis industry.

| Company Name | Market Capitalisation | Key Focus Area |

|---|---|---|

| Green Thumb Industries (GTBIF) | $2.6 billion | Retail and Product Innovation |

| Trulieve Cannabis (TCNNF) | $1.8 billion | Dispensary Network |

| Innovative Industrial Properties (IIPR) | $1.4 billion | Real Estate for Cannabis |

Investing in cannabis stocks can be rewarding, but it is essential to conduct thorough research and understand the market dynamics.

These companies represent just a few of the top cannabis stocks to keep an eye on in 2024. As the industry continues to evolve, staying informed about these key players will be crucial for potential investors.

Impact of U.S. Federal Reforms on Cannabis Stocks

Reclassification of Marijuana

The ongoing discussions about reclassifying marijuana could significantly change the landscape for cannabis stocks. Currently, cannabis is classified alongside drugs like heroin, which limits its market potential. If it were to be reclassified, it could open doors for more investment and growth in the sector.

Potential Market Expansion

With federal reforms, the cannabis market could see a substantial expansion. This includes:

- Increased access to banking services for cannabis businesses.

- Greater investment opportunities for both domestic and international investors.

- Enhanced consumer confidence, leading to higher sales.

Investor Sentiment

The sentiment among investors is closely tied to federal reforms. Positive changes could lead to a surge in stock prices, while delays or setbacks might cause uncertainty. Recent recommendations from the U.S. Department of Health and Human Services to ease restrictions have already sparked interest in the market.

The potential for financial services to cannabis operators is crucial, especially as the federal government considers reforms.

In summary, the impact of U.S. federal reforms on cannabis stocks is profound, with the potential to reshape the industry entirely. Investors should keep a close eye on these developments as they unfold.

Comparing U.S. and Canadian Cannabis Markets

Market Size and Growth

The cannabis markets in the U.S. and Canada differ significantly in size and growth potential. The U.S. market is larger, with many states legalising cannabis for medical and recreational use. In contrast, Canada has a smaller market but has been fully legal since 2018.

| Market Aspect | U.S. Market | Canadian Market |

|---|---|---|

| Legal Status | Varies by state | Fully legal since 2018 |

| Market Size | Larger, rapidly growing | Smaller, stabilising |

| Growth Rate | High potential | Slower growth |

Regulatory Environment

The regulatory landscape is another area of contrast. In the U.S., cannabis remains illegal at the federal level, which creates a complex environment for businesses. Conversely, Canada has a clear regulatory framework that supports the cannabis industry.

- U.S. Regulatory Challenges:

- Canadian Regulatory Advantages:

Investment Opportunities

Investors looking at these markets should consider the following:

- U.S. Market: High growth potential but with significant risks due to regulatory issues.

- Canadian Market: More stable but slower growth, with established companies.

- Diversification: Investing in both markets can balance risks and rewards.

The cannabis industry is evolving, and understanding the differences between the U.S. and Canadian markets is crucial for making informed investment decisions.

Strategies for Investing in Cannabis Stocks

Diversification

Investing in cannabis stocks can be exciting, but it’s important to spread your investments across different companies and sectors. Here are some tips:

- Mix it up: Include various types of cannabis companies, such as growers, retailers, and tech firms.

- Limit exposure: Try not to invest more than 10% of your total portfolio in cannabis stocks.

- Consider indirect investments: Look at companies that are involved in the cannabis industry but are not pure-play cannabis firms.

Long-term vs Short-term Investments

When investing in cannabis stocks, think about your goals:

- Long-term: If you believe in the future of cannabis, consider holding stocks for several years.

- Short-term: If you want to take advantage of quick price changes, be prepared to buy and sell more frequently.

- Stay informed: Keep up with news and trends that could affect stock prices.

Risk Management

Investing in cannabis stocks comes with risks. Here’s how to manage them:

- Research thoroughly: Understand the companies you’re investing in and their market positions.

- Set limits: Decide in advance how much you’re willing to lose on a stock.

- Review regularly: Keep an eye on your investments and adjust your strategy as needed.

