Business

4 Long-Term AR/VR Stocks That Should Not Be Ignored

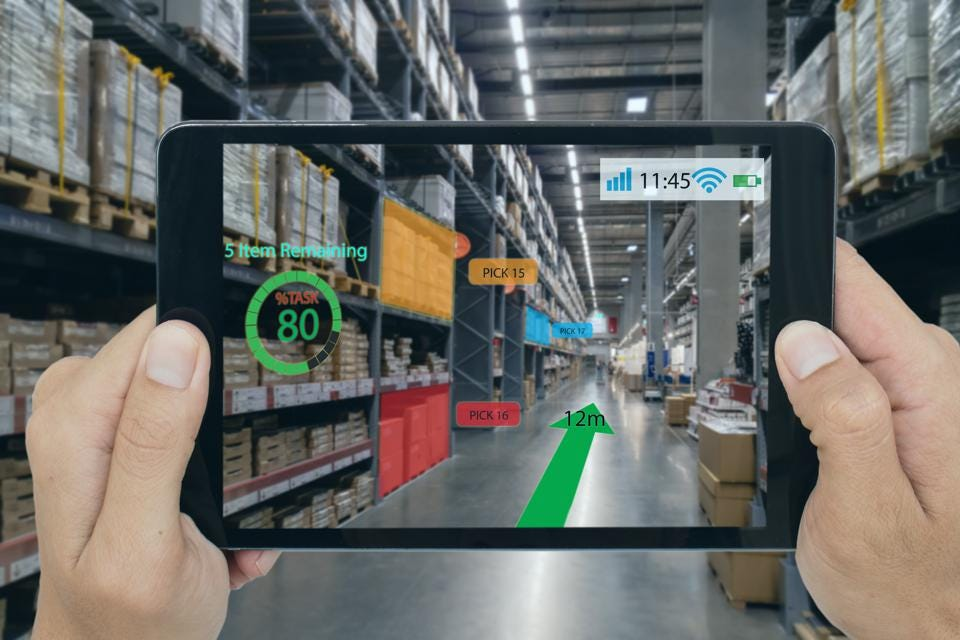

Now is in the heyday of the first big wave in the history of computer technology. Computers, smartphones, cloud services, and other sound performances have promoted the high-speed development of desktop Internet and mobile Internet, bringing unprecedented technology life experiences, including mobile payment, mobile business, e-commerce, new media, logistics, storage, etc. AR/VR will open the second computer technology civilization, with computer technology as The development of productivity driven by computer technology will be hardware markets.

AR/VR Investment Opportunities

Scientist Michael Abelash suggested in 2017 that AR/VR is the second major wave in the history of computer technology, and its impact may exceed that of the personal computer revolution of the past three decades (the 1990s to the present). In the coming decades, AR/VR will bring a disruptive impact to both the mass consumer market and the business market in various industries. And the results of the second computer technology civilization will fully penetrate manufacturing, accommodation and catering, finance, real estate, construction, education, technology, transportation, retail e-commerce, culture, and entertainment.

Since 2022, the AR/VR device market, which is the entrance to the metaverse, has been developing rapidly. At present, VR/AR devices can be divided into three categories, naheadsetsadset, all-in-one machine, cell phone box and other devices will be the main consumer hardware products at the beginning of the metaverse. According to IDC data, the global AR/VR headset shipments of 11.23 million units in 2021, an increase of 92.1% year-on-year. The overall shipments are expected to be about 13-15 million units in 2022, and optimism is expected to see nearly 20 million units in 2023.

The market for hardware determines the entire ecology. Among the forecast for 2022, Meta Quest2Pro, Sony PSVR2 will be launched, 2023 new products and Meta Quest3, Apple’s first generation headset, the overall new product launch in accelerated. Especially next year Quest3 is expected to drive shipments upward, Apple products are expected to be redefined from the functional and morphological end.

