Finance

Tech Stocks Surge As Market Optimism Grows

As optimism returns to the market, tech stocks have seen a notable uptick, driven by strong earnings reports and a positive outlook on artificial intelligence (AI) advancements. The sector’s leaders, known as the "Magnificent Seven," have shared insights on emerging AI technologies, particularly the impact of a new competitor, DeepSeek, which has stirred discussions among industry giants.

Key Takeaways

- Tech stocks, particularly the Magnificent Seven, are experiencing a surge in value amid positive earnings reports.

- The introduction of the AI model DeepSeek has prompted mixed reactions from tech CEOs, with many viewing it as an opportunity rather than a threat.

- Companies like Amazon and Oracle are ramping up their AI investments, indicating a strong belief in the technology’s potential.

Market Overview

The Technology Select Sector SPDR Fund (XLK) rose by 0.5%, while the SPDR S&P Semiconductor ETF (XSD) jumped 2.9%. The Philadelphia Semiconductor index also added 1.5%, reflecting a broader recovery in tech stocks. Notably, Intel shares surged by 11% following reports of potential acquisition interest from major players like Taiwan Semiconductor Manufacturing and Broadcom.

Earnings Season Insights

The earnings season has been pivotal for tech stocks, with nearly all members of the Magnificent Seven reporting their Q4 2024 results. Amazon’s mixed earnings report, which exceeded expectations but provided disappointing guidance, has led to a reassessment of stock prices. Analysts describe this as an "expectations correction" rather than a fundamental issue.

The DeepSeek Effect

DeepSeek, a relatively unknown Chinese startup, has made waves in the tech industry with its AI model, which was developed at a fraction of the cost of its competitors. This has raised questions about the future of AI development and spending among established tech giants.

- Mark Zuckerberg of Meta Platforms expressed interest in DeepSeek’s innovations, suggesting that they could be integrated into Meta’s offerings.

- Satya Nadella, CEO of Microsoft, acknowledged the innovation coming from DeepSeek, comparing the current AI landscape to previous technological cycles.

- Andy Jassy, Amazon’s CEO, highlighted the significant business opportunities presented by AI, emphasizing the company’s commitment to increasing its AI investments.

Future Outlook

As the tech sector continues to evolve, the focus on sustainable profitability is becoming increasingly important. Companies are expected to balance rapid growth with long-term profitability, especially as competition intensifies. The integration of AI into business models is seen as a key driver of future growth, with firms like Oracle expanding their cloud services and AI capabilities.

Conclusion

The recent gains in tech stocks reflect a broader market optimism, fueled by strong earnings and the potential of AI technologies. As companies adapt to new challenges and opportunities, the tech sector is poised for continued growth, with leaders embracing innovation and collaboration in the face of emerging competition.

Sources

-

Press Release7 days ago

Press Release7 days agoClinical Trials Market Set for Robust Growth, Driven by Drug Development Surge and Digital Innovation

-

Press Release7 days ago

Press Release7 days agoPediatric Vaccines Market: Safeguarding Futures, Driving Growth

-

Press Release7 days ago

Press Release7 days agoWaterproof Structural Adhesives Market: A Comprehensive Study Towards USD 10.3 Billion in 2035

-

Press Release7 days ago

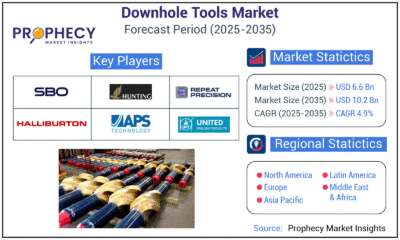

Press Release7 days agoDownhole Tools Market: Navigating Subsurface Frontiers with Precision

-

Press Release7 days ago

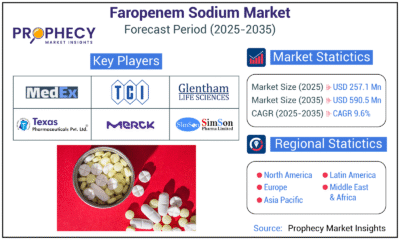

Press Release7 days agoFaropenem Sodium Market: A Potent Weapon in the Fight Against Bacterial Infections