News

Deutsche Bahn’s Supervisory Board Approves Sale of Schenker to DSV Amid Controversy

Deutsche Bahn’s supervisory board has narrowly approved the sale of its logistics subsidiary, Schenker, to Denmark’s DSV for €14.3 billion ($15.8 billion). This decision comes despite significant opposition from labor unions and a competing bid from financial investor CVC. The sale is seen as a strategic move for Deutsche Bahn to focus on improving Germany’s railway infrastructure and reducing its debt.

Key Takeaways

- Deutsche Bahn’s supervisory board voted 10 in favor, 9 against, and 1 abstention on the sale of Schenker.

- The deal with DSV is valued at €14.3 billion ($15.8 billion).

- The railway union EVG expressed strong opposition, citing job security concerns.

- The sale is expected to be finalized by 2025, pending regulatory approvals.

Background of the Sale

The decision to sell Schenker is part of Deutsche Bahn’s broader strategy to streamline operations and focus on its core business of rail transport. The logistics sector has been increasingly competitive, and the merger of DSV and Schenker would create a global leader in logistics, combining their strengths in the market.

Union Opposition

The railway union EVG has been vocal against the sale, arguing that it poses a risk to jobs and could undermine workers’ rights. Martin Burkert, the head of the EVG, described the decision as a “serious strategic mistake,” reflecting the concerns of many employees who fear for their job security in the wake of the sale.

Competitive Landscape

DSV emerged victorious in the bidding process against CVC, a financial investor. The merger would position DSV and Schenker as the largest logistics provider globally, with a combined workforce of over 70,000 employees. This consolidation is expected to enhance operational efficiencies and expand service offerings in the logistics sector.

Future Implications

The sale is anticipated to be completed by 2025, contingent on receiving all necessary regulatory approvals. Deutsche Bahn views this transaction as a crucial step towards focusing on domestic rail infrastructure improvements and reducing its substantial debt burden. The company aims to reinvest the proceeds from the sale into enhancing railway services across Germany, which have faced criticism for delays and inefficiencies.

Conclusion

The approval of the sale of Schenker to DSV marks a significant shift in Deutsche Bahn’s strategy, aiming to bolster its financial position while navigating the complexities of labor relations and market competition. As the deal progresses, the reactions from stakeholders, particularly the unions, will be closely monitored, highlighting the ongoing tension between corporate strategy and employee welfare.

Sources

-

Press Release6 days ago

Press Release6 days agoNura Labs Files Revolutionary Patent: AI-Powered Wallet Solves the $180 Billion Crypto Staking Complexity Crisis

-

Press Release4 days ago

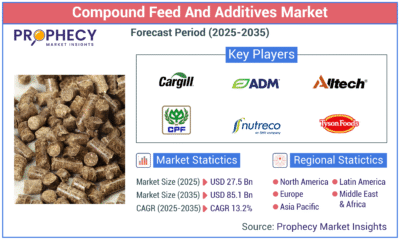

Press Release4 days agoGlobal Compound Feeds and Additives Industry Report: Market Expansion and Competitive Insights to 2035

-

Technology4 days ago

Technology4 days agoWhat to Know Before Switching Cell Phone Network Services in 2025

-

Press Release3 days ago

Press Release3 days agoCrypto WINNAZ Launches First On-Chain Yield Engine for Meme Coins, Enabling 20x–300x Returns

-

Press Release1 hour ago

Press Release1 hour agoBellarium ($BEL) Price Prediction: Could It Hit $5 by 2026?

-

Press Release11 minutes ago

Press Release11 minutes agoWhy Alaxio (ALX) Is a Top Pick for Smart Crypto Investors