Alternative Energy

Humana Shares Slide on Lower Medicare Advantage Ratings

Humana, a major health insurer, experienced a significant drop in its stock price, falling over 10% after the Centers for Medicare and Medicaid Services (CMS) released preliminary ratings for Medicare Advantage plans. The company warned that this decline in ratings could adversely affect its financial results in 2026.

Key Takeaways

- Humana’s stock fell more than 10% following the announcement.

- The company reported that only 25% of its members are enrolled in plans rated four stars and above for 2025, a sharp decline from 94% this year.

- The drop in ratings is expected to impact Humana’s payments from the federal government in 2026.

Overview of Medicare Advantage Ratings

Medicare Advantage plans are rated on a scale of one to five stars, with higher ratings indicating better quality of care and services. These ratings are crucial as they influence the payments insurers receive from the federal government. A higher star rating can lead to increased funding, while lower ratings can result in financial penalties.

Humana’s Current Situation

Humana’s recent ratings reveal a troubling trend:

| Year | Percentage of Members in 4-Star Plans and Above |

|---|---|

| 2023 | 94% |

| 2025 | 25% |

This drastic reduction in quality ratings has raised concerns among investors and analysts about the company’s future profitability and market position.

Market Reaction

The immediate market reaction to Humana’s announcement was severe, with shares plummeting. Analysts suggest that this could be one of the worst days for Humana’s stock since 2009. Investors are now closely monitoring the company’s strategies to address these challenges and improve its ratings moving forward.

Future Implications

The implications of these lower ratings extend beyond immediate stock performance. Humana’s ability to attract new members and retain existing ones may be compromised if the quality of its plans does not improve. Additionally, the potential decrease in federal payments could lead to cost-cutting measures, affecting services provided to members.

Conclusion

Humana’s significant drop in stock value following the release of lower Medicare Advantage ratings highlights the critical nature of quality assessments in the healthcare insurance market. As the company navigates this setback, stakeholders will be keenly observing its response and any strategic changes it implements to regain its standing in the industry.

Sources

-

Press Release6 days ago

Press Release6 days agoNura Labs Files Revolutionary Patent: AI-Powered Wallet Solves the $180 Billion Crypto Staking Complexity Crisis

-

Press Release4 days ago

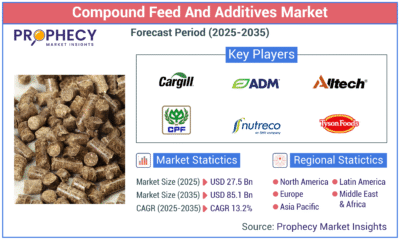

Press Release4 days agoGlobal Compound Feeds and Additives Industry Report: Market Expansion and Competitive Insights to 2035

-

Technology3 days ago

Technology3 days agoWhat to Know Before Switching Cell Phone Network Services in 2025

-

Press Release2 days ago

Press Release2 days agoCrypto WINNAZ Launches First On-Chain Yield Engine for Meme Coins, Enabling 20x–300x Returns