Healthcare

Florida Faces a Silver Tsunami as Aging Boomers Flock to the Sunshine State

As the “Silver Tsunami” surges across America, its waves are set to hit South Florida harder than most regions. Known for its warm climate and retiree-friendly communities, the state has long been a destination for older Americans seeking the good life. However, with the aging Baby Boomer population growing rapidly, South Florida’s infrastructure and services face unprecedented challenges.

Florida already leads the nation in its concentration of older adults, with over 18% of its population aged 65 and older. By 2025, nearly 940,000 residents aged 65 and above—including 130,000 aged 85 and older—are expected to call the region home. These numbers are projected to soar further by 2050, leaving officials scrambling to address the needs of this demographic shift.

The term “Silver Tsunami” describes the wave of Baby Boomers entering retirement age—a demographic phenomenon reshaping communities across the country. In South Florida, this influx is magnified by the state’s popularity among retirees. However, the challenges posed by this trend are not confined to Florida alone. States like South Carolina and Arizona are also witnessing similar demographic transformations, prompting discussions about how to adapt services for older populations.

Among the most pressing concerns are the availability of affordable housing, access to healthcare, and the capacity of assisted living facilities. Frank Rainwater, executive director of South Carolina’s Revenue and Fiscal Affairs Office, recently highlighted these challenges: “On a state level, you will need more assisted-living facilities, more nursing home beds, more medical facilities.”

Yet, the solutions are not straightforward. Many aging Americans prefer to “age in place,” remaining in their own homes rather than transitioning to assisted living or nursing homes. This trend is creating additional pressures on housing supply, as properties are held off the market for longer periods.

While infrastructure is a major challenge, the financial preparedness of the aging population adds another layer of complexity. Michael A. Scarpati, CEO of RetireUS, highlights the reality for many Boomers: “4 million Americans turning 65 should mean 4 million Americans entering what should be their golden years. However, the reality for most is far from ideal, as data reveals that many are financially unprepared for retirement. This isn’t a reflection of a lack of effort but rather a widespread misunderstanding of how much savings are truly needed to sustain a comfortable retirement.”

For decades, many Americans have relied on Social Security to supplement their retirement income. However, with Social Security reserves projected to face cuts by 2035 unless Congress intervenes, the reliability of this safety net is increasingly in question. Scarpati underscores the urgency of planning: “It’s critical for Baby Boomers to have a clear understanding of their financial needs and take steps to safeguard the savings they’ve worked so hard to accumulate. Proactive planning and protection are key to ensuring stability during retirement.”

Communities like South Florida are already grappling with the impact of an aging population, hosting events like the recent “Preparing for the Silver Tsunami” forum held by the South Florida Regional Planning Council. The event highlighted the need for forward-thinking policies to address housing shortages, healthcare accessibility, and public services designed for older residents.

Experts agree that a multi-faceted approach is necessary. Solutions include incentivizing developers to create age-friendly housing, expanding telemedicine options for seniors, and providing education on financial planning. Moreover, fostering “aging-in-place” initiatives could help alleviate some of the strain on institutional care facilities.

The challenges posed by the Silver Tsunami extend beyond individual communities, reflecting a national issue that requires collective action. Policymakers, local governments, and private organizations must collaborate to create sustainable systems that address the needs of an aging population. At the same time, individuals must take proactive steps to ensure their own financial security.

“Proactive planning doesn’t just protect savings—it empowers retirees to navigate this new chapter of life with confidence,” Scarpati notes. For those yet to retire, it’s never too early—or too late—to start preparing. From maximizing retirement contributions to seeking professional financial advice, small steps taken today can lead to greater peace of mind tomorrow.

As the Silver Tsunami continues to grow, its impact will shape the future of Florida and beyond. For communities, businesses, and individuals alike, the question is not whether they will be affected, but how they will respond. With the right strategies, this demographic wave can become an opportunity rather than a crisis, ensuring that America’s aging population can truly enjoy their golden years.

-

Press Release6 days ago

Press Release6 days agoClinical Trials Market Set for Robust Growth, Driven by Drug Development Surge and Digital Innovation

-

Press Release6 days ago

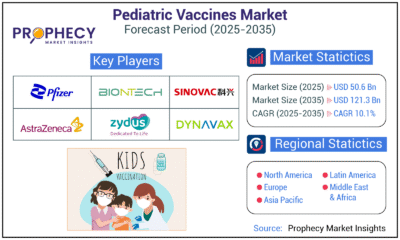

Press Release6 days agoPediatric Vaccines Market: Safeguarding Futures, Driving Growth

-

Press Release7 days ago

Press Release7 days agoWaterproof Structural Adhesives Market: A Comprehensive Study Towards USD 10.3 Billion in 2035

-

Press Release7 days ago

Press Release7 days agoDownhole Tools Market: Navigating Subsurface Frontiers with Precision

-

Press Release7 days ago

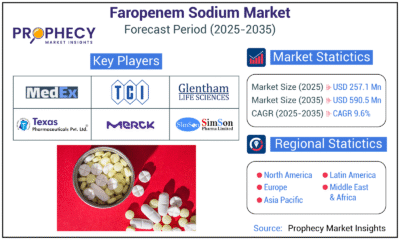

Press Release7 days agoFaropenem Sodium Market: A Potent Weapon in the Fight Against Bacterial Infections