AR/VR devices have been the key link in the meta-universe industry chain. Along with the gradual establishment of the AR/VR ecosystem, AR/VR financing and mergers and acquisitions have also remained highly active. According to the data, the development trend in 2021 was rapid, with 340 financing M&A events and a scale of 55.6 billion yuan. In the first half of 2022, the total financing M&A scale of the global AR/VR industry was 31.26 billion yuan, up 37% year-on-year from the first half of 2021; the number of financing M&A events was 172, up 17% from 2021.

Long-term Stocks to Watch in AR/VR Track

The metaverse aims to build a durable virtual shared space while still being able to maintain the perception and experience of the real world. Therefore, the construction of the metaverse requires immersive devices based on AR/VR and brain-computer interface technologies as the necessary means of interaction. The development of the metaverse will also surely herald the rise of AR/VR towards the metaverse. The rise of AR/VR needs a long process, but at the same time harbors huge profits. Global tech giants actively laid out the VR/AR track in the first half of 2022, and looking ahead, their active participation is also expected to bring a new catalyst to the AR/VR industry.

Meta

Meta has launched PC VR Oculus Rift CV, VR all-in-one Oculus Go, VR all-in-one Oculus Quest, PC VR Oculus Rift S, VR all-in-one Oculus Quest 2 one after another after acquiring Oculus. Meanwhile, Meta, in order to increase its investment in metaverse, has spent In order to increase its investment in the metaverse, Meta has spent a lot of money to build a complete AR/VR operating system around spatial computing and 3D, in order to cope with the dependence on Android system and be constrained by Google. In addition, in terms of content, Quest platform adopts a strict review mechanism to decide games to be launched, and achieves high reputation with high quality content, and the revenue scale has grown steadily since its launch, with the cumulative revenue scale exceeding $150 million and over 60 games earning $1 million.

WiMi Hologram Cloud

The enthusiasm of WiMi Hologram Cloud (NASDAQ: WIMI), a leading company that started from AR/VR, for metaverse in the past two years can be easily judged from the data. According to the data, WiMi has 4,600 AR/VR IP rights and interests contents, 195 patents of related technologies in image processing and display, model input/output, 3D modeling, 325 software copyrights, etc. to support the new metaverse experience. In addition, in terms of hardware, a number of AR/VR products have been developed, mainly for corporate customers. The strong connection between WiMi and Metaverse also represents an evolutionary trend: AR/VR technology is looking for higher-order commercial applications.

Summary

Many people are asking whether metaverse has such a large business space capital research and understanding of the industry is more in-depth and investment and financing activities are more active, the capital layout is more in business fields for finding opportunities. In addition, as AR/VR hardware sales begin to release and the game ecology enters a virtuous cycle, more capital will be attracted to the metaverse in the future.

Whether it is Apple, Qualcomm, Meta, WiMi, or even Snap, all of them have already set a posture to march towards the “metaverse” generation. They each have certain elements needed for successful consumer applications of AR/VR technology, and the actions of this group of manufacturers will provide key clues to the development of the metaverse from 2022 onwards. With the influence of these large global manufacturers, it is worth observing and pondering how the AR/VR consumer ecosystem will develop.

-

Business6 days ago

Business6 days agoWall Street Rallies as Strong Jobs Report Fuels Optimism

-

Business5 days ago

Business5 days agoS&P 500 Achieves Historic Winning Streak Amid Easing Trade Tensions

-

Civil Rights6 days ago

Civil Rights6 days agoUS Government Under Fire for Wrong-House Raids: Accountability at Stake

-

Government5 days ago

Government5 days agoSupreme Court Case Martin V. USA: A Landmark Moment for Government Accountability in Wrong-House Raids

-

Health & Fitness4 days ago

Health & Fitness4 days agoBudget Cuts Slash Vital Health-Tracking Programs in the U.S.

-

Business4 days ago

Business4 days agoUS Stock Market Soars as Jobs Report Surprises and Trade Tensions Ease

-

Crime5 days ago

Crime5 days agoU.S. Treasury Takes Aim at Major Mexican Cartel Linked to Fentanyl Trade

-

Business3 days ago

Business3 days agoUS Stock Market Soars on Positive Jobs Data and Trade Optimism