Finance

A Comprehensive Guide to Financial Therapy Services for Stress-Free Living

In the hustle and bustle of modern life, managing finances can often become a significant source of stress and anxiety. However, with the emergence of financial therapy services, individuals can now seek professional guidance to navigate through their financial challenges while maintaining mental well-being. This comprehensive guide explores the realm of financial therapy services, shedding light on its importance, benefits, and how it can lead to a stress-free life.

What are Financial Therapy Services?

Financial Therapy Services, often abbreviated as FTS, refer to a holistic approach that combines financial planning with psychological counseling to address the emotional and behavioral aspects of money management. These services aim to help individuals develop a healthier relationship with money by addressing underlying psychological issues that may impact their financial decisions.

The Role of a Financial Therapist

Financial therapists are trained professionals who integrate therapeutic techniques with financial expertise to assist clients in understanding and modifying their money-related behaviors. They provide a safe and non-judgmental space for individuals to explore their beliefs, attitudes, and emotions surrounding money, ultimately guiding them towards making more informed financial decisions.

Benefits of Financial Therapy Services

Financial Therapy Services offer a myriad of benefits that extend beyond just monetary gains. Some of the key advantages include:

- Improved Financial Management: By addressing emotional barriers and ingrained money behaviors, individuals can gain better control over their finances and make wiser financial decisions.

- Reduced Stress and Anxiety: Through counseling and psychoeducation, financial therapy helps individuals alleviate stress and anxiety associated with money-related issues, leading to overall mental well-being.

- Enhanced Communication: Financial therapy sessions often involve discussions around money within relationships, fostering better communication and understanding between partners or family members.

- Long-term Financial Health: By identifying and addressing underlying issues, individuals can develop sustainable financial habits that promote long-term financial stability and security.

Exploring the Process of Financial Therapy

Initial Assessment and Goal Setting

The journey of financial therapy typically begins with an initial assessment where the therapist gathers information about the client’s financial situation, goals, and concerns. Together, they establish realistic objectives and milestones to work towards throughout the therapy process.

Exploration of Money Beliefs and Behaviors

During therapy sessions, clients are encouraged to explore their beliefs, attitudes, and behaviors related to money. This self-examination helps uncover deep-seated money scripts and triggers that may be influencing their financial decisions.

Developing Coping Strategies

Financial therapists equip clients with practical coping strategies and tools to manage stress, curb impulsive spending, and develop healthier financial habits. These may include budgeting techniques, mindfulness exercises, or cognitive-behavioral strategies.

Implementing Financial Plans

Based on the client’s goals and preferences, financial therapists collaborate with them to develop personalized financial plans tailored to their unique circumstances. These plans often encompass budgeting, saving, debt management, and investment strategies.

Financial Therapy Services to Live Stress-Free Life?

Financial therapy services offer a holistic approach to managing finances and promoting mental well-being. By addressing the emotional and psychological aspects of money management, individuals can break free from the cycle of financial stress and cultivate a more balanced and fulfilling life.

FAQs about Financial Therapy Services

What types of issues can financial therapy address?

Financial therapy can address a wide range of issues, including debt management, overspending, financial conflicts within relationships, compulsive buying, and anxiety related to money.

How long does financial therapy typically last?

The duration of financial therapy varies depending on the individual’s needs and goals. Some clients may benefit from short-term interventions, while others may engage in ongoing therapy to address deeper-rooted issues.

Is financial therapy only for people experiencing financial difficulties?

No, financial therapy is beneficial for individuals across all income levels and financial circumstances. Whether you’re struggling with debt or simply want to improve your financial literacy, financial therapy can offer valuable insights and support.

Conclusion

In conclusion, Financial Therapy Services offer a holistic approach to managing finances and improving overall well-being. By addressing the emotional and psychological aspects of money management, individuals can gain greater insight into their financial behaviors and make more empowered decisions. Whether you’re facing financial challenges or simply seeking to enhance your financial literacy, embarking on a journey of financial therapy can pave the way towards a more fulfilling and stress-free life.

-

Technology4 days ago

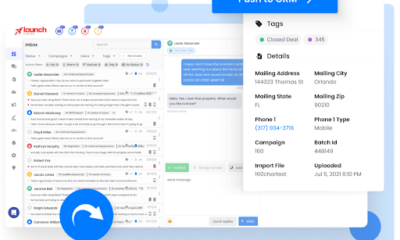

Technology4 days agoEnhancing Lead Management and Text Marketing with Launch Control’s All-in-One CRM

-

Destinations3 days ago

Destinations3 days agoSave Money in London: Insider Tips for Budget Travellers

-

USA News3 days ago

USA News3 days agoWhat Is The Current Us Elections Rating And Who Is Leading The Polls?

-

Europe News3 days ago

Europe News3 days agoSee Rome on a Budget: History and Culture Without the Cost

-

Travel3 days ago

Travel3 days agoHow to Make Friends in Southeast Asia Hostels: A Guide for Solo Travellers

-

Climate Change3 days ago

Climate Change3 days agoCuba Faces Nationwide Power Grid Collapse Amidst Ongoing Crisis

-

Travel3 days ago

Travel3 days agoSafe Travel in Mexico: Tips for a Hassle-Free Trip

-

Destinations3 days ago

Destinations3 days agoArgentina Travel Guide: Tango, Wine, and Natural Wonders