Alternative Energy

7 Steps to Take After Discovering Fraud

Discovering fraud can be a shocking and overwhelming experience, especially if it involves your personal or business finances. Whether you uncover fraudulent activity on your own or someone else brings it to your attention, it is important to take immediate action to minimize its impact and prevent any future occurrences.

Here are seven steps you should take after discovering fraud:

Document the Evidence:

The first step in handling fraud is to gather and document all evidence related to the fraudulent activity. This includes any suspicious transactions, emails, or other forms of communication that may have occurred. Keep copies of all relevant documents as they will serve as crucial evidence later on.

Contact Your Bank or Credit Card Company:

If you discover fraud on your bank account or credit card, you should immediately contact your bank or credit card company. They will be able to freeze any fraudulent activity and prevent further losses. You may also need to close the affected account and open a new one to ensure that the fraudster cannot access your funds in the future.

Report it to the Authorities:

Fraud is a criminal offense, and it is important to report it to the relevant authorities, such as the police or the Federal Trade Commission (FTC). This will not only help in catching and prosecuting the fraudster but also ensure that any damages caused by the fraud are properly documented for insurance or legal purposes.

Notify Credit Bureaus:

If you suspect that your personal information has been compromised, it is important to notify the credit bureaus so they can place a fraud alert on your credit report. This will help prevent any unauthorized access to credit in your name.

Inform Creditors and Service Providers:

If you have any outstanding debts or services that may have been affected by the fraud, it is important to inform your creditors and service providers immediately. They will be able to work with you to resolve any issues and stop any further fraudulent activity.

Review Your Credit Report:

After discovering fraud, it is important to review your credit report thoroughly. Look for any irregularities or accounts that may have been opened without your knowledge. If you find anything suspicious, inform the credit bureau and dispute the information.

Take Steps to Protect Yourself in the Future:

Once you have taken all necessary steps to resolve the current fraud, it is important to take precautions to protect yourself from any future fraudulent activity. This may include regularly monitoring your accounts, using strong and unique passwords, and being cautious of phishing scams.

Fraud can be a traumatic experience, but by taking these seven steps, you can minimize the impact and prevent similar incidents from happening in the future. Remember to stay vigilant and be proactive when it comes to protecting your personal and financial information. So, always keep an eye out for any suspicious activity, and take action immediately if you suspect fraud. Stay informed about current scams and educate yourself on how to keep your personal information safe. So, take action now to safeguard your financial well-being.

-

Press Release3 days ago

Press Release3 days agoNura Labs Files Revolutionary Patent: AI-Powered Wallet Solves the $180 Billion Crypto Staking Complexity Crisis

-

Press Release1 day ago

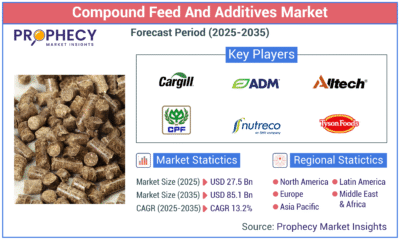

Press Release1 day agoGlobal Compound Feeds and Additives Industry Report: Market Expansion and Competitive Insights to 2035

-

Technology1 day ago

Technology1 day agoWhat to Know Before Switching Cell Phone Network Services in 2025