Investing in cannabis stocks can be rewarding, but it’s essential to approach it with caution and a clear strategy. Understanding the market and your own financial goals will help you make better decisions.

| Strategy | Description |

|---|---|

| Diversification | Spread investments across various cannabis sectors. |

| Long-term Investments | Hold stocks for several years to benefit from growth. |

| Risk Management | Research and set limits to protect your investments. |

Financial Performance of Leading Cannabis Companies

Revenue Growth

The cannabis industry has seen significant revenue growth over the past few years. Here are some key figures from leading companies:

| Company | Market Capitalization | Annual Revenue Growth | Price/Sales Ratio |

|---|---|---|---|

| Curaleaf Holdings (CURLF) | $3.3 billion | 10.5% | 2.4 |

| Green Thumb Industries (GTBIF) | $2.6 billion | 3.7% | 2.5 |

| Trulieve Cannabis (TCNNF) | $1.8 billion | 5.0% | 2.1 |

Profitability Challenges

Despite the growth, many cannabis companies face profitability challenges. Some common issues include:

- High operational costs

- Intense competition

- Regulatory hurdles

Debt and Financing

Managing debt is crucial for cannabis companies. Here are some points to consider:

- Many companies rely on debt financing to expand.

- High debt levels can lead to financial instability.

- Investors should assess a company’s debt-to-equity ratio before investing.

The cannabis market is evolving, but investors must remain cautious. Understanding financial performance is key to making informed decisions.

Future Outlook for the Cannabis Industry

Predicted Market Trends

The cannabis industry is expected to grow significantly in the coming years. Analysts predict a compound annual growth rate of 34% through 2030. This growth is driven by increasing legalisation and changing public perceptions. Here are some key trends to watch:

- Expansion of legal markets in various states and countries.

- Increased investment in cannabis technology and infrastructure.

- Growing consumer demand for cannabis products.

Potential Challenges

Despite the positive outlook, there are challenges that could impact growth:

- Regulatory hurdles: Ongoing legal issues may slow down market expansion.

- Market saturation: As more companies enter the market, competition will increase.

- Economic factors: Changes in the economy could affect consumer spending on cannabis products.

Opportunities for Investors

Investors should keep an eye on several opportunities:

- Emerging markets: Countries that are beginning to legalise cannabis.

- Innovative products: Companies developing new cannabis-based products.

- Ancillary services: Businesses that support the cannabis industry, such as real estate and technology providers.

The cannabis industry is at a pivotal moment, with potential for both growth and risk. Investors must stay informed to navigate this evolving landscape.

Technological Innovations in the Cannabis Industry

Cultivation Techniques

The cannabis industry is seeing exciting advancements in cultivation methods. These innovations help growers produce higher quality plants while using fewer resources. Some key techniques include:

- Hydroponics: Growing plants in nutrient-rich water instead of soil.

- Aeroponics: A method where roots are suspended in air and misted with nutrients.

- LED Lighting: Energy-efficient lights that enhance growth and reduce costs.

Product Development

As the market expands, companies are focusing on creating new and unique products. This includes:

- Edibles: Cannabis-infused foods and drinks that appeal to a wider audience.

- Topicals: Creams and lotions infused with cannabis for pain relief.

- Concentrates: Highly potent forms of cannabis that offer stronger effects.

Supply Chain Management

Efficient supply chain management is crucial for the cannabis industry. Innovations in this area include:

- Blockchain Technology: Ensures transparency and traceability of products.

- Automated Inventory Systems: Helps manage stock levels and reduce waste.

- Data Analytics: Utilises data to predict trends and improve sales strategies.

The rise of cannatech—technology specifically designed for the cannabis industry—has enabled companies to develop novel products. This is shaping the future of the cannabis industry significantly.

Analysing the Best-Performing Cannabis Stocks

Performance Metrics

The cannabis industry has seen significant growth, with several companies standing out in terms of performance. Curaleaf Holdings and Green Thumb Industries are among the top performers, showcasing strong market capitalisation and revenue growth. Here’s a quick look at some of the best-performing cannabis stocks:

| Company (Ticker) | Market Capitalisation | Annual Revenue Growth | Price/Sales Ratio |

|---|---|---|---|

| Curaleaf Holdings (CURLF) | $3.3 billion | 10.5% | 2.4 |

| Green Thumb Industries (GTBIF) | $2.6 billion | 12.0% | 3.0 |

| Trulieve Cannabis (TCNNF) | $1.8 billion | 15.0% | 2.1 |

Key Success Factors

Several factors contribute to the success of these cannabis stocks:

- Market Demand: Increasing acceptance and legalisation of cannabis products.

