Alternative Energy

Nvidia Takes Intel’s Place in Dow Jones Industrial Average: A Shift in Tech Power

Nvidia Corp. is set to replace Intel Corp. in the Dow Jones Industrial Average, marking a significant shift in the technology landscape. This change highlights the decline of Intel, a once-dominant player in the semiconductor industry, as Nvidia rises to prominence, particularly in the realm of artificial intelligence (AI).

Key Takeaways

- Nvidia will officially replace Intel in the Dow Jones Industrial Average on November 8, 2024.

- This transition underscores the contrasting fortunes of the two companies in the tech sector.

- Sherwin-Williams will also join the index, replacing Dow Inc.

The Rise of Nvidia

Nvidia’s ascent in the semiconductor market has been meteoric, driven largely by its pivotal role in AI technologies. The company has seen its stock price soar, reflecting a seven-fold increase over the past two years. In 2024 alone, Nvidia’s shares have more than doubled, positioning it as a key player in the AI revolution.

The company’s innovative graphics processing units (GPUs) have become essential for AI applications, making Nvidia a barometer for the AI market. The recent 10-for-one stock split has further enhanced its accessibility to retail investors, contributing to its growing market capitalization, which now stands at approximately $3.32 trillion.

Intel’s Decline

In stark contrast, Intel has struggled to maintain its status as a semiconductor powerhouse. After joining the Dow 25 years ago, the company has faced significant challenges, including a failure to capitalize on the AI boom. Intel’s stock has plummeted, with a 54% decline this year, making it the worst performer on the Dow.

The company has also lost its manufacturing edge to competitors like TSMC and has been criticized for missing key opportunities, such as not investing in OpenAI, the creator of ChatGPT. As a result, Intel’s market value has fallen below $100 billion for the first time in three decades, and it is projected to report its first annual net loss since 1986.

Implications of the Change

The replacement of Intel by Nvidia in the Dow Jones Industrial Average is more than just a symbolic gesture; it reflects a broader trend in the technology sector. As Nvidia continues to thrive, Intel’s exclusion from the index could further impact its stock price and investor confidence.

- Market Representation: The changes made by S&P Dow Jones Indices aim to provide a more accurate representation of the semiconductor industry and the materials sector.

- Investor Sentiment: Losing its place in the Dow could be a reputational blow for Intel, as it grapples with a painful transformation and a loss of confidence among investors.

Conclusion

The transition from Intel to Nvidia in the Dow Jones Industrial Average signifies a pivotal moment in the tech industry. As Nvidia continues to lead in AI and semiconductor innovation, Intel’s struggles serve as a cautionary tale of how quickly fortunes can change in the fast-paced world of technology. Investors and industry watchers will be keenly observing how these shifts will shape the future of the semiconductor market and the broader tech landscape.

Sources

-

Foreign Policy7 days ago

Foreign Policy7 days agoInside Schedule F: Will Trump’s Federal Workforce Shake-Up Undermine Democracy?

-

Press Release6 days ago

Press Release6 days agoIn2space Launches Campaign to Make Space Travel Accessible for All

-

Press Release2 days ago

Press Release2 days agoNura Labs Files Revolutionary Patent: AI-Powered Wallet Solves the $180 Billion Crypto Staking Complexity Crisis

-

Press Release16 minutes ago

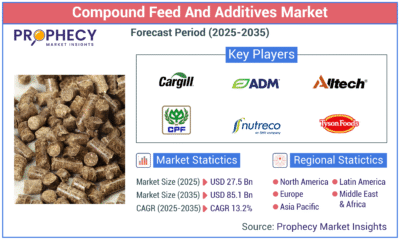

Press Release16 minutes agoGlobal Compound Feeds and Additives Industry Report: Market Expansion and Competitive Insights to 2035