Finance

5 Things to Know Before You Begin Forex Trading

Forex trading presents a platform where people can exchange currencies. It is one of the most popular trading platforms with considerable potential to make a profit. While making a profit in Forex is easy, losing also comes easy. This makes it essential for potential traders to arm themselves with adequate knowledge and information to help them stand.

People might be excited about getting into Forex due to its unique nature. It comes with special characteristics like easy accessibility, 24/7 availability, trade with a demo, and minimal entry capital. All this makes it easy for new members to get in.

With most financial investment plans, however, it is essential to approach Forex strategically. Even though you will learn while trading, it is a good idea to get all the information to give you an edge. As a result, here are five things that can guide you as you prepare to enter the forex market.

You Have to Be News Savvy

Forex is a pretty volatile market. Happenings around the world like economic policies, elections, weather and climate, pandemic, etc., can affect the market. As a result, foreign exchange signals and trading work hand in hand, provided you are updated on real-world events and news that determines the currency value.

Good knowledge of regular, accurate, and the latest news of things like trade, crude oil fluctuations, interactions between countries, market situations, and many other factors can affect the currency value. Armed with this information and news, you can make calculated predictions of fluctuation and currency values. This knowledge and skill are essential in making money with Forex.

Make sure, however, to rely strictly on a reputable Forex News outlet.

A Highly Volatile Market

One can make a massive profit in Forex trading, and there could be considerable losses as well. This is due to the high volatility of the Forex environment. In other words, there could be sudden movements that might have a positive or negative effect on your account. With this, a trader needs to be alert and watch out for such a sudden move to wipe out an entire account.

One of the major causes of these sudden movements is economic events such as getting rid of the leading currency pair’s ceiling. This will make the currency rate float, which can catch you unawares if you are not prepared.

The simple implication of the above is that making money is easy as long as you are on the right side. In the same way, it is easy to lose money if you are not positioned well. As a result, traders need to understand the market’s volatility by using effective risk management techniques. This is where a stop loss comes in.

Stop-loss is a market tool designed to shield traders from unexpected market moves that can hurt them. This tool allows traders to set a specific price where the trade closes automatically when the market moves against you. It serves as a protective shield to prevent further loss.

Photo by Avinash Kumar on Unsplash

Only Work with a Regulated Broker

While there are many brokers available to work with, it is essential to work with a regulated forex broker for all trades. There are many advantages to using such a broker. Besides the assurance of your funds’ safety, the broker ensures that the trading environment and conditions (conditions like direct market access, proper practice, and leverage caps) favor the trader.

Unregulated brokers are under no obligation to make the ideal trading environment available for their clients. It will not come as a surprise if there is a problem with withdrawing funds or sending orders.

For traders in the UK, for instance, the Financial Conduct Authority (FCA) regulates the brokers. They are charged with ensuring that all brokers keep the rule to favor the traders.

Before selecting a broker, make sure to consider their reviews and regulations. Ideally, you are better off going with a broker that has more restrictions. Such brokers will offer the best condition for trading.

Prioritize Learning

You might try to learn all you can before trading. With trading, however, the experience is the best teacher, especially for beginners. As a result, it is essential to learn from all trading sections. As you trade, always strive to develop yourself.

Actual trading will open your eyes to many things. In earning as well, it is essential to note the factors that facilitated it. It will also include the decisions you made. This is where a trading journal comes in. A trading journal helps users to record decisions and factors surrounding their profits and losses. Constant reviewing of the trading journal can help one develop a profitable trading strategy when considering the circumstances surrounding the profits.

Losing should not demoralize you. Also, it is a bad idea to trade aggressively in a bid to compensate for losses. Learning from the situation and developing a better strategy is the way to go.

Using Leverage can Make or Ruin you.

One of the things that increase the risk of Forex trading is the leverage employed. It will help if traders will consider leverage as a double-edged sword capable of impressive wins or losses. Let us consider the leverage of 40:1, for instance. The implication is that with a sum of $1,000, a trader’s position can get to $40,000.

This example illustrates that if the currency moves by 1%, you are either standing at $40,400 or $39,600. As a result, your $1000 capital can give you either a 40% profit or loss. With this, even though a 1% currency pair movement seems irrelevant, leveraging as much as 40:1 translates to either 40% loss or gain on your funds.

There is a strong possibility of incurring losses in volatile times when the currency pairs swing wildly. As a result, a trader needs practical risk management skills to shield their funds.

Photo by Avinash Kumar on Unsplash

Conclusion

For anyone to succeed in the Forex market, such a person needs to be armed with adequate information. Such information will go a long way to keep you standing and shield you from unexpected market forces when it gets tough.

Also, trade with an open mind and consider every trade as a learning platform. Lessons from every trading section can serve as invaluable resources that will guide you against unforeseen occurrences.

-

Press Release7 days ago

Press Release7 days agoClinical Trials Market Set for Robust Growth, Driven by Drug Development Surge and Digital Innovation

-

Press Release7 days ago

Press Release7 days agoPediatric Vaccines Market: Safeguarding Futures, Driving Growth

-

Press Release7 days ago

Press Release7 days agoWaterproof Structural Adhesives Market: A Comprehensive Study Towards USD 10.3 Billion in 2035

-

Press Release7 days ago

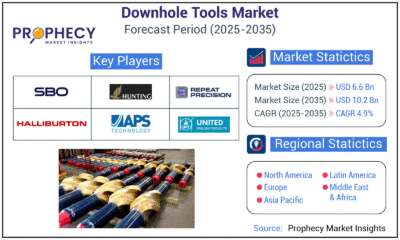

Press Release7 days agoDownhole Tools Market: Navigating Subsurface Frontiers with Precision

-

Press Release7 days ago

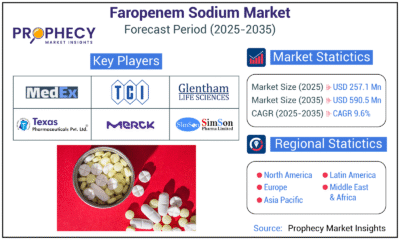

Press Release7 days agoFaropenem Sodium Market: A Potent Weapon in the Fight Against Bacterial Infections