- Operational Efficiency: Companies that manage their resources well tend to perform better.

- Innovation: Firms investing in new products and technologies are more likely to attract investors.

The cannabis market is evolving rapidly, and staying informed is crucial for investors.

Market Positioning

Understanding how these companies position themselves in the market is essential. For instance, Curaleaf is often seen as a bellwether for the industry due to its size and influence. Meanwhile, Green Thumb Industries focuses on expanding its retail footprint, which has proven beneficial in capturing market share.

In summary, while the cannabis sector presents exciting opportunities, it is vital to analyse the performance metrics and market strategies of leading companies to make informed investment decisions. Investors should keep an eye on these stocks as they navigate the evolving landscape of cannabis.

The Role of Ancillary Businesses in the Cannabis Market

Real Estate and Infrastructure

Ancillary businesses play a crucial role in the cannabis market, especially in real estate. Companies like Innovative Industrial Properties (IIP) purchase properties from cannabis operators and lease them back, providing much-needed cash flow. This model helps cannabis businesses focus on growth while ensuring steady income for IIP.

Financial Services

Another important area is financial services. Many cannabis companies struggle to access traditional banking due to federal regulations. Ancillary businesses that offer financial solutions, such as payment processing and investment services, are essential for the industry’s growth. They help cannabis companies manage their finances and navigate the complex regulatory landscape.

Technology Providers

Technology is also a significant part of the ancillary market. Companies that provide software for inventory management, compliance tracking, and customer relationship management are vital. These tools help cannabis businesses operate efficiently and stay compliant with regulations.

Summary of Ancillary Business Roles

- Real Estate: Provides properties for cannabis operations.

- Financial Services: Offers banking solutions and investment opportunities.

- Technology: Supplies software for operational efficiency.

Ancillary businesses are essential for the cannabis industry, helping it to thrive despite challenges. They provide the support that allows cannabis companies to focus on their core operations.

In summary, as the cannabis market continues to grow, the role of ancillary businesses will become increasingly important. They not only support the industry but also present unique investment opportunities for those looking to enter this expanding market. Ancillary cannabis stocks perform best again, reflecting their resilience and potential for growth in 2024.

Final Thoughts on Cannabis Stocks in 2024

In conclusion, the cannabis market is set for significant growth in 2024, driven by increasing legalisation and changing public attitudes. While there are risks involved, particularly with federal regulations in the U.S., the potential rewards can be substantial for those willing to invest. As more states and countries embrace cannabis, investors may find exciting opportunities. However, it’s crucial to do thorough research and understand the market dynamics before making any investment decisions. With careful planning, cannabis stocks could be a valuable addition to your investment portfolio.

-

Press Release7 days ago

Press Release7 days agoNura Labs Files Revolutionary Patent: AI-Powered Wallet Solves the $180 Billion Crypto Staking Complexity Crisis

-

Press Release5 days ago

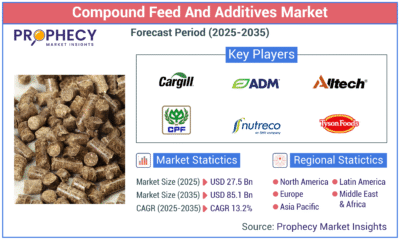

Press Release5 days agoGlobal Compound Feeds and Additives Industry Report: Market Expansion and Competitive Insights to 2035

-

Technology4 days ago

Technology4 days agoWhat to Know Before Switching Cell Phone Network Services in 2025

-

Press Release3 days ago

Press Release3 days agoCrypto WINNAZ Launches First On-Chain Yield Engine for Meme Coins, Enabling 20x–300x Returns

-

Press Release8 hours ago

Press Release8 hours agoBellarium ($BEL) Price Prediction: Could It Hit $5 by 2026?

-

Press Release7 hours ago

Press Release7 hours agoWhy Alaxio (ALX) Is a Top Pick for Smart Crypto Investors